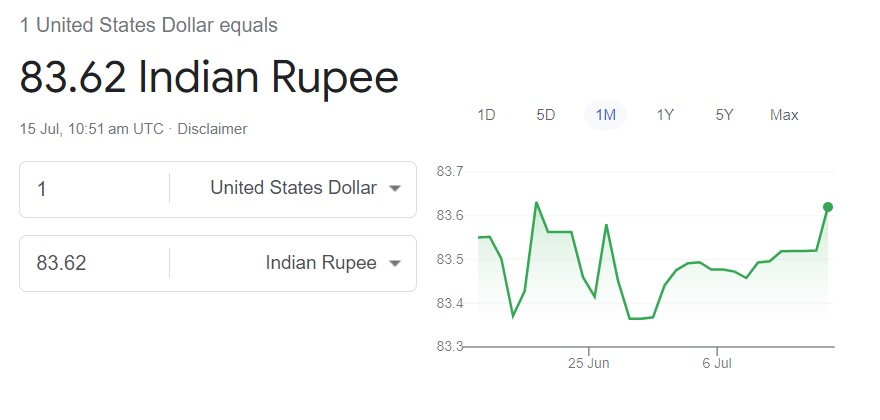

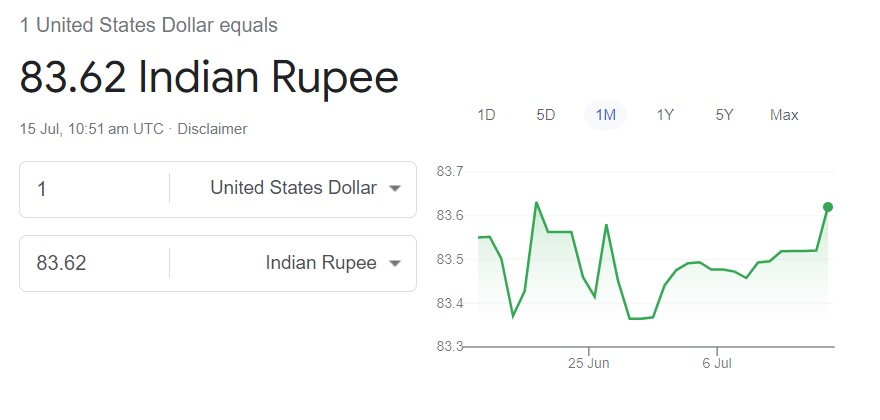

The U.S. dollar is making its way to the top in the currency markets by hammering the Indian rupee this week. The Indian rupee had fallen to a low of 83.63 in June 2024 last month but slightly recovered thereafter. However, the Indian rupee is now back near its all-time low falling to 83.62 on Monday’s opening bell.

Also Read: If Trump Gets Elected, Gold Prices Could Boost Significantly: Analyst

The Indian rupee is reeling under pressure from a stronger U.S. dollar this week in the currency markets. The development could make the INR dip further as the USD remains in command in the forex market. Not just the INR, the USD has also outperformed 22 out of 23 leading Asian currencies this month.

Also Read: BRICS Supports Donald Trump

Only the Hong Kong dollar has managed to stay afloat against the onslaught of the U.S. dollar. The other leading local currencies, including the Indian rupee, Chinese yuan, and Japanese yen have fallen to new lows against the U.S. dollar. While the Chinese yuan has dipped to its December 2023 lows, the Japanese yen plummeted to its 1990s low.

Currency: Why is the Indian Rupee Falling Against the U.S. Dollar This Week?

Foreign institutional investors (FII) exited from the Indian markets early this month making the rupee lose balance. An outflow of $2.6 billion worth of equities from the Indian stock market was initiated by the FIIs. The development added pressure on the INR leading it to slump against the USD.

Also Read: Shiba Inu or Pepe Coin: Which Cryptocurrency Can Reach $0.01 First?

If the INR falls to 83.80, the Indian stock market and its currency will enter dangerous territory. It will “be a matter of concern till it is holding above 83.80,” said Sajal Gupta, Head of Forex at Nuvama Institutional. A fall to 83.80 could open the pathway for the rupee to spiral downward to 84. Chances of that happening might turn true if it falls to 83.80 this year.