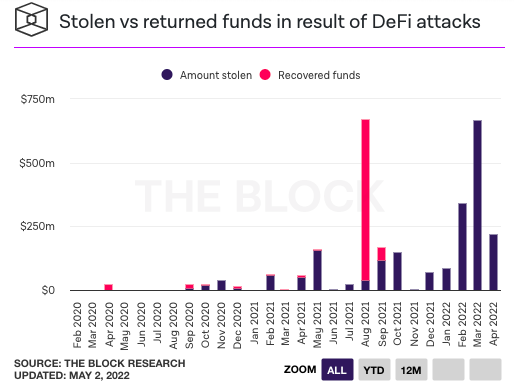

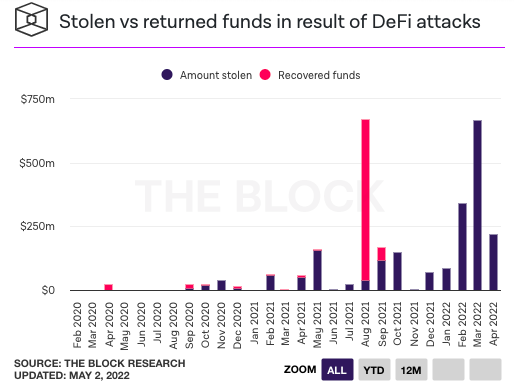

Exploiters keenly keep track of technical vulnerabilities present in the ecosystem. When the right time comes, lo and behold, they execute pre-planned hacks. In just 4 months into 2022, over $1.6 billion have already been stolen from crypto users. In fact, the said figure is single-handedly more than the total amount stolen in 2020 and 2021 combined.

The number talk

Blockchain security firm CertiK brought to light that March accounted for the most value stolen – $719.2 million. The same is approximately $200 million more than what was stolen throughout the 12 months in 2020. The $600 million Ronin bridge hack had the most contribution.

Last month, the community lost $5.5 million—an amount perhaps equivalent to Elon Musk’s “lunch money“—to merely the top 10 exit scams. On the whole, however, 31 major attacks were recorded in April, with the total losses mounting to $376,736,790. The most valuable exploit was the Beanstalk Farm one where funds more than $180 million were drained.

The $79 million lost by Fei Protocol towards the end of the month was the next most valuable heist, followed by DEUS Finance’s multi-million hack. The blockchain security firm highlighted,

“April 2022 holds the record for highest $ amount losses in #flashloan attacks ever recorded by us.”

Per Block’s data, none of the DeFi attack stolen funds in April, or any of the three months in 2022, have been recovered.

DeFi health check

The DeFi market has been chaotic for quite some time. The overall health—as highlighted in a recent article—has been deteriorating, owing to the dwindling TVL.

Back in December, the cumulative value of assets locked on all DeFi protocols stood around $250 billion. However now, it has already slipped below the $200 billion mark.

Well, the dip in the TVL and the rise in the number of hacks brings to light the inverse relation that the said datasets share. And perhaps, the falling the TVL is a direct result of people withdrawing their assets from the DeFi space out of fear.