The downfall of the world’s largest cryptocurrency Bitcoin [BTC] seemed to have a bigger impact than expected. It is no news that the entire market is operating under a loss. However, these losses crept up to a prominent crypto exchange Upbit’s parent company Dunamu.

According to a recent report, the net profits of the South Korean platform Dunamu dipped by 76 percent when compared to last year. It should be noted that the sales decreased by 66.3 percent. The net profit on the other hand plummeted by nearly 73 percent.

In the third quarter, the sales of Upbit’s parent company were at 1.57 trillion won while its operating profits were at 734.8 billion KRW. The cumulative net profit of the firm depleted by 83.8 percent pushing the total numbers to 332.8 billion won.

It should be noted that there was a 24.1 percent decrease in sales as well as operating profit when compared to the second quarter. Addressing the same, a Dunamu official stated,

“It seems that the continued decline in global liquidity and the overall contraction of the capital market have affected the performance.”

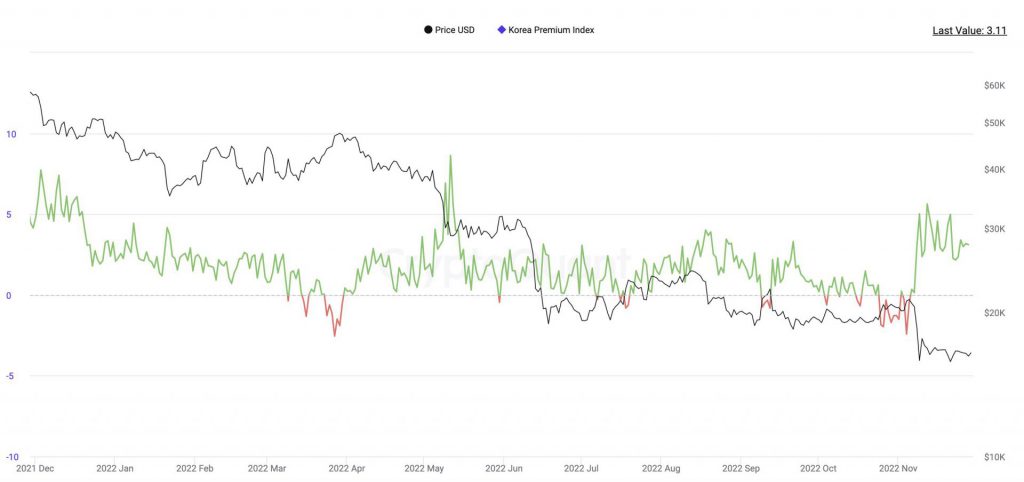

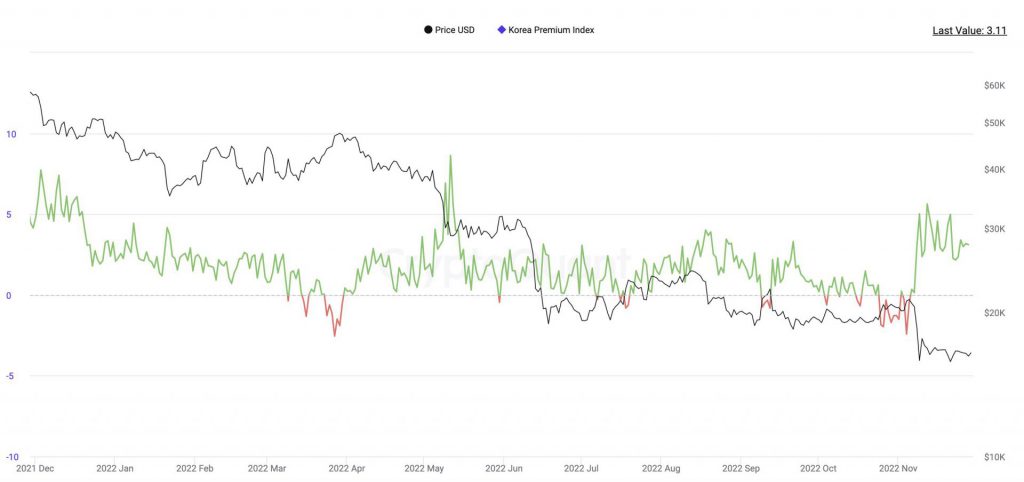

In addition to this, the Bitcoin Kimchi premium has been in control compared to its previous levels this year. During the third quarter, the Kimchi premium index ranged from 3 to 4.

Dunamu places trading restrictions on families of executives

It was brought to light that Upbit’s parent firm was restricting executives of the firm as well as their families from trading. These trading restrictions were applied back in August on its staff and executives. However now, their family members were also in the restricted bandwidth.

The firm decided to move forward with this in order to garner and enhance the level of trust it entails in the industry. A spokesperson from the firm reportedly said,

“We came to strengthen the regulation since August to be commensurate with our status as the most trusted digital asset exchange that meets global standards.”

Dunamu seems to be turning a new page in the industry, however, the current market conditions continued to pose detrimental to the firm.