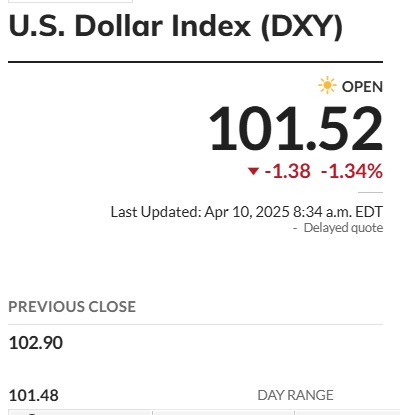

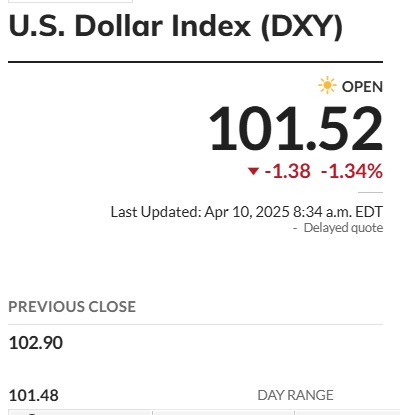

The US dollar failed to maintain momentum from the 90-day tariffs pause announced by President Donald Trump on Wednesday. The DXY index, which tracks the performance of the greenback shows the currency falling to the 101.50 level on Thursday’s opening bell. It dipped 1.38 points in the day trade shedding 1.34% of its value in the indices minutes after the markets opened.

Also Read: Gold Hits New All-Time High of $3,132: Can It Surge Even Higher?

It has crossed the psychological factor going below the 102 mark signally that the currency has entered a weaker territory. It is now down to its January 2024 lows as it shed most of its value in the last 15 months, The greenback had touched a high of 109.6 in January this year on the heels of Trump taking office. The USD is now down by a massive 6.4% YTD and has been at its lowest since Trump entered the White House.

Also Read: US Inflation Drops to 2.4% in March 2025

US Dollar Dipping in the Currency Markets

A weaker US dollar allows local currencies to recover in the charts and maintain a balance in the forex markets. The Indian rupee had fallen more than 2.5% YTD against the greenback but rebounded in the last 30 days. It is now down only 0.58% YTD and scaled up in the charts despite stiff competition from the USD.

Also Read: Ripple: ChatGPT Predicts XRPs Price For Q2, 2025

The US dollar is also facing challenges from emerging economies that are diversifying their reserves with gold. Countries such as China, India, Russia, and Brazil are buying tonnes of gold and diversifying their central bank reserves. Just recently, Poland accumulated 16 tonnes of the precious metal in April and surpassed China for the month.

If the US dollar declines below the 100 mark in the DXY index, the American economy could face major turbulence. Leading stocks could begin to dip as local currencies could outweigh the USD in the currency markets.