The implications of the federal rate cut have already started to show their ripple effect. In his recent address, Jerome Powell, the Federal Reserve chair, shared his stance on the latest rate cut expectations, adding how a policy change is already under consideration.

Powell’s remark has potentially caused a domino effect on the current US economy, with investors and organizations bracing for a headstrong economic collision that may either break or make the economy’s robustness. The new currency dynamics are also at play, which may change the course of the USD in the long haul.

Also Read: Investors Pivot To ASEAN Amid Weak US Data Assumptions

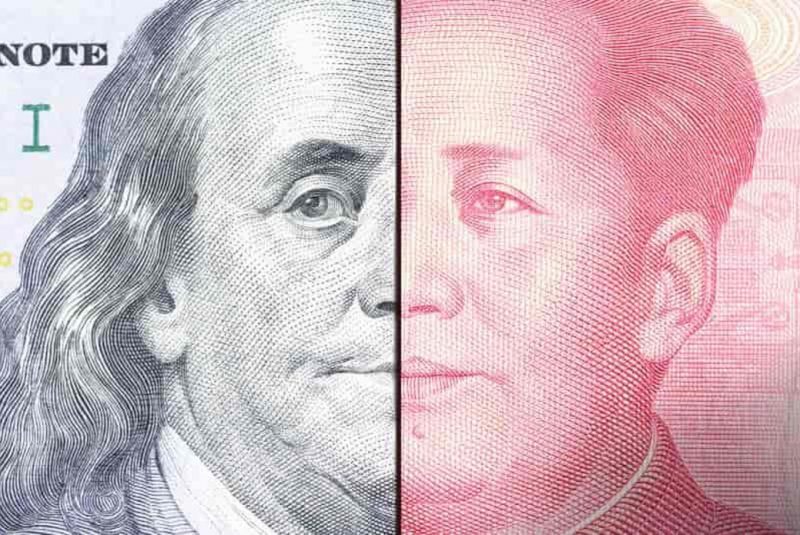

How US Interest Rates Cut May Strengthen Yuan?

According to Bloomberg, Chinese companies may look forward to selling their $1 trillion worth of dollar-denominated assets once the rate cut expectations are finalized. This phenomenon can trigger an “avalanche” in space, amping the price of yuan by at least 10%.

“Analysts worry there will be a dramatic devaluation of the dollar as the Fed cuts rates. Chinese companies in particular may be enticed to sell a $1 trillion pile of dollar-denominated assets, potentially strengthening the yuan by up to 10%: Stephen Jen”

In simpler terms, the Chinese firm’s investment strategy may have included investing in assets denominated higher in valuation than the Yuan.

The process also includes investing in dollars. If the Federal Reserve lowers borrowing costs, it may lessen the dollar’s allure in the Chinese market. This may compel Chinese investors to sell their investments while ballooning Yuan.

“Think of an avalanche. The yuan “will appreciate and probably be allowed to…Five to 10% would be modest and acceptable to China.” notable analyst Stephen Jen told Bloomberg

Also Read: Shiba Inu: 2 Reasons Why SHIB’s Spike To $0.0005 Is Inevitable

ASEAN and BRICS Continues To Challenge The US Dollar

The US dollar is at one of its most crucial thresholds at the moment. While the much-anticipated rate cut may jeopardize its allure on a global scale, alliances like BRICS and ASEAN are also leaving no stone unturned to hit the greenback fiercely. BRICS is already working on launching a currency system. The development intends to rival the USD, which has lately been ditched for all its trade.

ASEAN, on the other hand, is currently on a hunt to find USD alternatives. The alliance is pioneering a local currency narrative and promoting a multipolar currency concept.

Also Read: Dogecoin (Doge) and Dogwifhat (WIF)Price Prediction For September 2024

If the phenomenon continues, the US dollar may invite lethal foes in this wake.