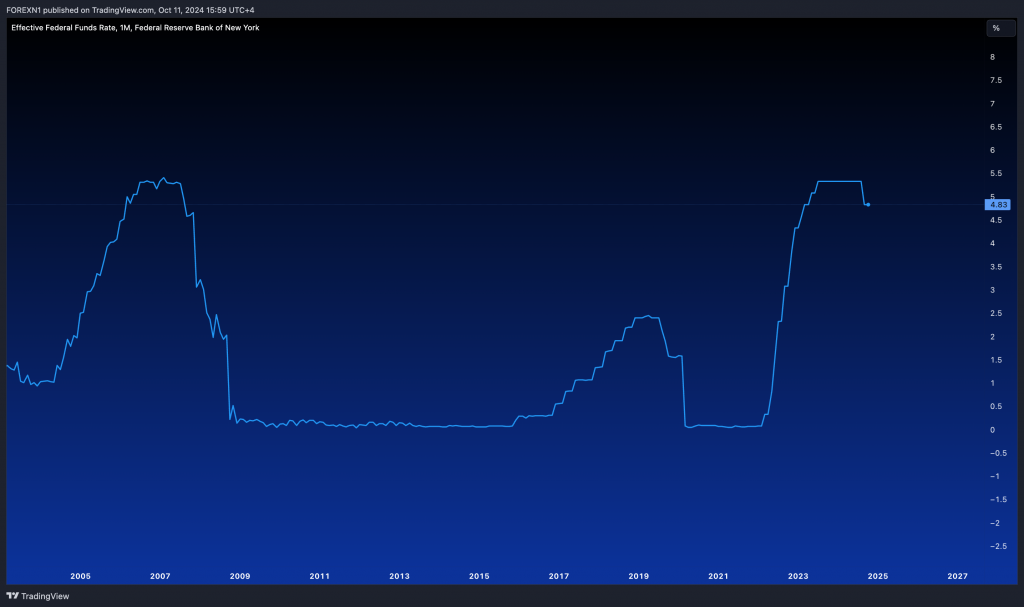

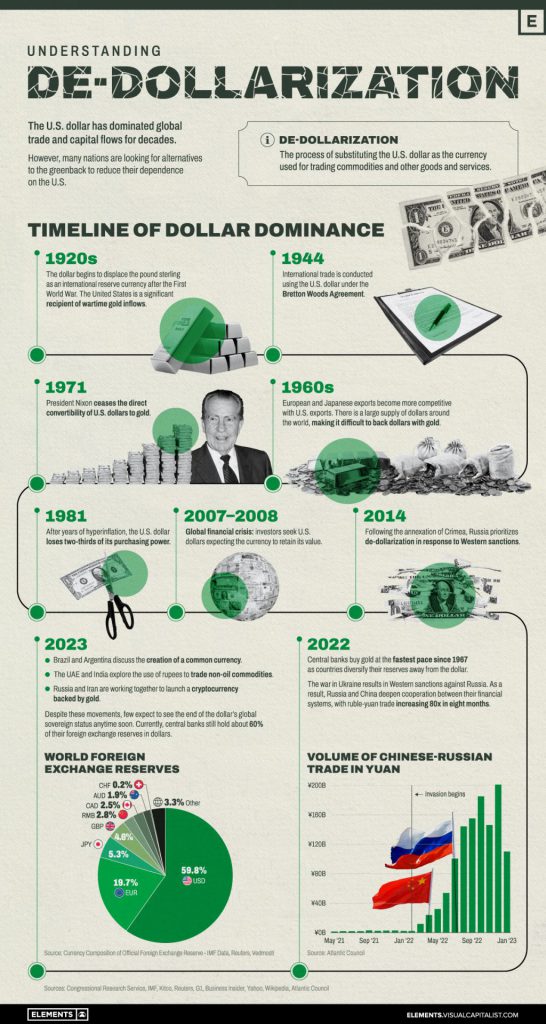

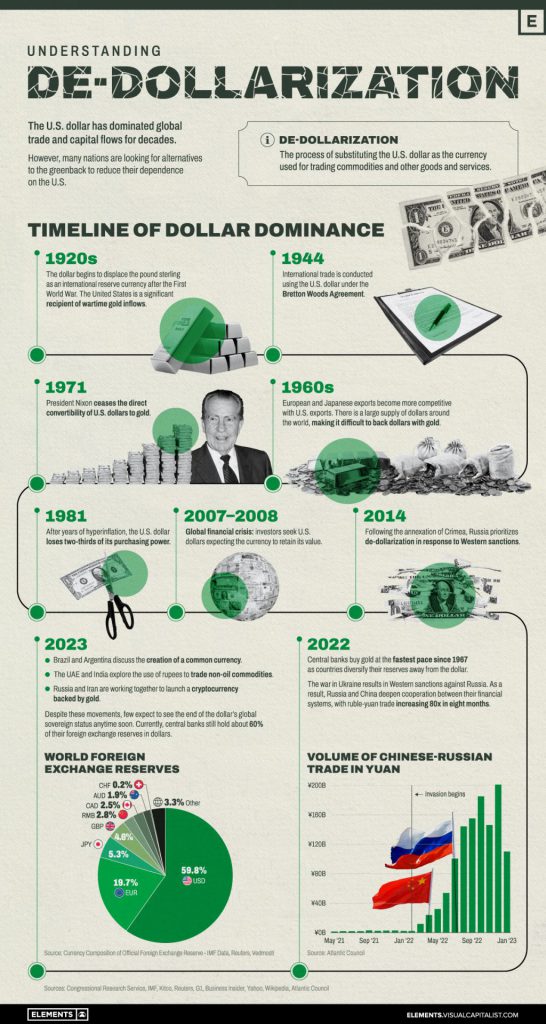

De-dollarization presents a serious threat to the U.S. economy. If the dollar loses its top currency status, the effects would be dramatic. The U.S. dollar reserve status weakening would make borrowing costs soar. Companies would struggle to get capital. U.S. business costs would rise sharply. The stock market could see a significant value drain. These global currency shifts associated with de-dollarization are already showing troubling signs.

Also Read: Why Nvidia’s Q3 Results Could Shake the S&P 500 This Week

How De-Dollarization Will Affect Global Currency Systems and Financial Markets

Economic Implications of Dollar Decline

De-dollarization puts pressure on U.S. markets. Higher borrowing costs would make it harder to get loans. Business costs would go up significantly. The stock market could lose value as traders look for dollar replacement alternatives.

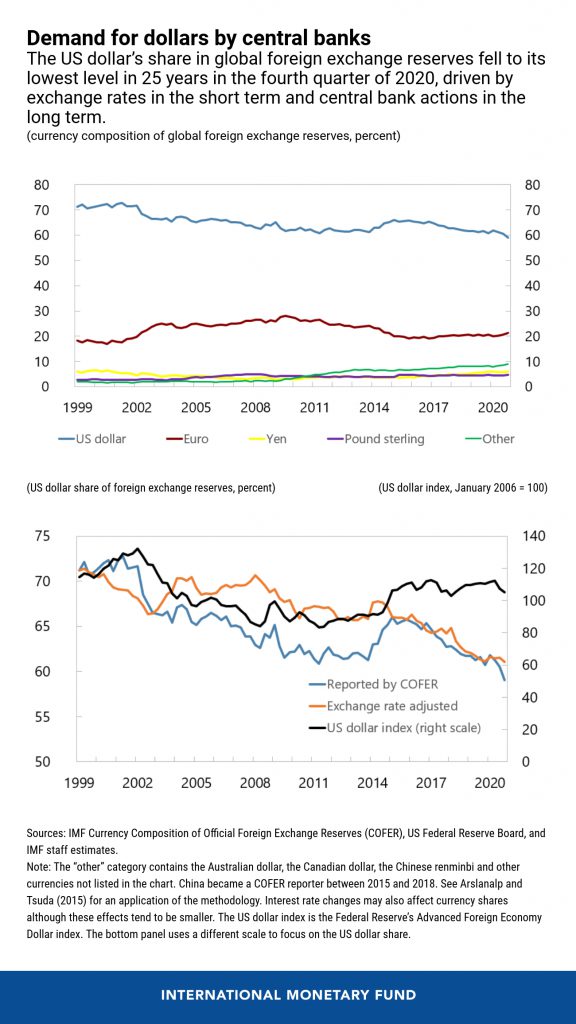

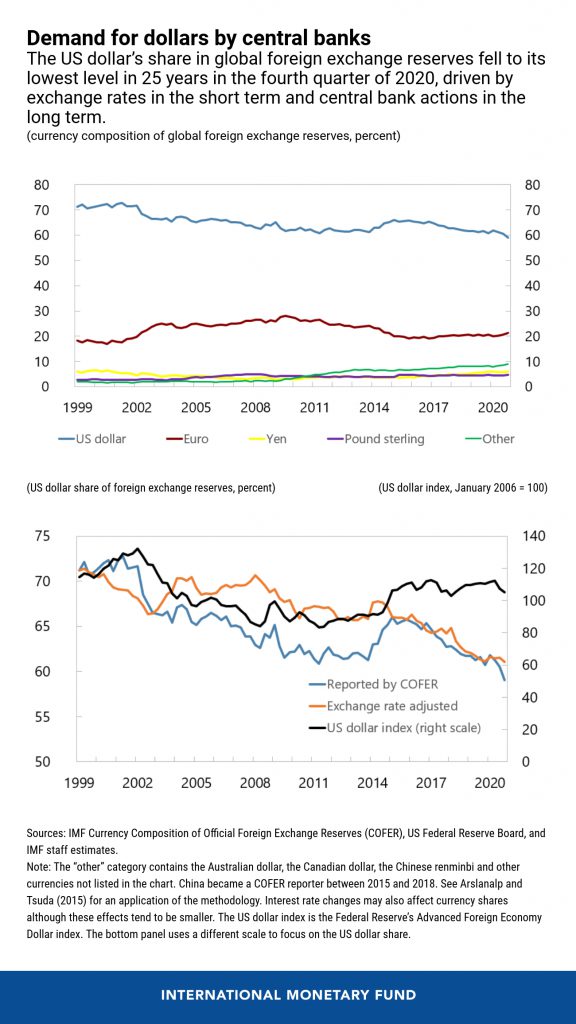

Central Banks Seek Alternative Reserves

Russian President Vladimir Putin emphasized: “The dollar is being used as a weapon. We really see that this is so. I think that this is a big mistake by those who do this. Nearly 95% of trade between Russia and China is now conducted in rubles and yuan.” This highlights the move towards de-dollarization.

Also Read: Billionaire Investor Laments Selling Billions Of Bitcoin (BTC) Early

Global Currency Shifts Accelerate

Bank of America economist Claudio Irigoyen warns: “If the U.S. moves to a point where the preferred policy is one of financial repression that allows to inflate the debt away, the market will start wondering about alternatives to the dollar as a store of value.” Consequently, de-dollarization might become inevitable.

Investment Strategy Adaptation

Investment expert Michael Landsberg advises: “Our main message to investors is to continue to diversify portfolios outside of the U.S. to take advantage of stronger growth and a falling dollar. India continues to be our most preferred non-U.S. country for opportunities in stocks.” The advice directly ties into strategies adapted due to de-dollarization trends.

Also Read: Pepe: Here’s How To Be A Millionaire When It Hits $0.0005

U.S. Dollar Reserve Status Under Pressure

The economic implications reach beyond markets. More countries now create their own payment systems. Dollar replacement alternatives keep growing stronger, accelerating de-dollarization. Central banks bought 152% more gold in 2022. This shows they worry about global currency shifts and want other options.