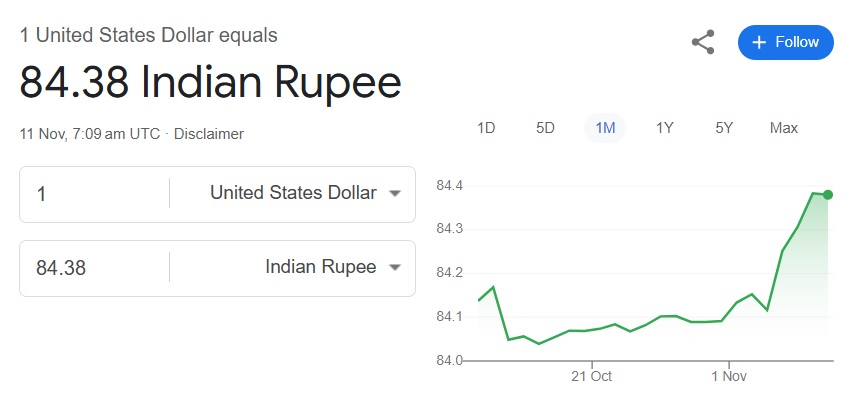

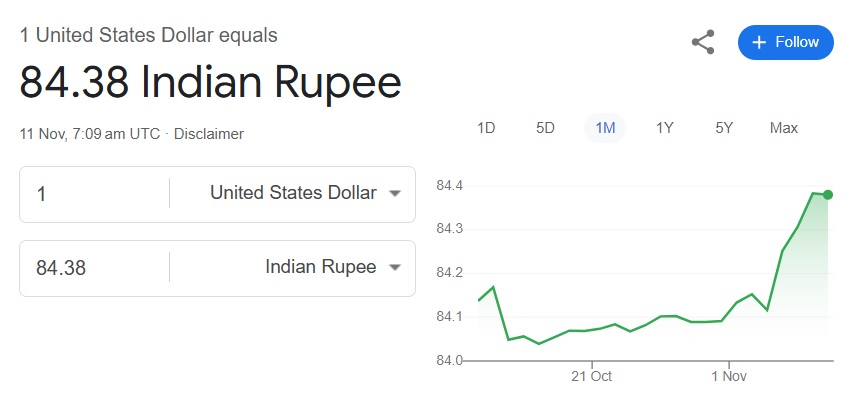

The US dollar is soaring in the currency markets and is strengthening in the charts in November. The DXY index, which measures the performance of the USD, shows that the currency has climbed above the 105 mark. The USD hit a high of 105.06 and spiked 0.006% in the indices. The Indian rupee hit a new monthly low against the US dollar after Trump reclaimed the presidency.

Also Read: Cardano & Dogecoin Lead: ADA & Doge Rally Amid Bitcoin’s Surge To 80K

The rupee slipped to 84.38 on Monday and is struggling to compete with the US dollar this month. The currency is under pressure from the USD, which is causing concerns about inflation and economic instability. The import and export sectors will take the first hit from the rising USD, and the price rise will eventually trickle down to the end consumers.

Also Read: Ripple XRP Rallies 17%: Can It Hit $1 In November?

The move could prove disastrous as the country is already grappling with inflation for day-to-day essentials. If concrete steps are not taken to address the issue, the rupee could fall further and hit an all-time low of 85. The next two months could decide the fate of the US dollar and how the rupee will overcome the battle.

Currency: Why is The Indian Rupee Falling Against the US Dollar?

The Indian rupee is dipping as a record outflow of foreign funds has exited the stock market since October. A total of $1,422,084,000 in equities from foreign institutional investors have been offloaded from the Indian stock market. The Sensex, which was at 85,000 in September, plummeted to a 79,800 level in November.

Also Read: Massive 56% Gain Puts Shiba Inu on Track for a New High

The slow crash led the rupee to depreciate against the US dollar as the market remained on slippery waters. Moreover, the sharp spike in US bond yields is the reason for the exit from the Indian stock market. “The primary reason for the sustained selling was the sharp spike in US bond yields, which took the 10-year yield to a 17-year high of 5% on 19th October, ” said V.K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.