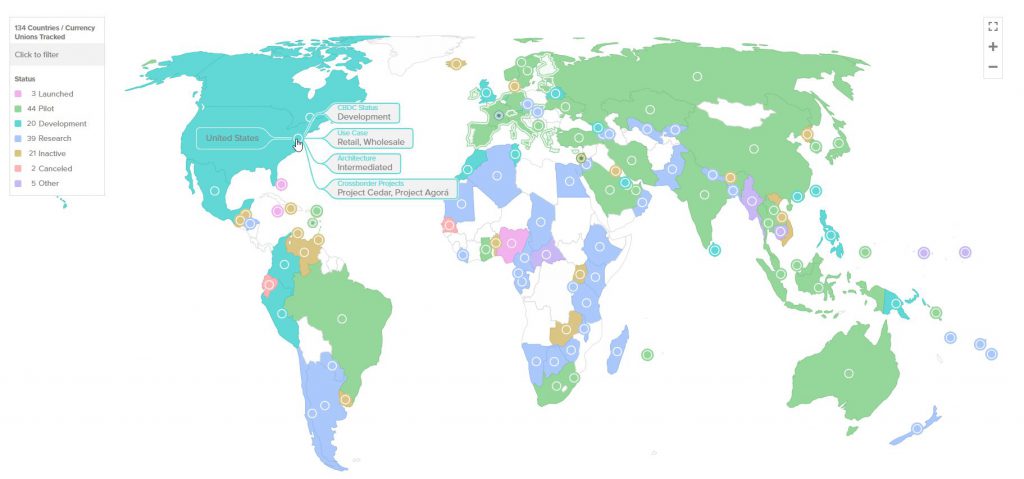

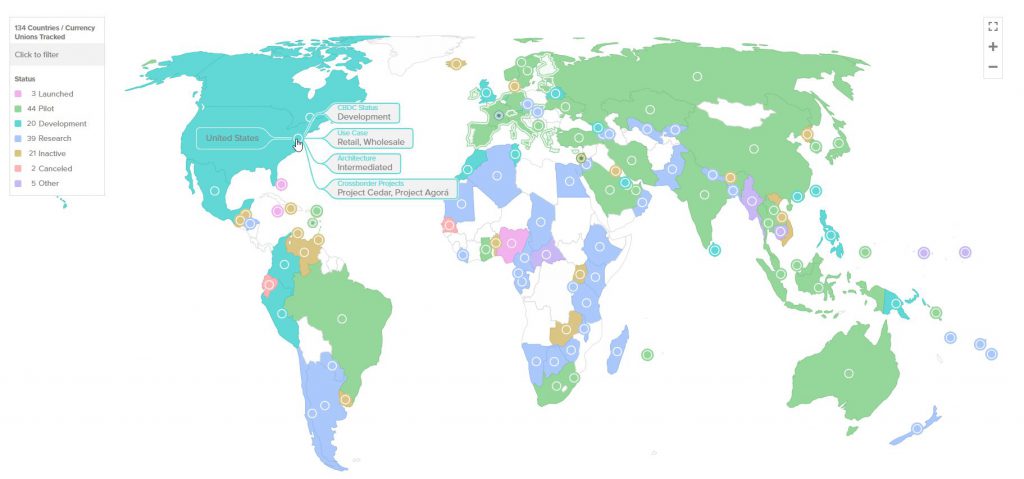

Central Bank Digital Currencies (CBDCs) enable unprecedented financial surveillance while simultaneously serving as tools for de-dollarization. This dual nature drives digital currency geopolitics as nations balance privacy concerns with CBDC adoption, revealing deep tensions between monetary control and individual rights.

Also Read: IRFC Shares Will Fall to Rs 90-92 Level: Accumulate at That Range

The Role of CBDCs in De-Dollarization and the Privacy Debate

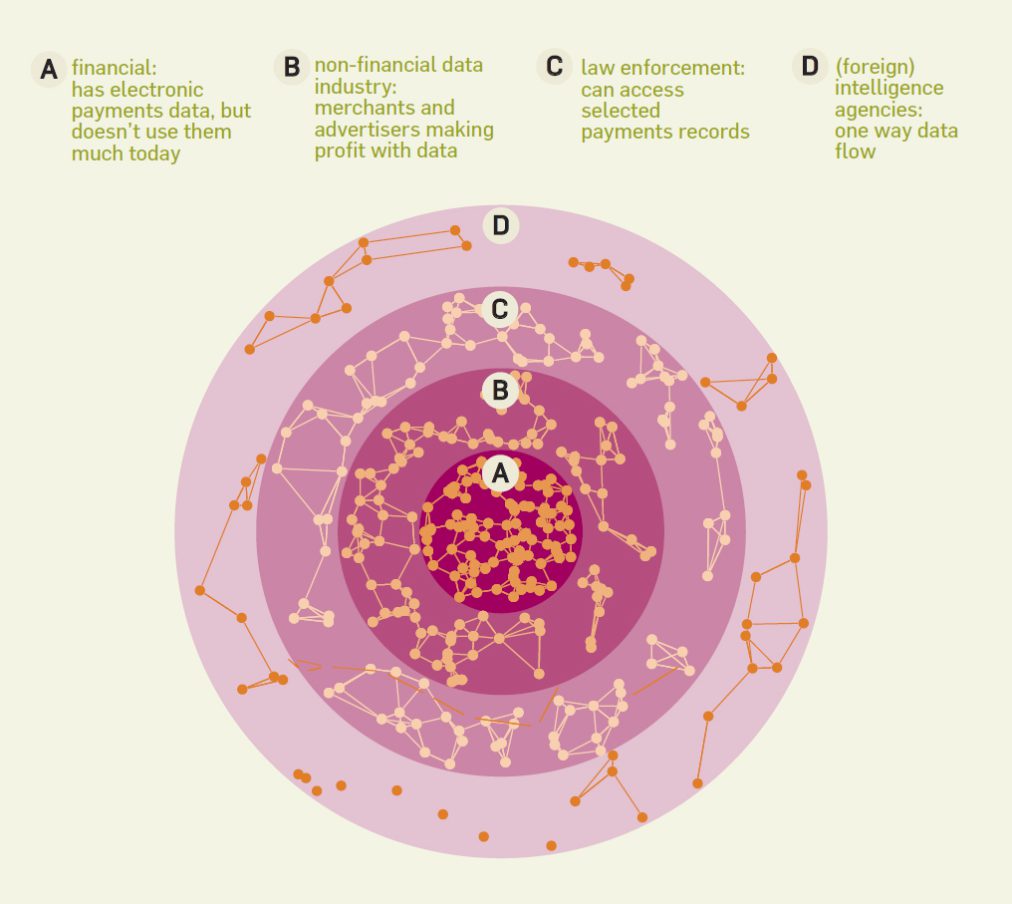

Central Bank Digital Currency Privacy Architecture

Seriously, various major Central Bank Digital Currency initiatives have engineered multiple privacy tiers, enabling central banks to access transaction data through strategic control mechanisms. China’s e-CNY has spearheaded an interesting “controlled anonymity” approach for numerous small transactions while maintaining some surveillance capabilities. Across several key European markets, CBDC development has prioritized various privacy-preserving features to protect individual data, though complete transaction anonymity? That’s still technically unfeasible.

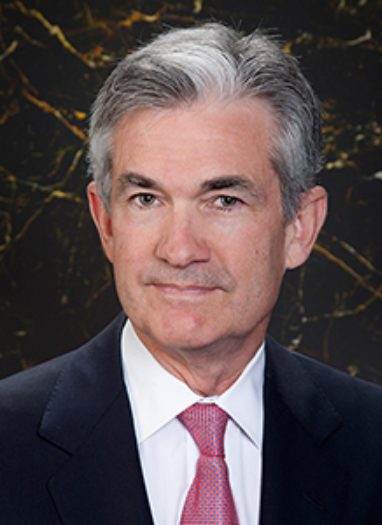

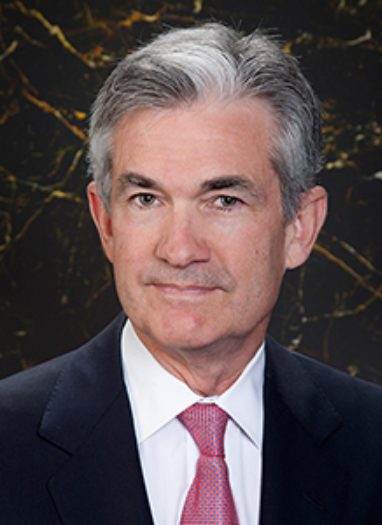

Federal Reserve Chairman Jerome Powell stated:

“I will not propose or pursue a digital dollar during the balance of my tenure at the central bank.”

De-Dollarization Through Digital Currencies

Check this out – several BRICS nations have engineered some impressive parallel payment systems outside US oversight. Digital currency geopolitics are heating up as multiple cross-border CBDC networks enable direct settlement without dollar intermediation. Get this – the US dollar’s share in global FX reserves dropped from 71% to 54.8% since 2001, with various CBDC initiatives accelerating the shift.

BIS General Manager emphasized:

“The BIS does not operate with any countries, nor can its products be used by any countries that are subject to sanctions…we need to be observant of sanctions and whatever products we put together should not be a conduit to violate sanctions.”

Also Read: Shiba Inu: Why Dogecoin & SEC Can Push SHIB Up 340%

Privacy vs. Sanctions

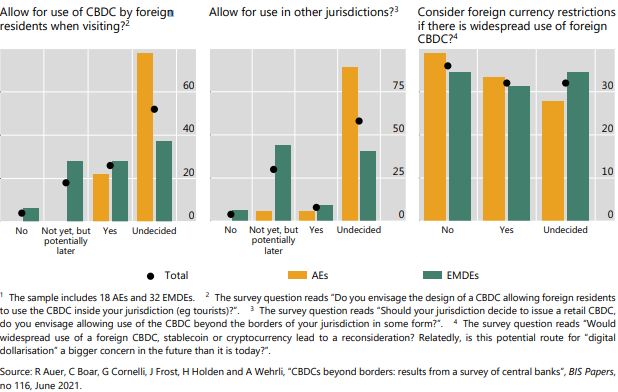

Here’s where it gets interesting – Project mBridge shows how CBDCs enable de-dollarization while raising numerous privacy concerns. This network, connecting several major economies like China, Thailand, UAE, Hong Kong, and Saudi Arabia, processes various transactions outside traditional monitoring systems. Privacy debates intensify as digital currency geopolitics reshape multiple financial surveillance capabilities.

Competing Visions

Listen up – the EU’s Markets in Crypto Assets (MiCA) framework demonstrates how several privacy considerations shape Central Bank Digital Currency development. While various European officials promote CBDC adoption for strategic autonomy, multiple strict data protection requirements limit surveillance capabilities.

House Financial Services Committee Chairman Hill noted:

“Extended stablecoin adoption would help extend the reserve currency status of the US dollar globally.”

Also Read: New Ripple XRP Price Surge to $3.40? What to Know

Surveillance and Sovereignty

Here’s the deal – nations deploying CBDCs gain numerous enhanced monitoring abilities while potentially escaping various US financial oversight mechanisms. Privacy debates center on several key aspects of CBDCs’ dual role in enabling both state surveillance and resistance to external monitoring, fundamentally altering multiple aspects of financial privacy and monetary control.

Federal Reserve Governor Christopher Waller emphasized:

“Stablecoins are likely to propagate the dollar’s status as a reserve currency, though they need a clear set of rules and regulations.”