The last couple of days has been quite wild for Dogecoin. All thanks to Elon Musk for first purchasing a 9.2% stake in Twitter and then joining the microblogging and social networking platform’s board.

Right after news of the said developments started doing the rounds on social media, people from the community started anticipating the addition of a Dogecoin tip jar on Twitter. Owing to the said euphoria, Dogecoin quickly reacted on the price charts.

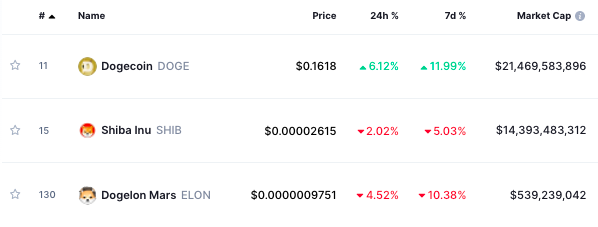

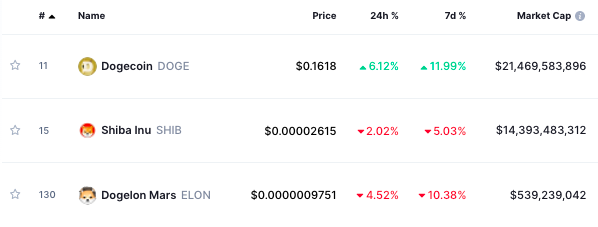

In the said process, it managed to leave behind its other counterparts like Shiba Inu and Dogelon Mars. After noting a 6% and 12% incline on the daily and weekly time frames, Dogecoin was priced at an elevated level of $0.1618 at the time of press.

Looking beyond Dogecoin’s hype-pump

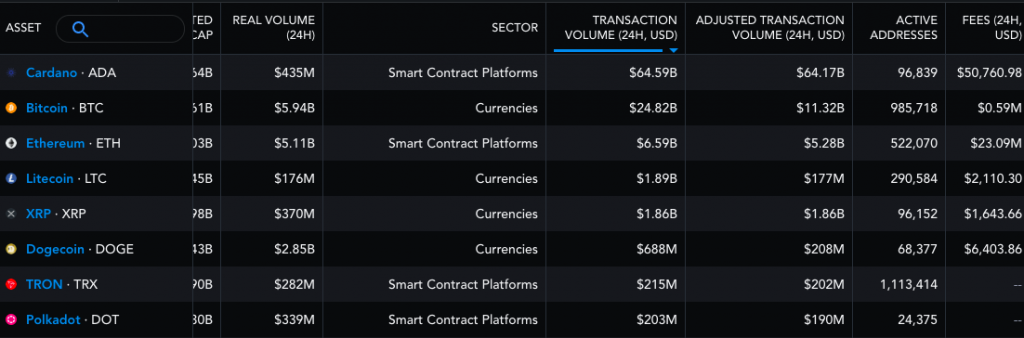

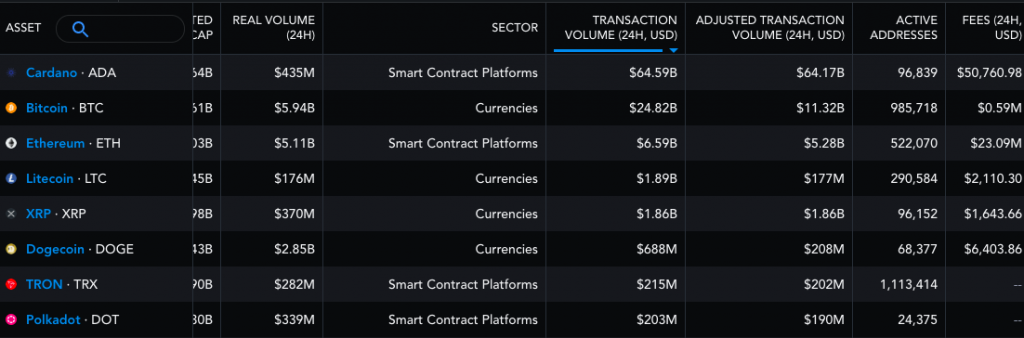

In terms of chain activity, Dogecoin continues to maintain a spot for itself next to other large-cap coin-associated networks. However, what is interesting to note, is the sharp incline in the transaction volume.

Towards the end of March, this metric revolved around $241 million for Dogecoin but has already notched up to $688 million now. When compared to the same period, the active addresses have shot up by 4801 and currently stand at 68,377.

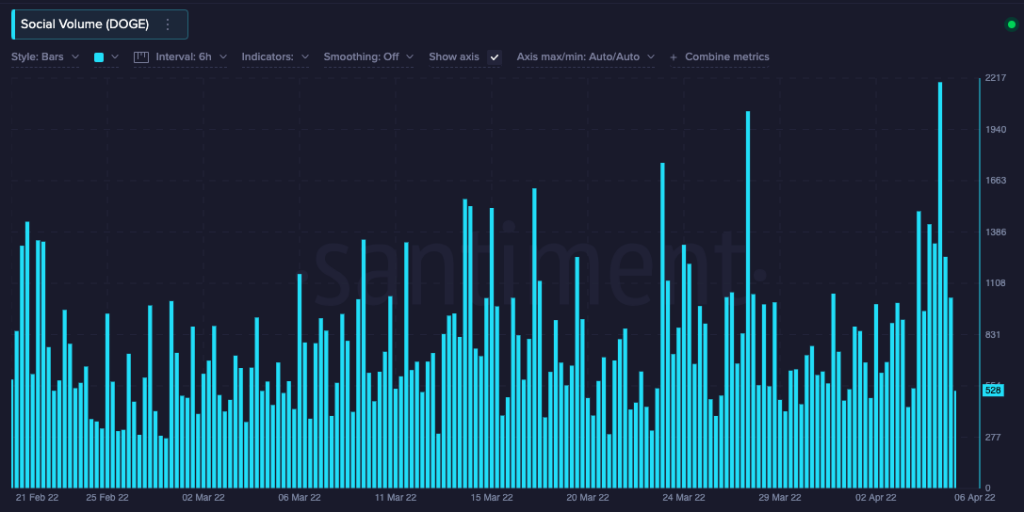

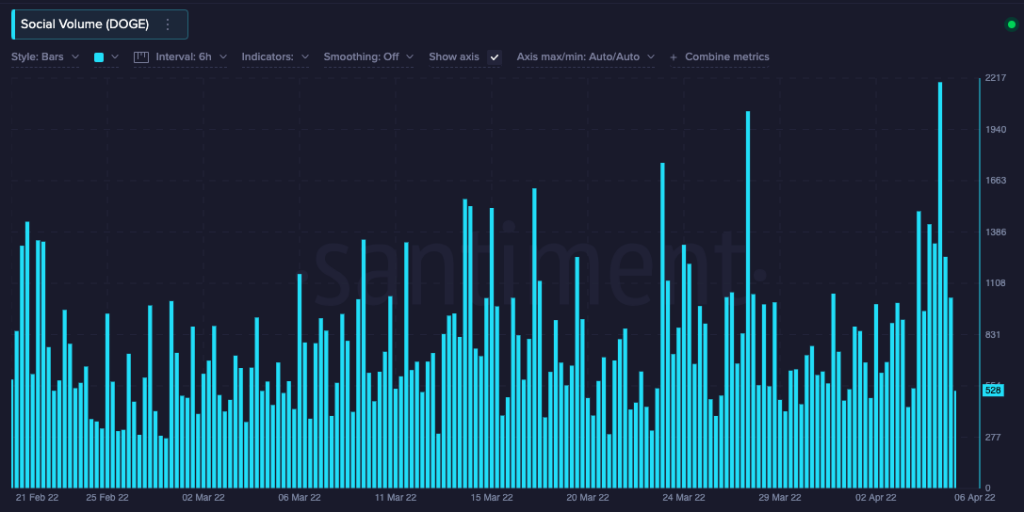

However, with the Musk-Twitter hype cooling down, the community that was once quite keenly chit-chatting about Dogecoin is not that euphoric anymore. As can be noted from the chart attached below, the 6-hour social volume number peaked at 2196 on 5 April, making it the highest since the end of February. However, over the past few hours, the number has already shrunk down to three digits.

Keeping the said datasets in mind, it can be contended that the hype managed to improve the state of the Dogecoin network, and the same would aid the token’s price rally organically over the long term. However, with the social volume gradually shrinking, we might witness Dogecoin briefly applying brakes before it continues inching towards its bullish $0.1938 target.