Nvidia earnings is this week’s biggest market event. Options traders expect major S&P 500 volatility. Bank of America says this Q3 earnings report will move markets more than jobs or inflation data. Nvidia drives 20% of S&P 500 returns yearly and will make up 25% of Q3 profit growth. The chipmaker’s performance could trigger unprecedented market swings across all sectors.

Also Read: Pepe: Here’s How To Be A Millionaire When It Hits $0.0005

How Nvidia’s Earnings Could Impact S&P 500 Volatility and Market Trends

Market Expectations and Potential Moves

The S&P 500 could move 1.05% after Nvidia’s report, and the stock itself might swing 12.5%. Bank of America’s Gonzalo Asis states, “It remains the most dominant stock in the market… expected to drive nearly 25% of the S&P 500’s EPS growth in 3Q.” This market impact brings new financial uncertainty. Trading volumes have surged as investors position themselves for potential volatility.

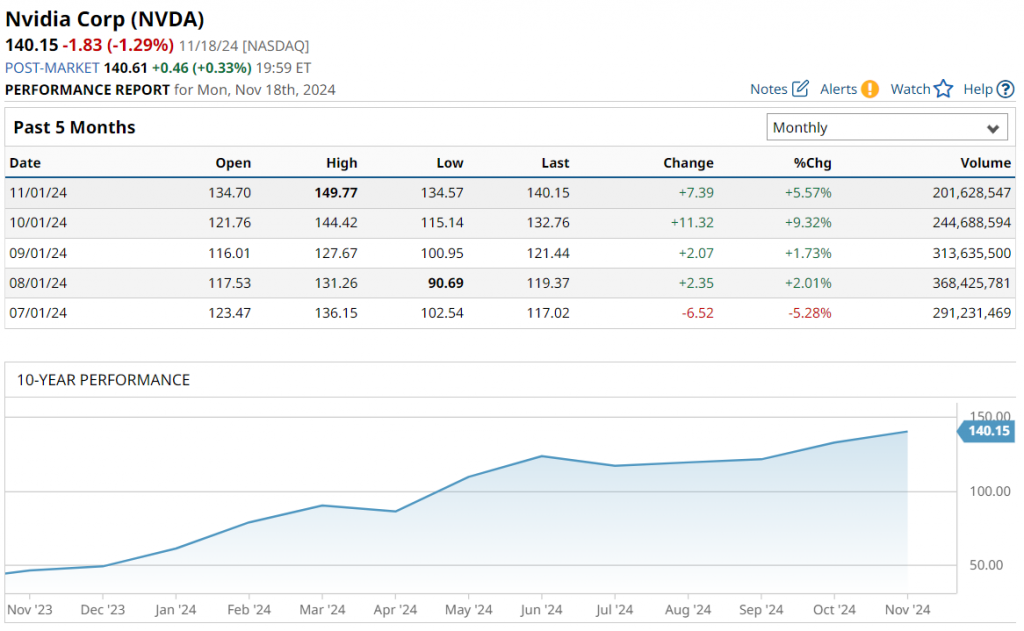

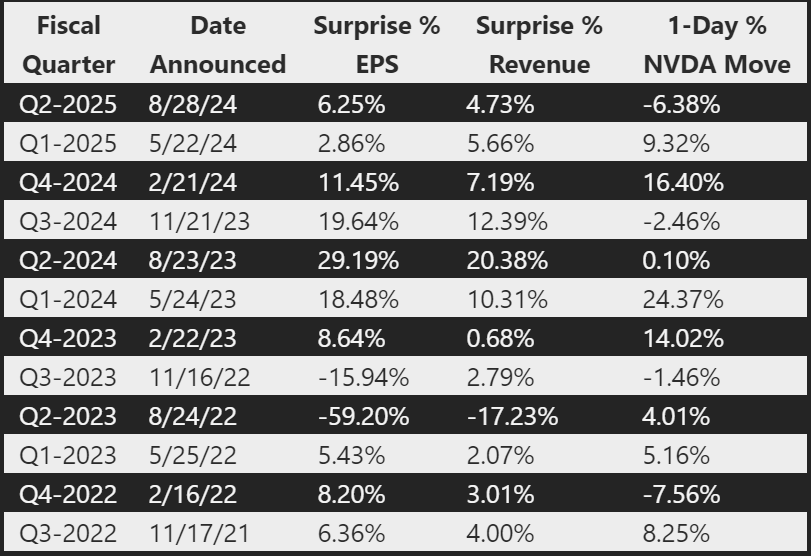

Historical Performance Context

Nvidia beat earnings targets in ten of the twelve past quarters. Their biggest one-day jump was 24.4% after Q1 2024 results, showing high S&P 500 volatility risk. Recent Q3 earnings reports show 15% average profit beats. Market analysts closely monitor these patterns for trading signals.

Also Read: Poll: 85% Investors Believe Bitcoin Will Reach $100,000 in 2024

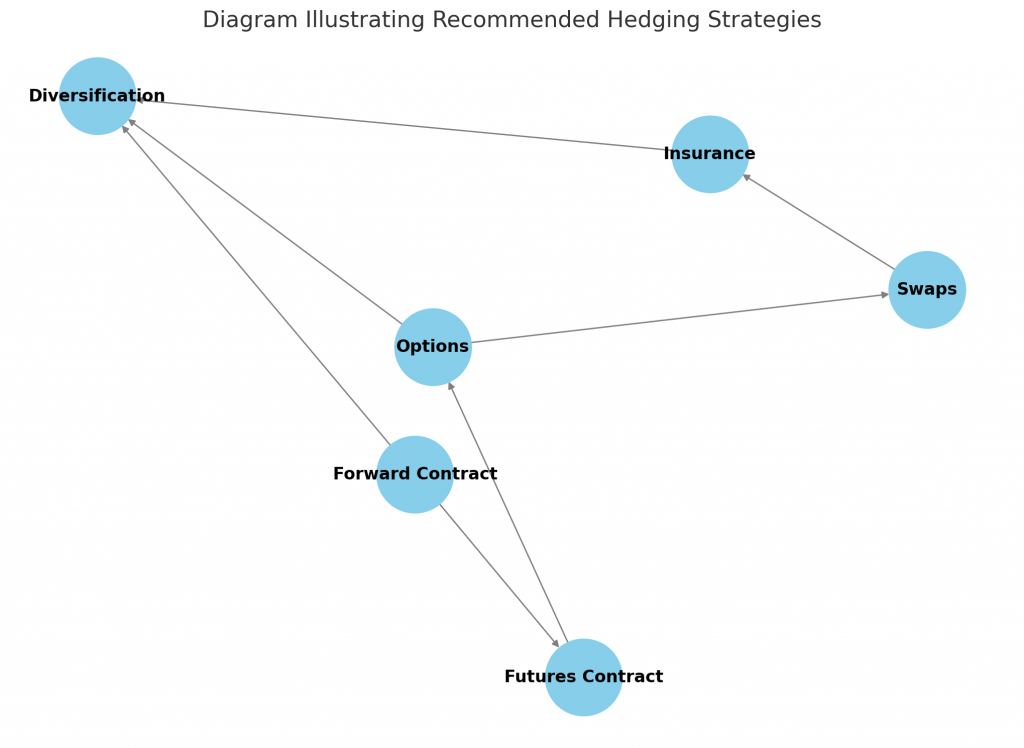

Hedging Strategies Emerge

Bank of America suggests Nasdaq-100 ETF put spreads. These could pay 5x if the index falls 3.3%. “Options are assigning more broad-market risk around NVDA earnings than around next month’s NFP and CPI days, and as much as the Dec FOMC,” their team says. More traders now seek protection, and institutional investors have doubled their hedging positions.

Also Read: Bitcoin: MicroStrategy to Raise $1.75B For BTC Purchase

Current Market Sentiment

Q3 earnings season brings extra market impact this time. Financial uncertainty has grown after recent elections. “We remain cautious of fragility risks in single names around earnings,” Assis warns. Past data shows Nvidia earnings often shake major indexes. Trading desks report increased client inquiries about protective strategies.