Donald Trump’s tax bill reform has officially reshaped American taxation through the “One Big Beautiful Bill,” and it’s delivering sweeping changes that directly impact your finances right now. This comprehensive US tax reform impact makes the 2017 tax cuts permanent while also introducing new exemptions, fundamentally altering how Trump tax cuts 2025 affect your wallet. The legislation also implements significant Medicaid spending changes and establishes new GOP tax legislation priorities.

Explore Donald Trump Tax Bill Reform Impact on US Tax Reform, Medicaid, and GOP Legislation

What Is the Big Beautiful Bill That Passed

The Donald Trump tax bill reform prevents a massive $4 trillion tax increase that would have hit American families when the 2017 cuts expired. This US tax reform impact permanently extends lower individual tax brackets, enhanced standard deductions, and also the 20% small business deduction. Your wallet benefits immediately through reduced tax liability and increased take-home pay.

The Trump tax cuts 2025 package creates new tax-free categories including tip income, overtime pay, and also Social Security benefits. The GOP tax legislation also provides $1,000 government-funded “Trump Accounts” for newborns, which parents can use for education or home purchases.

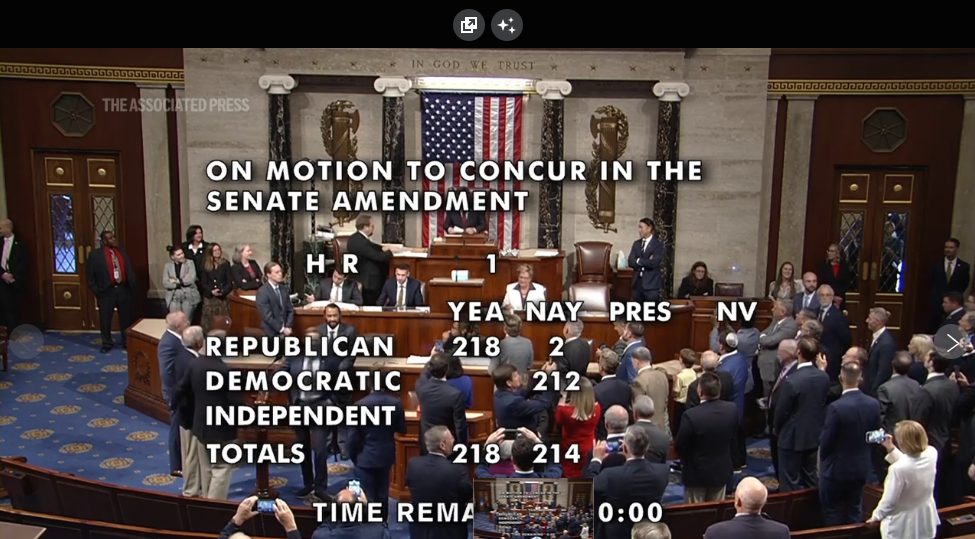

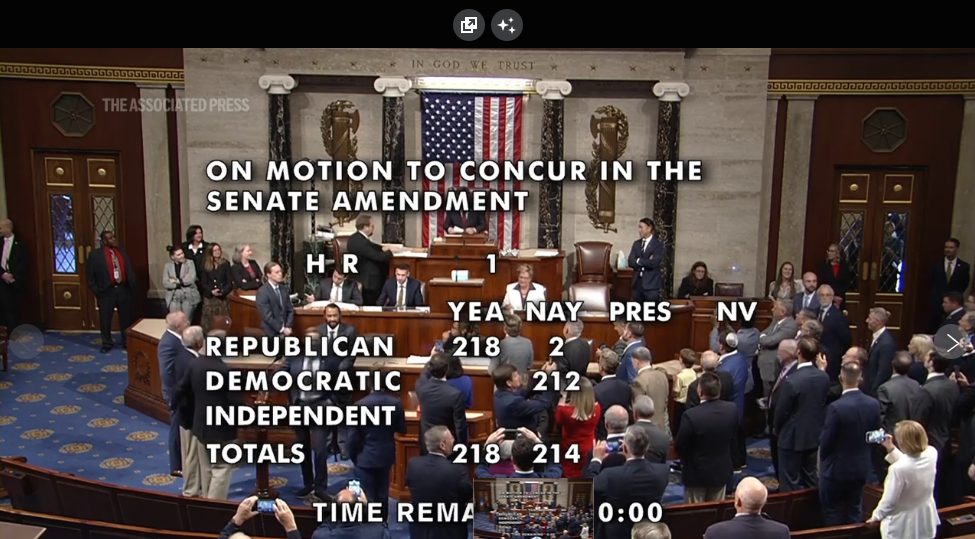

Representative Thomas Massie stated:

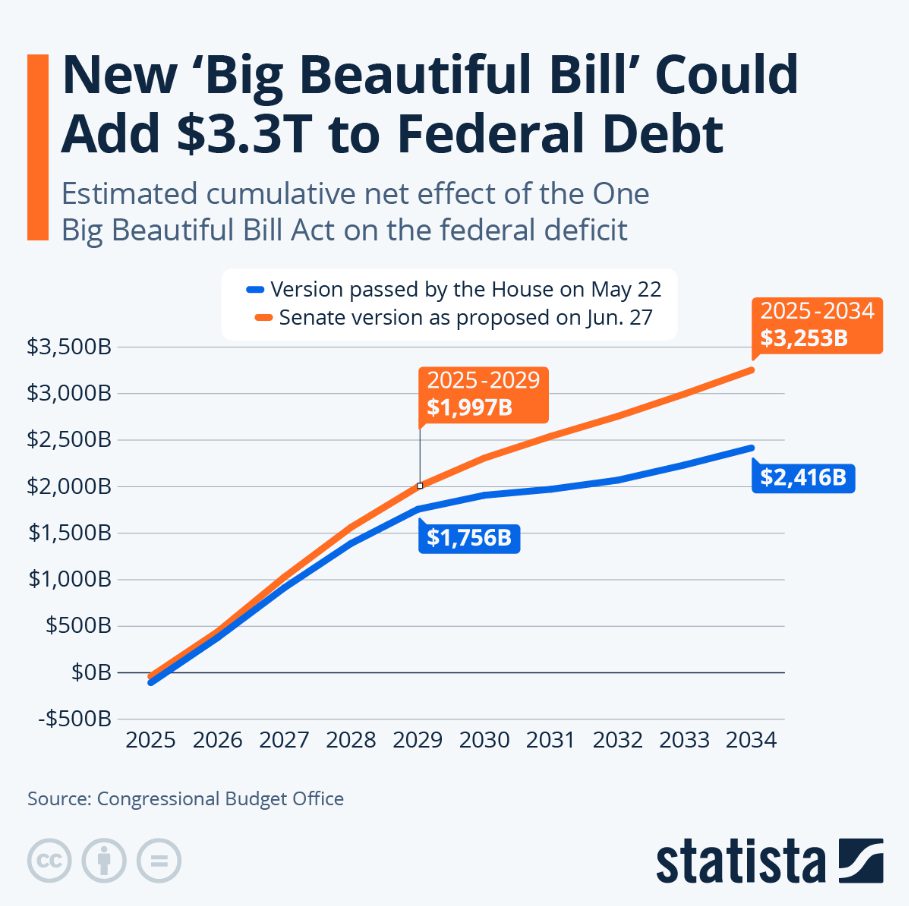

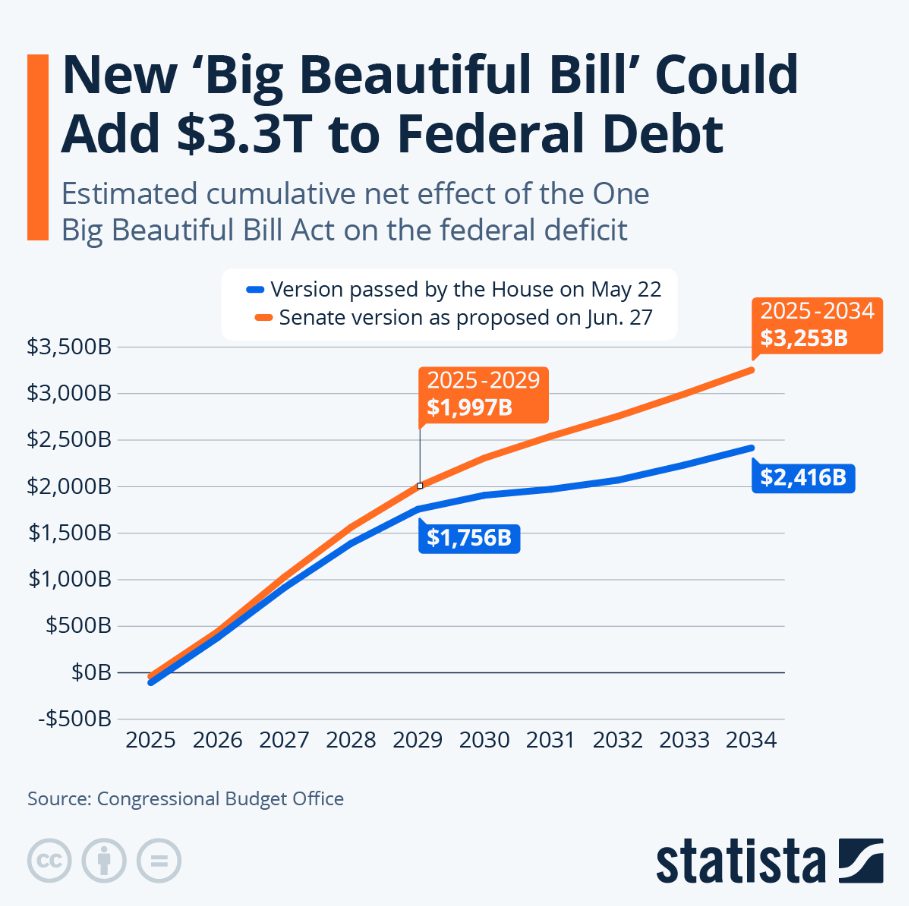

“Although there were some conservative wins in the budget reconciliation bill (OBBBA), I voted No on final passage because it will significantly increase U.S. budget deficits in the near term, impacting all Americans through sustained inflation and high interest rates.”

Although there were some conservative wins in the budget reconciliation bill (OBBBA), I voted No on final passage because it will significantly increase U.S. budget deficits in the near term, negatively impacting all Americans through sustained inflation and high interest rates. pic.twitter.com/rjcRc8t0ay

— Thomas Massie (@RepThomasMassie) July 3, 2025

Will There Be No Tax on Overtime in 2025

Yes, the Donald Trump tax bill reform eliminates federal taxes on overtime pay, and it’s putting more money directly in workers’ pockets right now. This US tax reform impact particularly benefits hourly employees who regularly work extra shifts. Combined with tax-free tips and also Social Security benefits, the Trump tax cuts 2025 represent substantial savings for millions of Americans.

Representative Brian Fitzpatrick had this to say:

“I voted to strengthen Medicaid protections, to permanently extend middle class tax cuts, for enhanced small business tax relief, and for historic investments in our border security and our military. However, it was the Senate’s amendments to Medicaid, in addition to several other Senate provisions, that altered the analysis for our PA-1 community.”

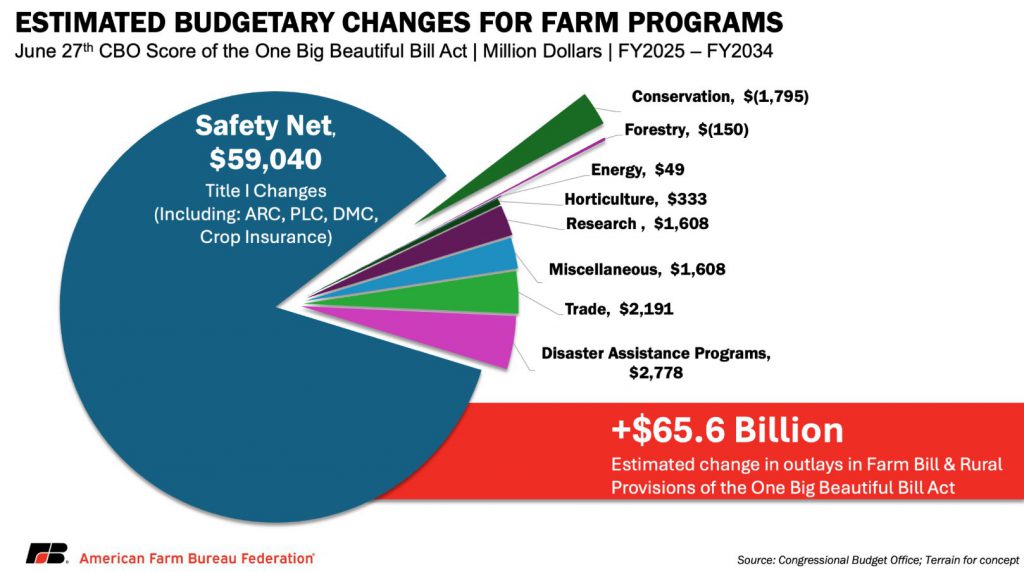

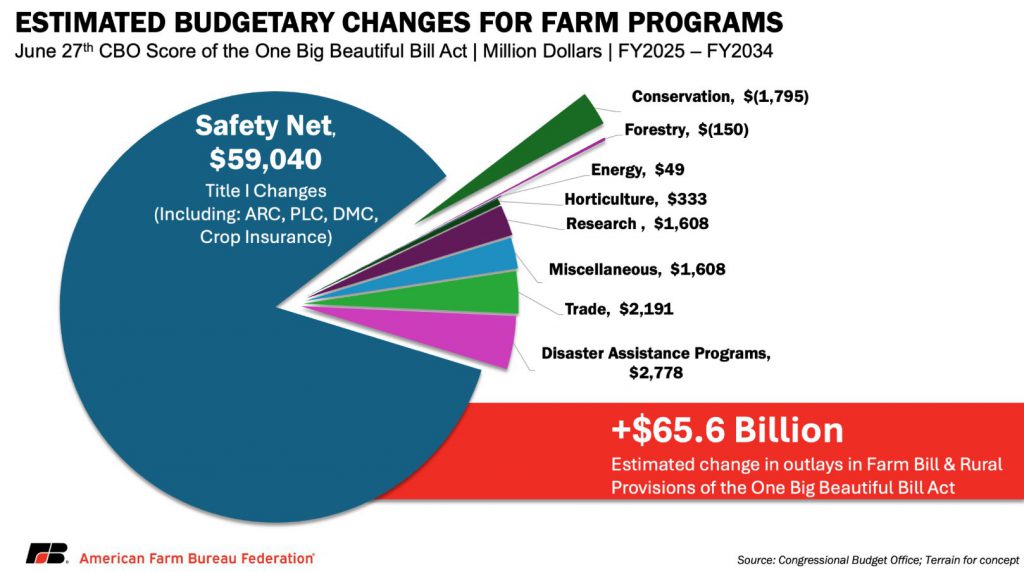

The GOP tax legislation adds approximately $3.8 trillion to federal debt over ten years while also eliminating billions in green energy subsidies. Medicaid spending changes include new work requirements by 2026, and they’re potentially affecting healthcare costs for millions of Americans at the time of writing.