The DeFi market has not been in its best shape of late. Per our February DeFi health checkup, the total DeFi market cap had dropped from $199.4 billion to $114.2 billion, in a period of less than 4-months. In the same timeframe, the Total Value Locked [TVL] in DeFi had dipped from $105 billion to $70 billion.

At press time, the market cap number was even lower—it merely reflected a value of $129.3 million. The TVL, however, stood elevated by close to $6 billion, at $75.9 billion.

Aave’s role

Since November last year, Aave’s TVL mirrored the macro DeFi TVL downtrend. However towards mid-March, things started changing, and at present, the cumulative worth of assets locked on the protocol stands at $11.5 billion [up from March’s $8.3 billion].

Aave’s market cap has been fluctuating alongside its price. So, having a look at its price trends will give us a better understanding of Aave’s state of affairs.

On the price front, Aave has been consolidating in and around the 61.8% Fib level since mid-April. Using the same level of support, the DeFi token managed to incline by around 3.8% to $174.8 in the day’s trade.

So, from here on, Aave evidently has the potential to climb up by 6%-7% until being tested by the 50% level. Post that, can it climb by another 20% to $226?

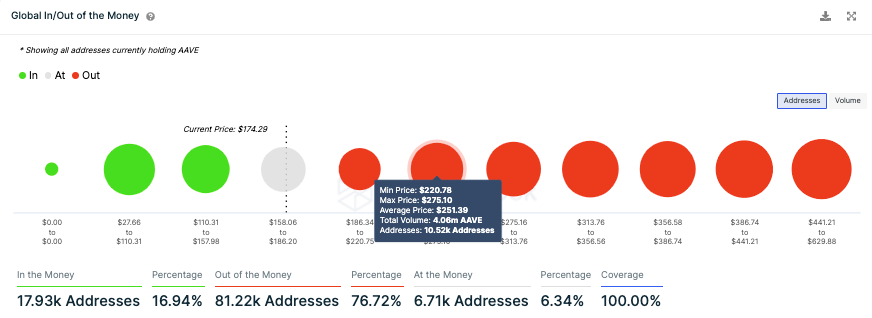

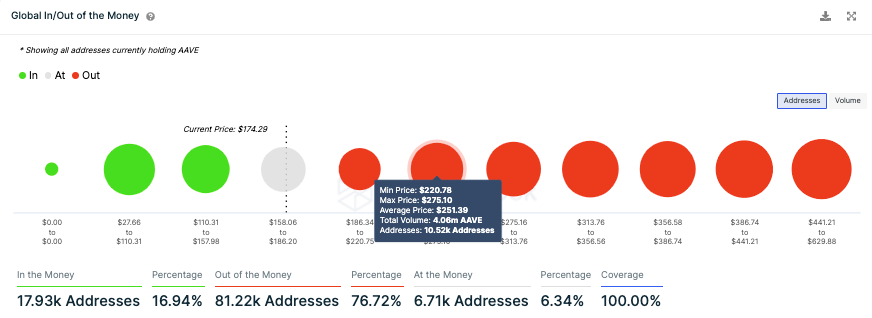

Probably, yes. At this stage, close to 80% of Aave HODLers are in losses, and the odds of them abandoning their tokens by selling are to be quite minimal. Per data from ITB, the next major resistance cluster for Aave extends from $220.78 to $275.1. Over here, over 10.52k addresses bought $4 million Aave.

So only when the price enters into the said price bracket, would the said HODLers be triggered to sell. Thus, until then, Aave should be able to rally, provided the broader market fosters its uptrend.

So, a rise in the DeFi token’s price would ultimately balloon up to its market cap, and the same would lead to a rise in the cumulative DeFi market cap.

On the flip side, if Bitcoin and co. end up extending their correction phase, traders can expect Aave’s price to consolidate in the $140-$170 range.