De-dollarization is accelerating globally right now as over 50 countries are actively working to reduce their dependence on the US dollar. This ongoing global currency shift has some pretty serious implications for the multipolar world economy as central banks are also boosting their gold reserves while at the same time reducing their dollar holdings.

![Chart showing the dollar sliding on fears tariffs will knock U.S. growth, with dollar index down 6.06%]](https://watcher.guru/news/wp-content/uploads/2025/04/image-130.png)

![Chart showing the dollar sliding on fears tariffs will knock U.S. growth, with dollar index down 6.06%]](https://watcher.guru/news/wp-content/uploads/2025/04/image-130.png)

Also Read: The Battle for Global Reserve Currency: Which CBDC Will Reign Supreme?

Why Global Currency Shifts and Gold Reserves Threaten the USD

BRICS Expansion Drives De-Dollarization

The BRICS economic bloc has actually emerged as a kind of counterweight to Western financial systems. Russia and China now conduct about 95% of their trade in local currencies, basically bypassing the dollar completely in their ongoing de-dollarization efforts.

Russian President Vladimir Putin stated:

“The dollar is being used as a weapon. We really see that this is so. I think that this is a big mistake by those who do this.”

Central Banks Turn to Gold

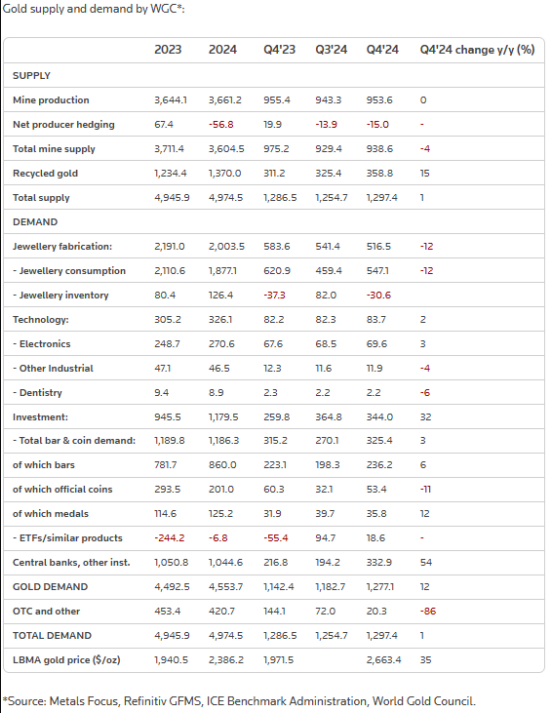

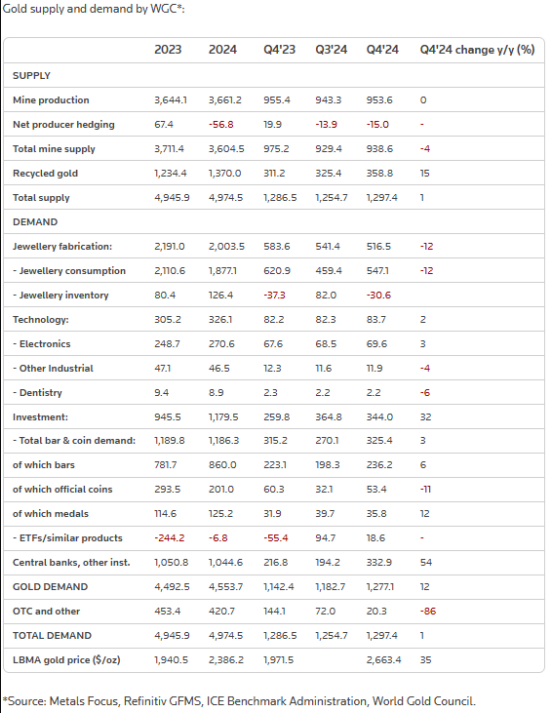

De-dollarization is pretty evident in central bank gold purchases, which jumped around 54% year-on-year to approximately 333 tons following recent economic policy shifts.

Michael Widmer, commodity strategist at Bank of America, stated:

“Emerging market central banks currently hold around 10% of their assets in gold. They should really hold 30% of their assets in gold.”

European Nations Join De-Dollarization

Poland has now become the largest gold buyer in March 2025, purchasing like 16 tonnes and actually outpacing China and Russia in its de-dollarization strategy.

David Miller, Chief Investment Officer at Catalyst Fund, noted:

“That increases its YTD net purchases to 49 tonnes, equivalent to 54% of its total purchases in 2024 (90 tonnes).”

Also Read: Two Economic Giants Team Up to Shatter US Dollar Dependence with 6 De-Dollarization Projects

Global Currency Shift Intensifies

The dollar is at this moment experiencing its worst start to a year since 2008, falling about 6.1% since January as the global currency shift continues to accelerate.

Thierry Wizman, global foreign exchange strategist at Macquarie, explains:

“What we’re seeing today is a further indication that the structure and nature of the U.S. dollar’s relationship to global markets has changed.”

Per Jansson, Sweden’s central bank deputy governor, warned:

“If the dollar’s status would change, that would be a big change for the world economy… and would basically create a mess.”

Also Read: XRP Eyes 12.5% Jump to $2.25 as $18.9T Tokenization Wave Approaches

As the multipolar world economy keeps strengthening, this whole de-dollarization trend represents a sort of fundamental transformation that Wall Street can no longer really ignore.