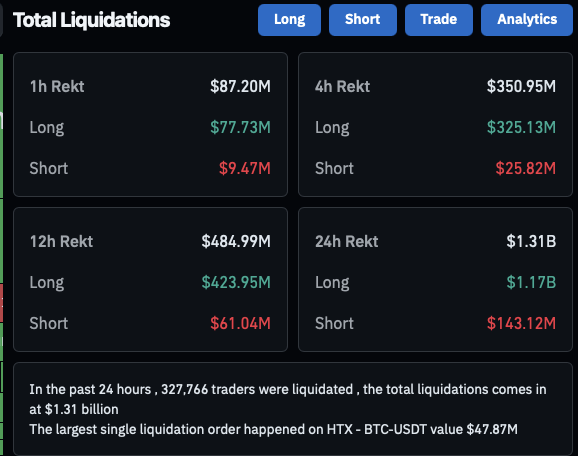

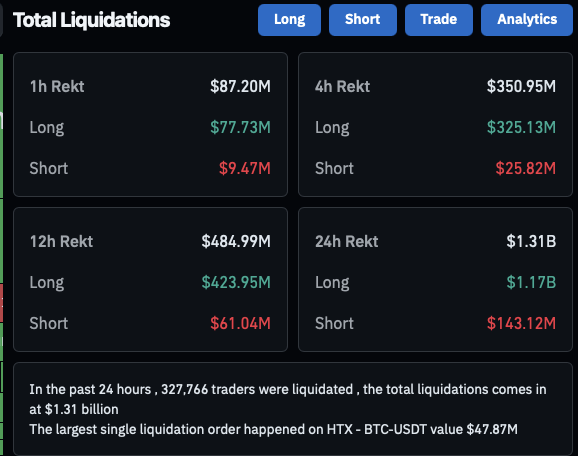

The cryptocurrency market crash shows no signs of slowing down. The global crypto market cap has fallen 3.6% in the last 24 hours, and currently sits at $3.55 trillion. According to CoinGlass data, $1.31 billion worth of assets were liquidated from the crypto market in the last 24 hours. The platform notes that the largest single liquidation order took place on HTX for BTC-USDT, valued at $47.87 million.

What’s Behind The Cryptocurrency Market Crash?

Not only is the crypto market facing substantial liquidations, but investor sentiment is also taking a beating. According to Alternative’s fear and greed index, market sentiment has fallen to 21, signaling “extreme fear” among market participants.

Most cryptocurrency assets have faced massive price corrections in the last 24 hours. Bitcoin (BTC), the market leader, has fallen to the $104,000 price level. Other crypto assets are following BTC’s trajectory.

The market dip could be due to slow economic growth and rising inflation warnings by Federal Reserve Chair Jerome Powell. The cryptocurrency market crash comes despite the Federal Reserve announcing an additional 25 basis point interest rate cut after its October meeting.

Moreover, Bitcoin (BTC) and Ethereum (ETH) ETFs have seen consecutive outflows over the last few days. ETF inflows played a major role in the market rally earlier this year. ETF outflows may be another signal for a weak cryptocurrency market.

Any Chances Of A Recovery?

The cryptocurrency market is plagued by volatile price swings. The current market predicament, while severe, is not a first. We may experience an extended correction phase before things lighten up.

Also Read: No Recovery In Sight For Bitcoin: Is The Bull Run Done For?

Macroeconomic conditions need to improve before cryptocurrency investors feel at ease again. Trade disputes are another factor that needs to be dealt with for investors to begin putting their money into risky assets.