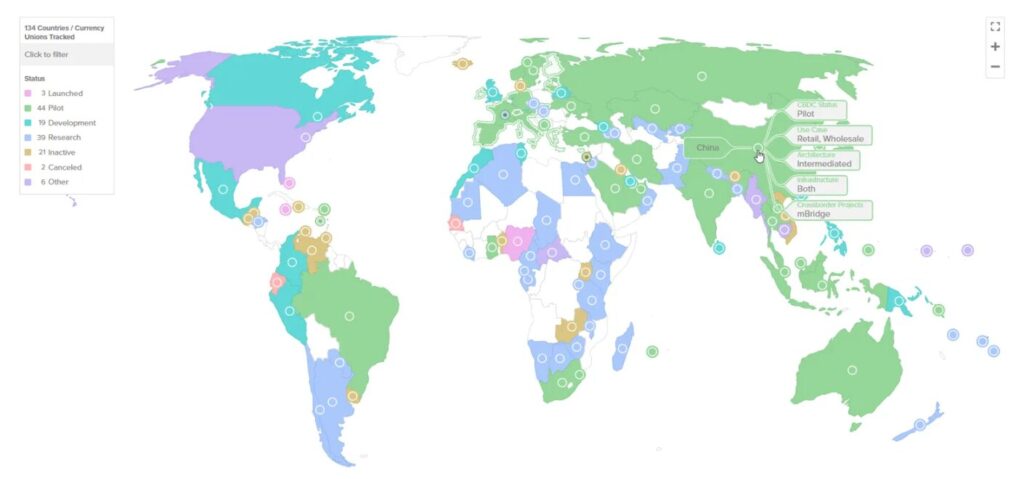

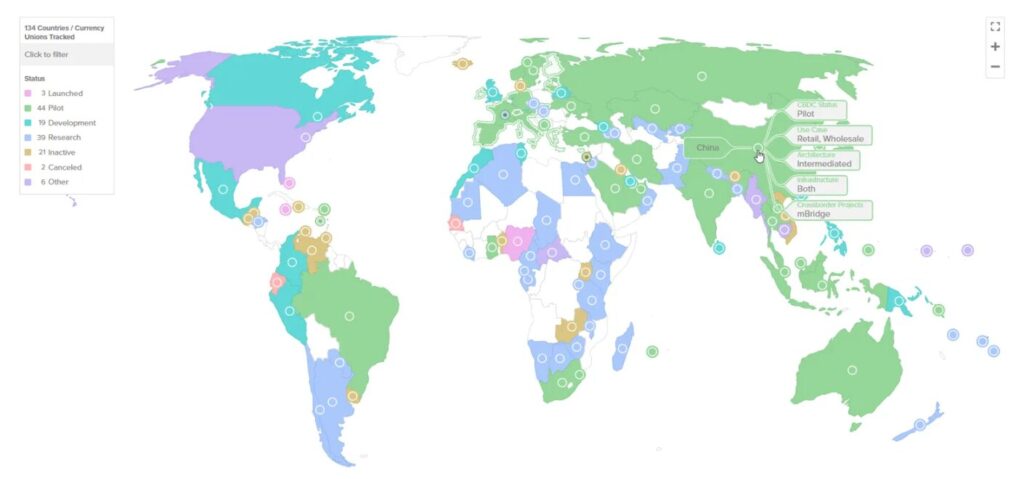

CBDCs are rapidly transforming the global financial system these days as nations around the world compete to establish digital versions of their currencies. Right now, with over 100 countries actively exploring central bank digital currencies, the race for dominance has some really significant implications for the future of global reserve currency status.

Also Read: XRP Eyes 12.5% Jump to $2.25 as $18.9T Tokenization Wave Approaches

Digital Yuan vs Global Competitors: The Race for CBDC Supremacy

China’s Digital Yuan Leading CBDC Development

China’s digital yuan (e-CNY) has emerged as probably the most advanced CBDC project globally at this point in time. First launched in 2019, its transaction volume has actually reached approximately $986 billion across 17 provincial regions by June 2024. The e-CNY basically aims to enhance payment efficiency while also giving the Chinese government greater financial system control.

Global CBDC Initiatives Gaining Momentum

The Bahamas introduced the Sand Dollar back in 2020 as the world’s first operational CBDC. And also, Sweden’s e-Krona and the European Central Bank’s digital euro are making significant progress as well.

The European Central Bank stated:

“Central bank money is a risk-free form of money that is guaranteed by the state.”

Meanwhile, in the United States, there have been some setbacks in digital dollar development under recent policy shifts, and this has created an opening for other CBDCs.

Also Read: Currency: E-Yuan is Here – How China’s CBDC Could Destroy the Dollar

Determining CBDC Dominance

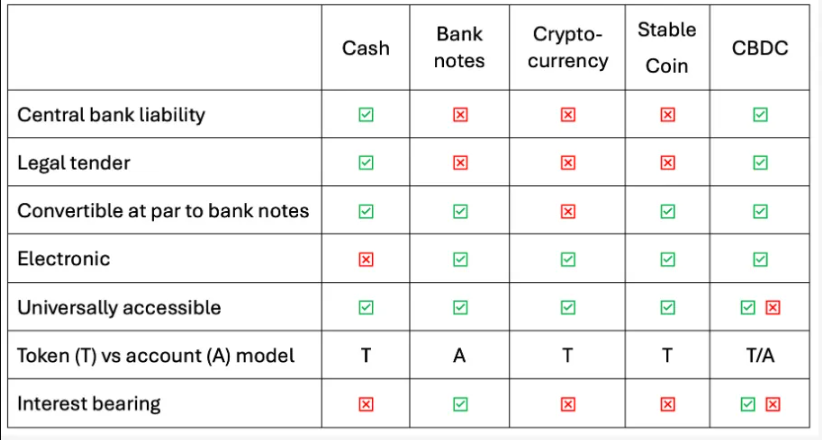

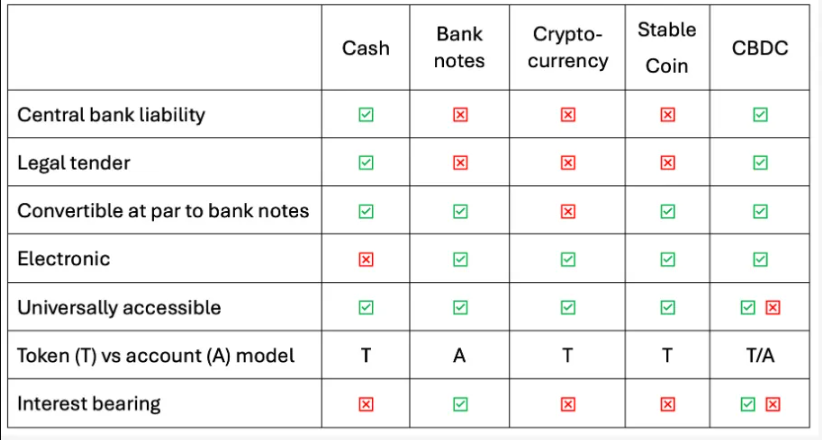

There are multiple factors that will eventually determine which CBDC might dominate global finance, such as adoption rates, technological infrastructure, and also international acceptance in various markets.

The Bank of England had this to say that:

“£10 of a UK digital currency would always be worth the same as a £10 note.”

This stability essentially contrasts with the volatility that’s often seen with private cryptocurrencies and makes CBDCs more attractive for everyday use.

Global Reserve Currency Implications

The potential for CBDCs to actually disrupt the U.S. dollar’s status as the primary global reserve currency remains a key consideration. China’s advanced position with the digital yuan could possibly grant it increased international financial influence in the coming years.

According to the Atlantic Council: “Central bank digital currencies can improve the transparency of money flows.”

This particular feature addresses concerns about financial crime that traditional cash systems enable, and it’s one of the reasons why many countries are exploring CBDCs.

Also Read: De-dollarization: China’s 10-Year Plan Now OPERATIONAL as Yuan Usage SURGES 3000%!

The Future of Digital Money

While China currently leads in CBDC development, the “power” of any CBDC will ultimately depend on domestic adoption, international acceptance, and strategic positioning. As more and more countries implement their digital currencies, the global financial landscape will continue evolving in unexpected ways.

The International Monetary Fund noted:

“If a natural disaster or the failure of a payments company made cash unavailable, a CBDC could provide a back-up.”

This resilience factor adds another dimension to CBDCs’ potential dominance in the future financial system, and it’s something that many central banks are considering, you know, as they go about their development plans and such. The ability to function as a backup payment method is actually pretty important for maintaining stability in today’s increasingly digital economy.

Also Read: What Happened To The U.S. Treasury Market?