De-dollarization efforts by China have been steadily advancing for over a decade now, with recent data actually showing a dramatic 3000% increase in yuan adoption for international trade. This currency diversification plan, which was initiated about 10 years ago, is currently fully operational as Beijing continues to implement various financial infrastructure changes to reduce their dependence on the US dollar.

Also Read: Bitcoin Beats Gold? 21M Cap Could Trigger a Supply Shock

How Currency Diversification Threatens Dollar Dominance

China’s Strategic De-dollarization Yields Results

China’s de-dollarization campaign began long before the recent tensions that we’re seeing today. And, as a matter of fact, a financial expert at the conference had this to say:

“China has been preparing for this journey since 10 years ago. It has already planned for less dependence on the dollar.”

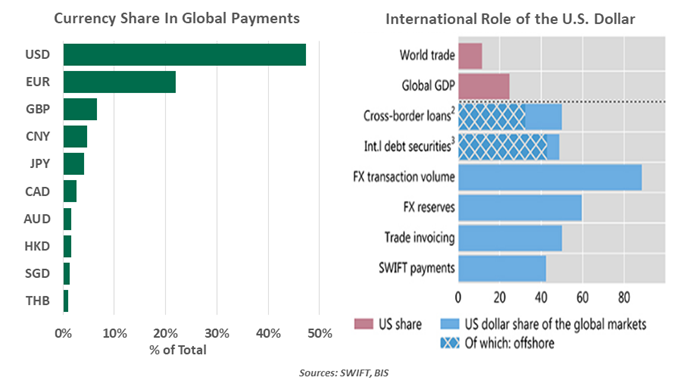

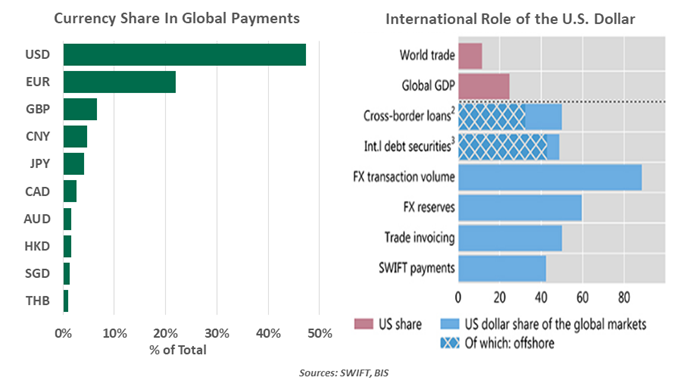

Yuan trade invoicing has, at this point in time, grown from nearly zero about 15 years ago to approximately 30% today, and, you know, some reports are even indicating that around 56% of China’s payments are now actually being conducted in their own currency right now. This shift represents, without a doubt, significant and important currency diversification progress in the global financial system as we can see.

Also Read: China Escalates Trade War: US Goods Face 125% Tariff Starting April 12

BRICS Payment System Challenges SWIFT

The development of alternative financial infrastructure remains, in many ways, critical to the ongoing de-dollarization strategy. An analyst who has been tracking these developments stated:

“These countries really have an interest to bypass SWIFT, whether it’s through CIPS, mBridge, or a blockchain-enabled BRICS common payment system.”

Dollar Decline Accelerated by Fiscal Issues

America’s growing fiscal challenges are also contributing to the dollar decline concerns that many experts have right now. A prominent economist at the event warned:

“During the 1970s, when things got out of control, the dollar lost a lot of territory. If things get out of control again… this is one of the potential triggers for having more inflation, and that’s going to undermine the dollar.”

The fragmentation of the global economic order has, in recent years, accelerated quite a bit, creating rather favorable conditions for currency diversification and various de-dollarization strategies across multiple regions.

Also Read: 3 Infrastructure Tokens Under $2 With 10x Potential in 2025