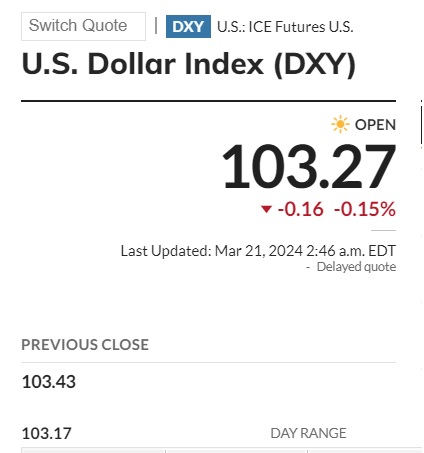

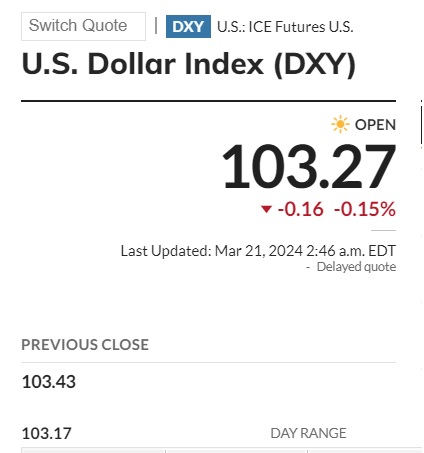

The currency market is experiencing volatility as the US dollar and Japanese Yen changed course after the Feds FOMC meeting. The US dollar outperformed gold, crude, and Brent oil, all local currencies including Yen before the Fed meeting on Wednesday. However, things went downhill for the USD currency on Thursday as it slipped from 104.20 to 103.27 within hours on Thursday.

Also Read: US Dollar King: Beats Gold, Local Currencies & Crude Oil in 1 Day

The Japanese Yen gained strength against the US dollar after the Feds meeting leading the USD currency to slide. The Fed’s updated quarterly economic projections indicate the personal consumption expenditures price index will rise by 2.6% by the end of 2024. The Central Bank projected a 2.4% rise in personal consumption expenditures, excluding food and energy in December last year.

Currency Updates: The US Dollar vs Japanese Yen For March Mid-Week

Leading currencies like the Japanese Yen are fairly performing well against the US dollar mid-week. The Japanese Yen reversed its previous decline as the US currency fell 0.17% to 151.10.

Also Read: Gold Prices Dip: Why Is The Precious Metal Falling?

“Jay Powell is trying to tell everyone that nothing has changed in the short term, that he’s still confident that inflation is going to proceed. That’s his main message during the press conference,” said Thierry Wizman, Macquarie’s Global FX to Reuters.

The analyst added, “There aren’t too many ways you can reconcile that unless what you’re saying is that the reason that inflation is going to continue to come down is that we’re going to see positive productivity trends, positive supply shocks”.

Also Read: Goldman Sachs Predicts the Future of the Cryptocurrency Market

However, despite the recent decline in the US dollar, currency investors are not giving up on the USD. Forex investors are buying the dips on the US dollar at every downturn leading it to gain a strong resistance. The move leads to the US dollar bouncing back stronger when the global markets begin to favor the currency.