The golden cross is quite an integral part of technical analysis. Such a crossover occurs when a short-term moving average overtakes a major long-term moving average to the upside. The golden cross suggests an upward flip in the price.

A few days back, the 50-day MA [red] on Dogecoin’s chart climbed above the 200-day MA [green]. Post the crossover, DOGE noted a brief uptick and went on to claim a local high of $0.111.

The bullish momentum, however, couldn’t sustain. Post gradually succumbing to bears, DOGE ultimately ended up adding another extra zero to its price and was trading at $0.09602 at press time. Effectively, a crossover is considered to be more significant when it is accompanied by high trading volume. In Dogecoin’s case, that has not been the case.

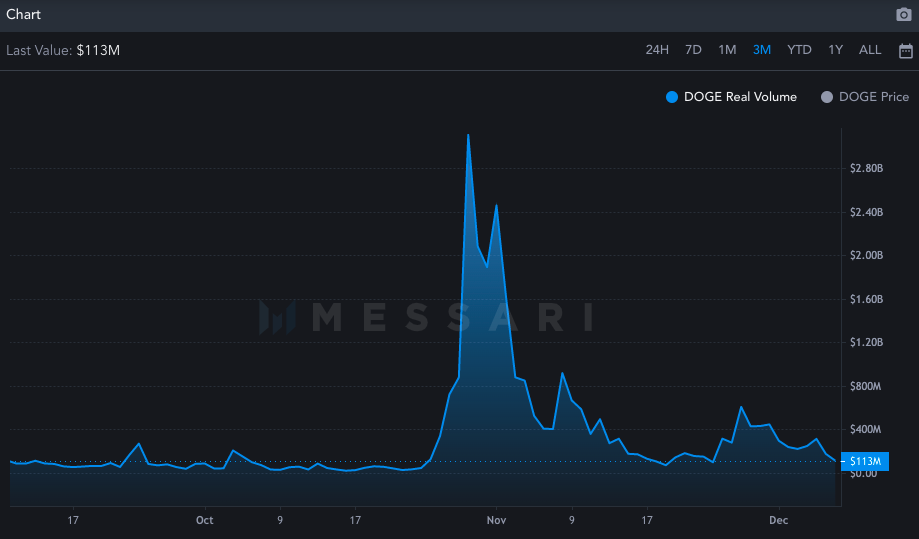

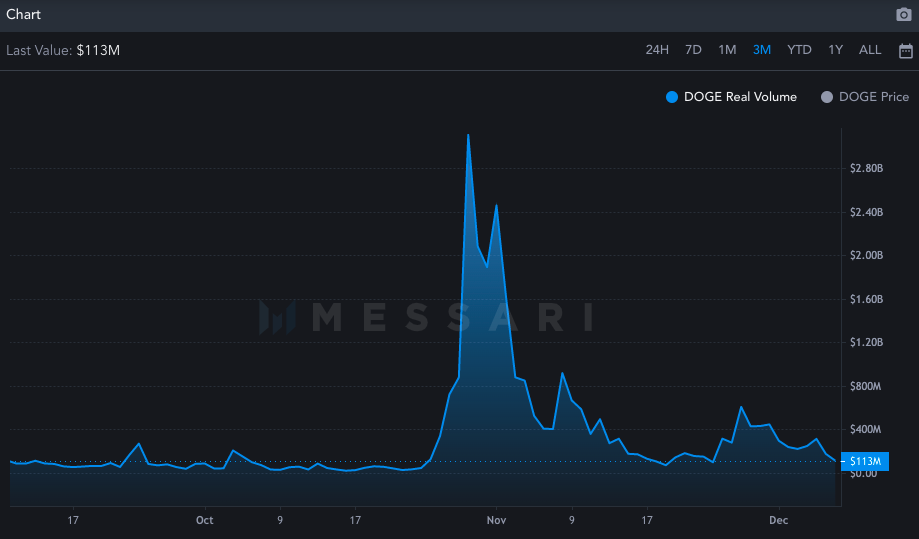

As illustrated below, the volume peaked in the October-November transition period and it quickly dropped after that. A similar uptick was registered during the latest month’s transition period, but the level was not sustained.

At press time, the reading of this metric stood at only $113 million when compared to 27 November’s $607 million and 29 October’s $3.1 billion.

Dogecoin and its Hype Rallies

Unlike other cryptos, Dogecoin is cut from a different cloth. Seldom has it honored technicals or patterns. Nevertheless, hype pumps have been DOGE’s cup of tea.

Towards the end of October, when it was revealed that Elon Musk’s Twitter deal was going to close, the OG meme coin initiated its rally. A couple of days after, post the takeover materialized, DOGE continued its green-candle streak. Musk’s Halloween tweet was the cherry on the cake that aided DOGE accomplishing its 168% rally and trade at levels last seen in April.

Thus, Dogecoin’s next leg up will transpire when the community gets excited again and the volumes start rising. Thus, more than the golden cross, Musk’s blessings are perhaps what the meme coin needs the most now.

Also Read: Shiba Inu, DOGE react to Elon’s Halloween Tweet: What’s ahead?