As the broader crypto market is in its recovery mode, a few alts across the board—like Waves and Zilliqa—have already started pumping and stealing the show. Most large-cap coins, on the other hand, have been holding their horses and waiting for Bitcoin to take off first.

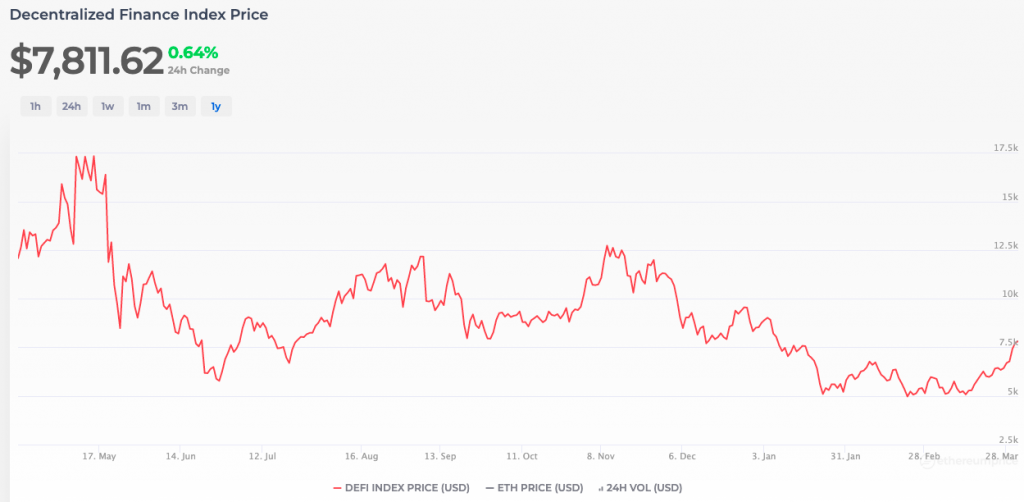

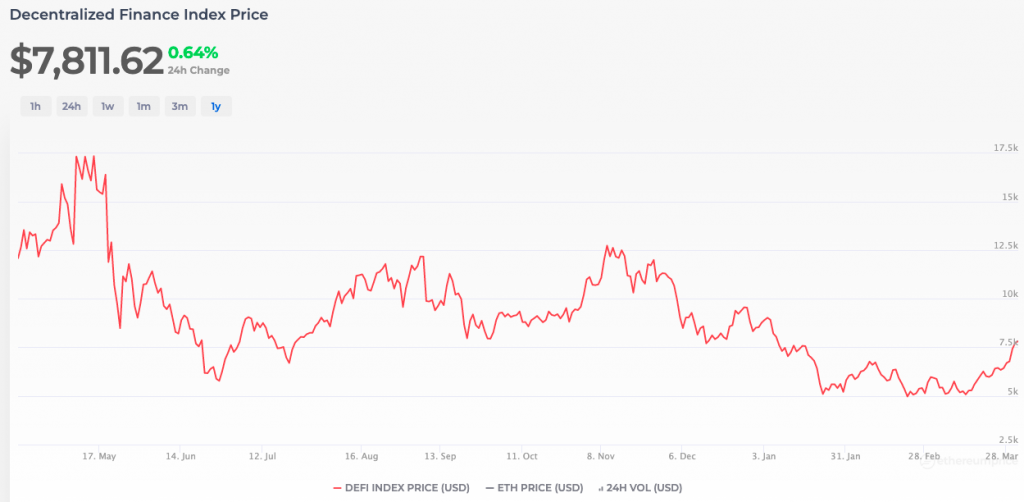

The state of the DeFi market, curiously, has improved by a fair extent over the past few days. Consider the state of its index price itself, for instance. From merely hovering around $5073 on 14 March, this index’s valuation has already notched up to $7812.

In fact, as can be seen from the chart attached, the same is at par with the levels noted at the beginning of this year.

With the rise in the index price, indigenous DeFi tokens have already spread started spreading their wings. In an article yesterday, the focus was on Aave and its 120% rally since mid-March. In this piece, we will be focussing on the apex DeFi token, Uniswap.

The overbought Uniswap market

Since 14 March, Uniswap has mostly flashed only green candles on its chart. Only on three instances in the said timeframe, the candles were in the red. In effect, UNI managed to establish its SMA as support and has already inclined by 56% till now.

However, Uniswap’s RSI reading was in the overbought boat. Interestingly, this indicator flashed a reading close to 70 only back in August before this. Usually, participants wait for the market to get overheated and tend to book profits by cashing out at RSI peaks. And looks like this time around too, we might see something playing out.

Bears re-enter Uniswap’s arena

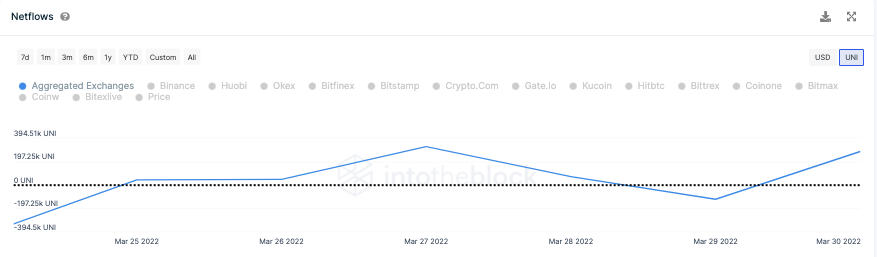

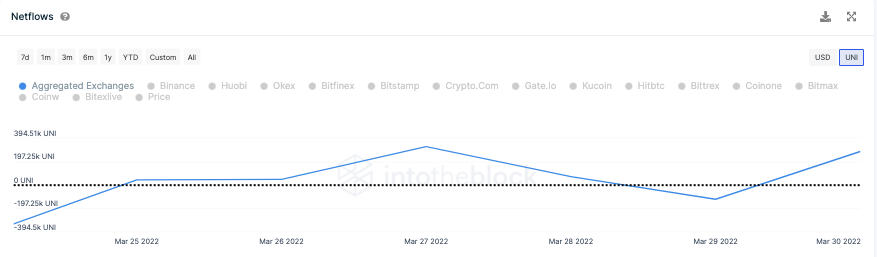

In the period between 29 to 30 March, Uniswap exchange net flows stepped into the positive territory from the negative territory. The rise in exchange balance usually resonates with people selling their HODLings.

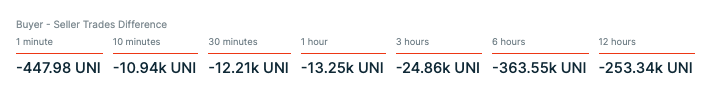

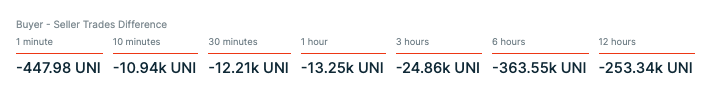

In fact, stats with respect to the buyer-seller trades difference supported the said narrative even further. Over the past 6 hours alone, for instance, the number of sold tokens had exceeded the ones bought by 364k.

Thus, if the profit booking continues, then Uniswap’s upswing phase might abruptly come to a halt. Only when weak hands leave the ecosystem, UNI would be able to execute another leg up.