Uniswap has been in the crypto limelight over the past day, thanks to its ‘Genie‘ announcement. The DeFi-based platform has acquired the said NFT marketplace aggregator, and intends to expand their products to include both ERC-20 tokens and NFTs. So now, starting this fall, users will be able to buy and sell NFTs directly on Uniswap.

Riding on the back of the said announcement, Uniswap managed to rise up in the charts by around 6%, from $4.9 to $5.2. However, it negated its gains right after that by dropping down almost instantly. The token kept shedding value throughout the early hours of Wednesday and was valued at $4.6 at press time.

Why didn’t Uniswap’s pump last longer?

As such, for pumps to last, a couple of conditions ought to be met.

First, the state of the macro-market should foster the same. At the moment, top cryptos have already broken their relief rally streak and have started tumbling in value. Uniswap shares a fairly high correlation with the broader market and isn’t essentially immune to its dumping.

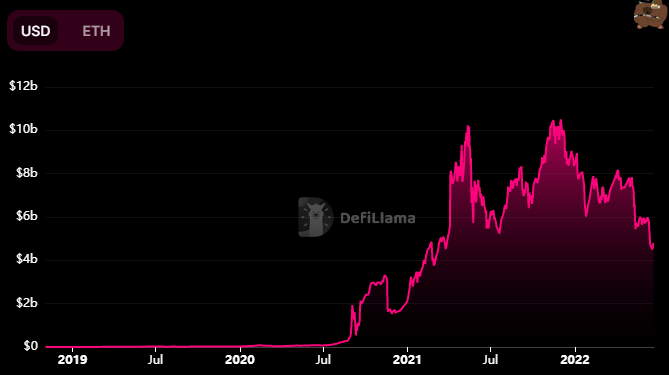

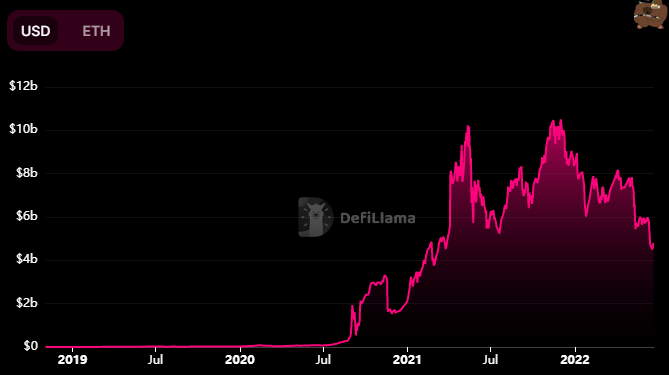

Second, fundamentals should paint a bright picture. For now, Uniswap’s fundamental legs are broken. The total value locked on its platform, for instance, has only been dipping. Notably, it registered a $10 billion high in November but it is currently down to merely $4.7 billion. The same indicates that users have been pulling out their funds from the platform, which ain’t a healthy sign.

Third, there should be some sort of optimism present among market participants. The OI, on its part, has been declining on the macro front, indicating that traders’ interest w.r.t. Uniswap has been withering away. Now even though UNI is not a go-to token for trading, during rally phases, traders tend to long it to reap additional gains.

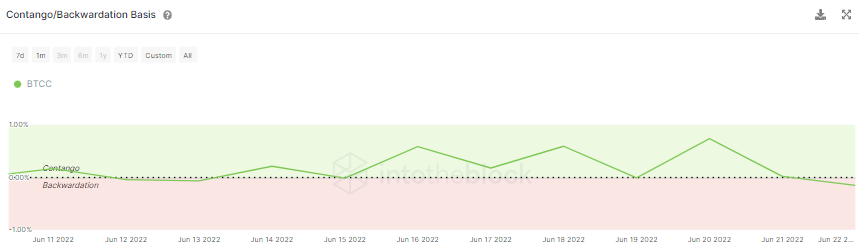

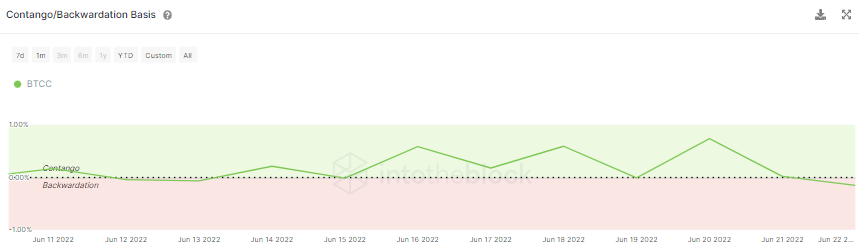

Alongside, it should also be noted that UNI’s[price has stepped from the contango territory to the backwardation over the past day. Usually, when futures prices are at a premium, the market is said to be in contango. On the other hand, if futures prices are at a discount, the condition is termed backwardation.

The current state of affairs clearly points to the fact that traders have started becoming bearish and expect UNI’s price to continue falling.

So, unless Uniswap notches up its game on the said fronts, it wouldn’t be able to carry out any sustainable rally. For now, it definitely looks like the ‘buy the news’ hype has vaporized already.