President Donald Trump has changed the course of the markets by levying heavy tariffs on nations, which is now compelling the nations to de-dollarize. By de-dollarizing or exploring de-dollarization, nations like China have already issued commands to reduce US purchases, ushering in reduced dollar dependency narratives. This instance is not new, as the world is now increasingly pivoting to a new financial order where local currencies lead the way, all while trying to jeopardize the dollar’s reserve asset stance. As the US dollar continues to weaken, here’s what BitMEX’s Arthur Hayes has to say about the US dollar and its future.

Also Read: Trade War Begins: 3 Things Investors & Entrepreneurs Need To Know

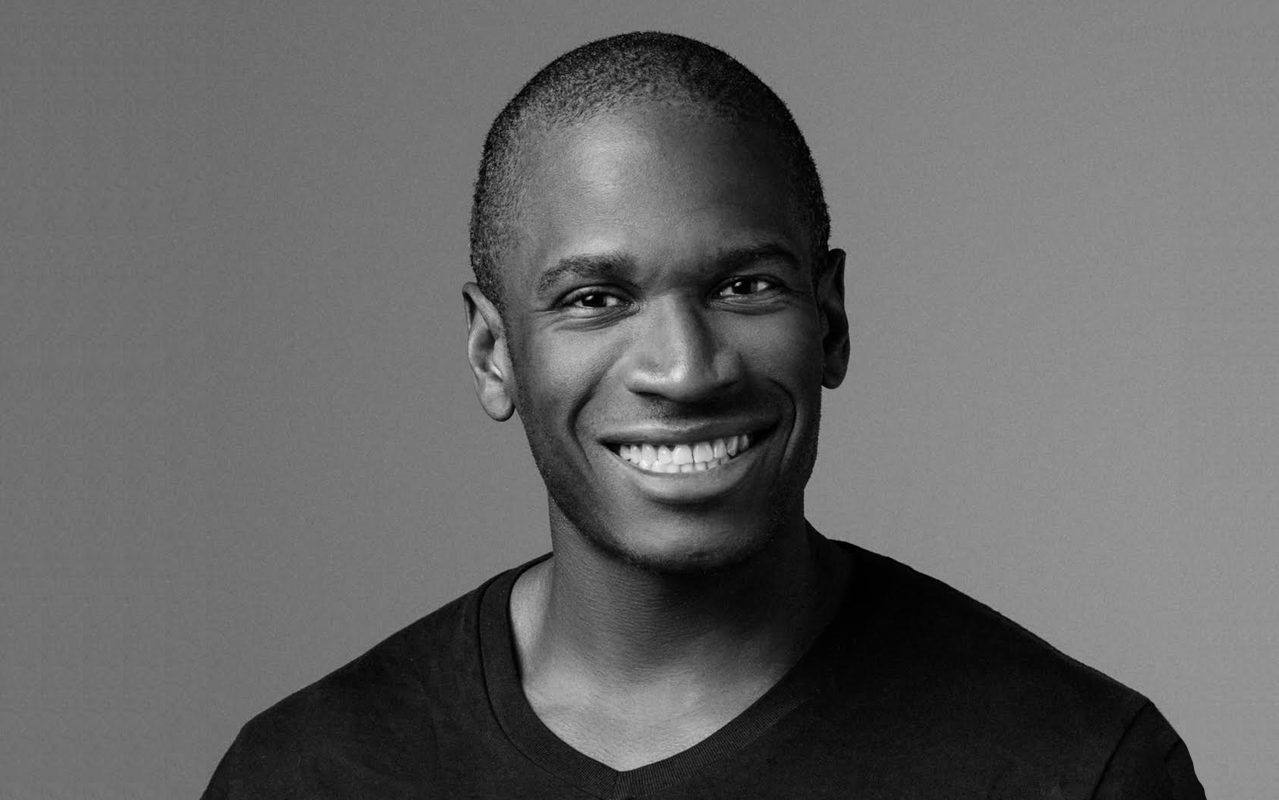

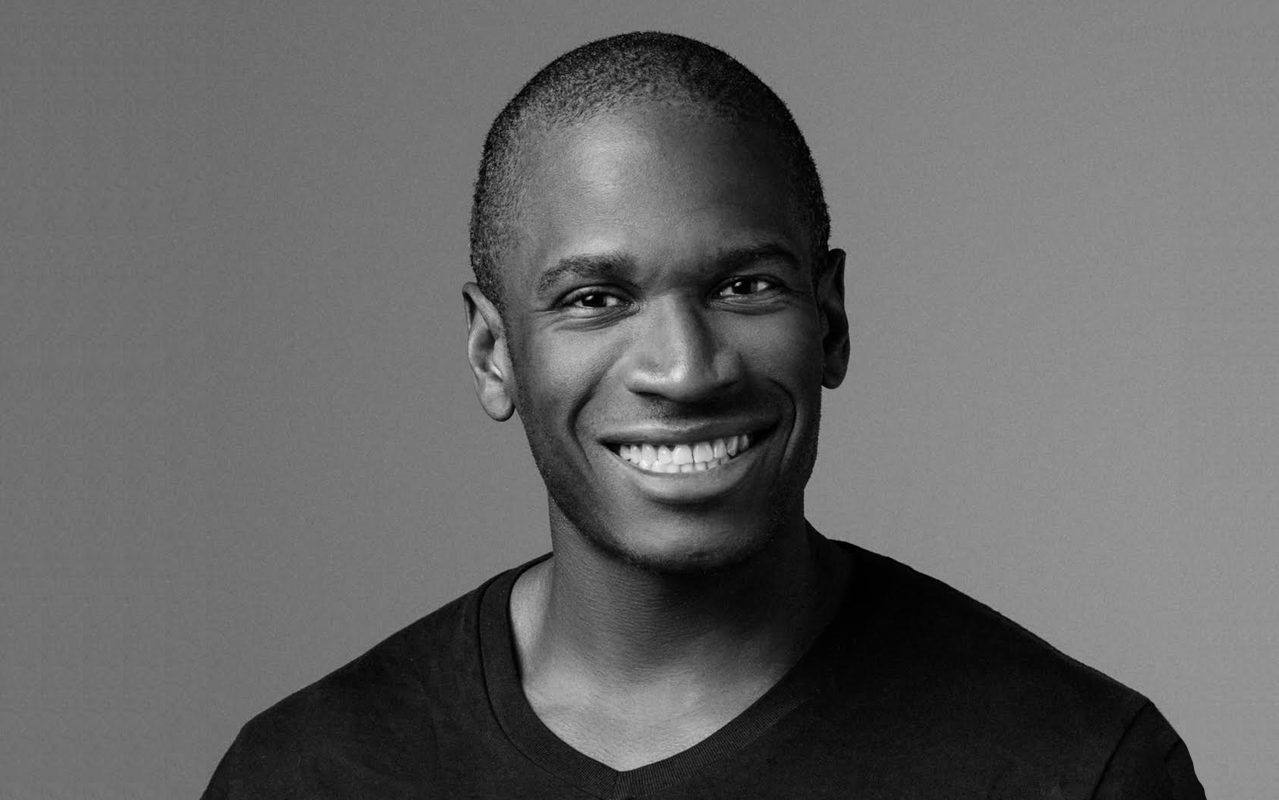

Arthur Hayes Speaks About The US Dollar

Former BitMEX CEO Arthur Hayes has shared his new statement about the changing narratives concerning the US dollar. In a recent X post, Hayes states how he believes it’s the end of US treasuries and US stocks as leading global reserve assets.

“THE END: Of US Treasuries and, to a lesser extent, US stocks as the global reserve asset. Since Nixon took the US off the gold standard in 1971, US treasury debt outstanding has grown by 85x. The US had to create the credit dollars necessary for the growth in the world economy. This was good for some Americans and bad for others. Trump was elected on average by those who believe they didn’t share in the US “prosperity” of the last 50 years”.

He later shared a compelling analysis, stating how the nations will be the first to sell US stocks and assets if their economies encounter any imminent danger. This will lead to further weakening of the dollar, leading the US economy to lose its luster. This development may also spearhead de-dollarization narratives to an extent.

Also Read: XRP Eyes 12.5% Jump to $2.25 as $18.9T Tokenization Wave Approaches

“If the US current account deficit is eliminated, then foreigners do not have dollars to buy bonds and stocks. If foreigners have to juice up their own nations’ economies, they will sell what they own, US bonds and stocks, to fund their nation-first policies. And even if Trump backtracks on the severity of the tariffs, no finance minister or world leader can risk Trump changing his mind again, and therefore things cannot return to the way they were. You must do what is best for your country.”

THE END:

— Arthur Hayes (@CryptoHayes) April 5, 2025

Of US Treasuries and to a lesser extent US stocks as the global reserve asset. Since Nixon took the US off the gold standard in 1971, US treasury debt outstanding grew by 85x. The US had to create the credit dollars necessary for the growth in the world economy. This was… pic.twitter.com/sR9p2lwK47

New Reserve Asset in the Making?

Hayes later shared how, instead of the US dollar, gold could return and make its brand appearance on the macro global plane. This would lead to the US dollar being secondary in value, with gold recognized as a “neutral“ reserve asset. This would entail nations to rummage for gold, exploring de-dollarization concepts.

“THE RETURN: Of gold as the neutral reserve asset. The dollar will still be the reserve currency, but nations will hold reserves in gold to settle global trade. Trump hinted at this because gold is tariff exempt! Gold must flow freely and cheaply in the new world monetary order.”

Gold Prediction for 2025

Per Deutsche Bank, gold has been consistently rising up on the radar. The bank has issued a new price forecast for gold, adding how it can reach up to $3350 by the end of 2025.

“We conclude that the bull case for gold remains strong despite this week’s correction and further upgrade our year-end (fourth quarter 2025) forecast to $3,350 per ounce,” the bank said in a note on Monday.”

Also Read: De-dollarization: China’s 10-Year Plan Now Operational as Yuan Usage Surges 3000%!