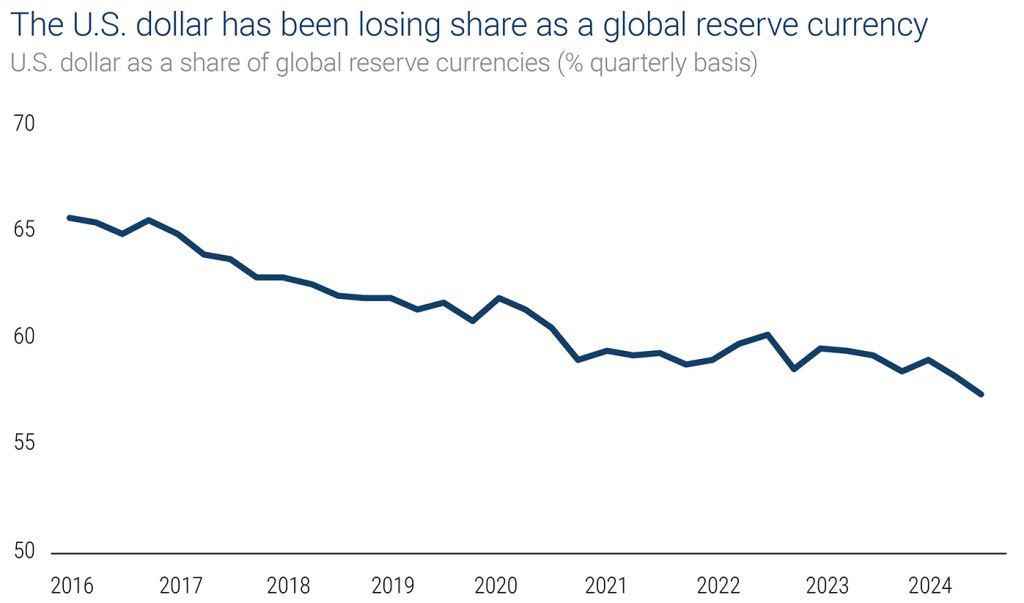

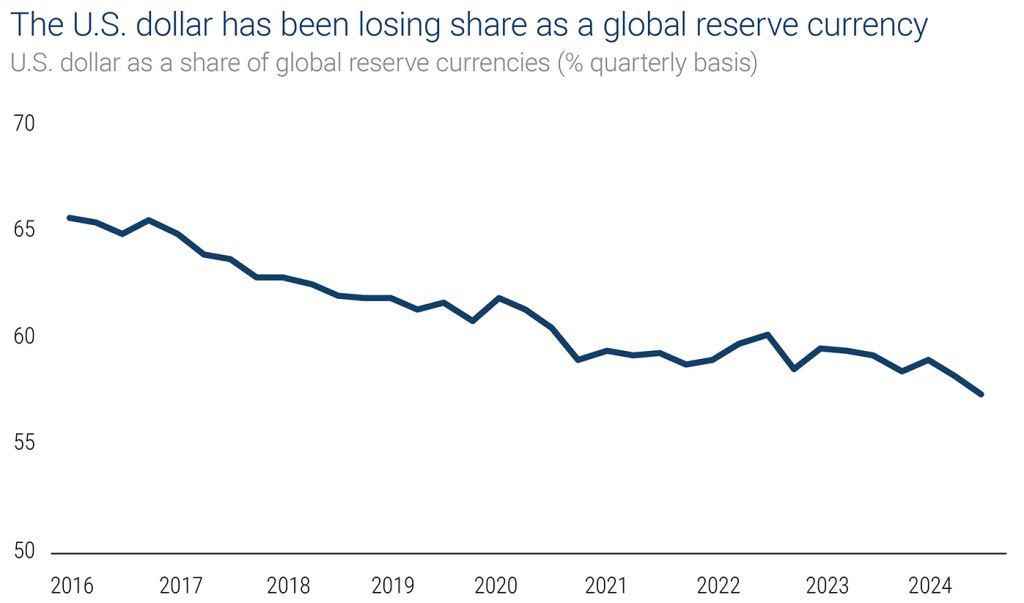

De-dollarization is actually gaining quite a bit of momentum these days as the US dollar’s global dominance faces some pretty serious challenges. Right now, at the time of writing, financial advisory firm Devere Group has just recently highlighted this growing trend, and they’re also warning investors about the significant implications for global markets and investment portfolios as well.

Also Read: Chainlink: AI Predicts LINK’s Price For May 10

Navigate Global Reserve Currency Shifts as Dollar Erosion Deepens Financial Security

Dollar Supremacy Cracking

Recent years show some significant decline in the US dollar holdings in world reserve assets which also creates some widespread fear about the potential end of dollar dominance. The global de-dollarization trend threatens investors who fail to prepare against any upcoming market instability.

Nigel Green, CEO of Devere Group, stated:

“Dollar supremacy isn’t vanishing overnight, but its era of unquestioned dominance is fading. This carries enormous consequences for global portfolios, pricing, and capital allocation.”

Green also emphasized the nature of this decline in his assessment:

“This decline is not a crash—it’s erosion.”

Also Read: De-dollarization in Action: China & Japan Back $240B Yuan-Based Bailout Fund

Asia Dumps USD

Asia has witnessed a crucial transformation in dollar currency preferences which represents a central component of today’s currency reform efforts. The economic sanctions drove countries to establish new financial systems because sanctions accelerated these alternative economic transitions.

Green also explained the shifting currency landscape in his analysis, by saying that:

“The euro is repositioning itself not just as a regional anchor, but as a serious global stabiliser.”

Regarding the future currency system, Green additionally noted:

“We don’t think any single currency is about to take the dollar’s place. Instead, we expect a more fragmented system—one where influence is shared across a handful of credible currencies.”

Global Reserve Currency Shifts

De-dollarization is absolutely reshaping global reserve currency shifts in many ways, and this is creating both challenges and also opportunities for investors who are trying to navigate this changing landscape.

Green warned investors about outdated assumptions in his recent statements:

“Investors must stop assuming the dollar will always rebound. That thinking is dangerously outdated. The shift to dominant currency plurality is underway.”

On monetary policy implications, Green further explained:

“This shrinking rate gap makes U.S. debt less attractive. And when demand for Treasuries softens, so does demand for dollars.”

Also Read: AI Predicts Odds Of Dogecoin (DOGE) Deployment On X Before 2025 Ends

Green concluded with this particular assessment of the situation:

“Dollar dominance isn’t over—but it’s being critically diluted. Those who act early will be best placed to capitalize on the next phase of global finance.”