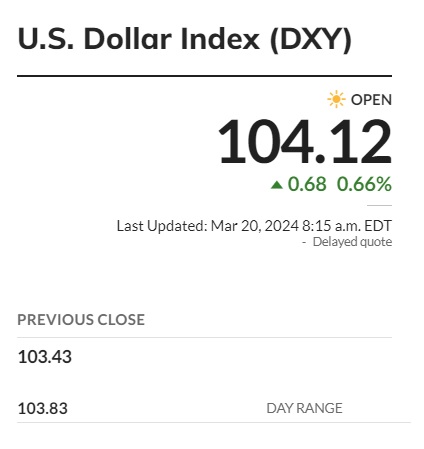

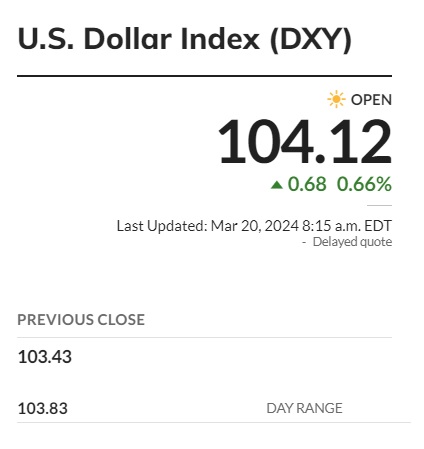

The US dollar reigned supreme as it outperformed gold, local currencies, crude and Brent oil, and other commodities all in a day’s trade. The DXY index shows the US dollar climbing above the 104 threshold trampling over the broader commodities market. Gold prices, crude oil, Brent oil, local currencies, and the overall commodity market turned red on Wednesday except for the US dollar, which steadily scaled up in the charts.

Also Read: Goldman Sachs Predicts the Future of the Cryptocurrency Market

1. US Dollar Beats Gold

The US dollar strengthened ahead of the FOMC meeting on Wednesday causing gold prices to nosedive in the XAU/USD charts. The slump in gold prices is due to the Federal Reserve maintaining its stance of a prolonged high-interest rate. Simultaneously, the development boosted the US Treasury bond yields putting the dollar on a pedestal. Gold prices fell to the $2,150 mark today and could dip further as the US dollar grows stronger.

Also Read: Gold Prices Dip: Why Is The Precious Metal Falling?

2. Local Currencies Slump

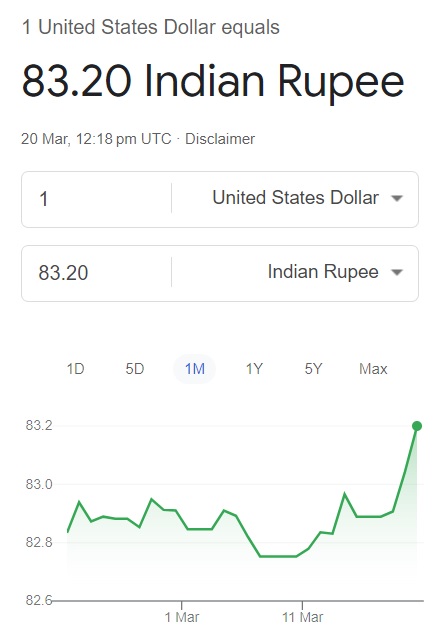

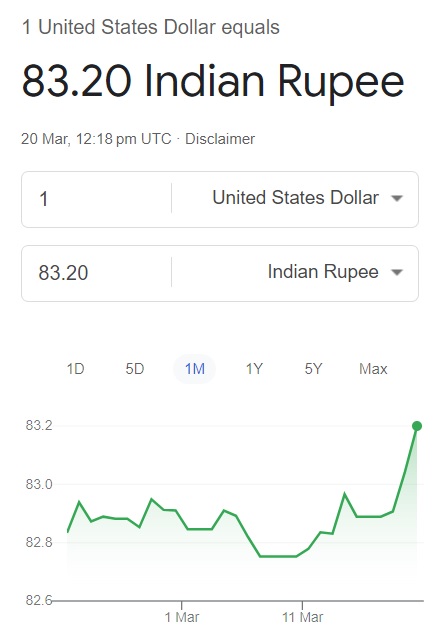

The majority of leading local currencies fell on Wednesday as the US dollar reigned supreme. The Indian Rupee, which dominated the charts early this month depreciated today falling to 83.20. The Rupee is standing no chance to lift itself as the USD has coiled against the local currency. Despite facing stiff competition from local currencies, the USD beat all odds and came out on top. The development shows that the US dollar still commands supremacy in the foreign exchange market.

Also Read: Currency: What’s Happening With the US Dollar and Indian Rupee?

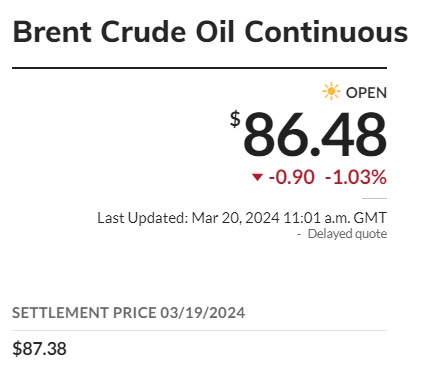

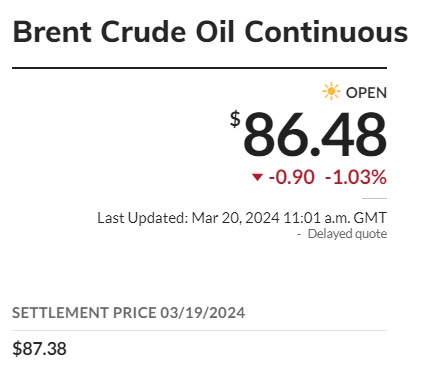

3. Crude & Brent Oil Prices Dip

This week has been harder for commodity investors as both Crude and Brent oil prices remained in the red. Brent Crude oil is down by 0.88 points leading it to slump more than 1%, as its price fell to $86.48 on Wednesday. In addition, crude oil dipped 1.14% losing its value by 0.94 points and falling to $81.76. Therefore, commodities like gold, oil, and gas sectors are printing losses this week making investors lose money.