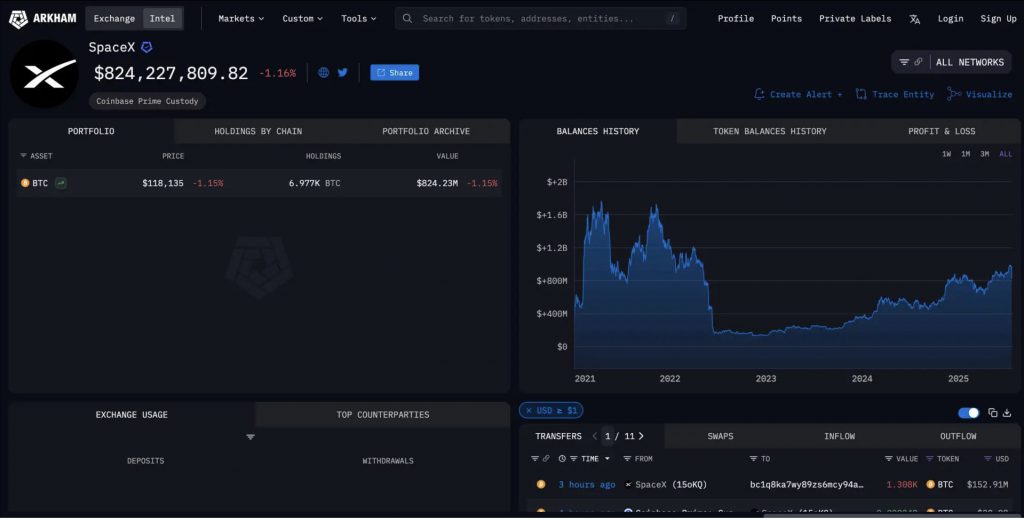

According to Arkham Intelligence data, Elon Musk’s SpaceX has moved around 1308 Bitcoin (BTC) worth nearly $153 million to a new wallet after almost 3 years of dormancy. The motive behind the transfer is still unclear. The space exploration company could be moving its holdings to cold storage, or may be reshuffling its assets. Arkham data shows that the firm holds about 6977 BTC, valued at $823.9 million.

Bitcoin Dips Amid Elon Musk’s SpaceX Wallet Transfer

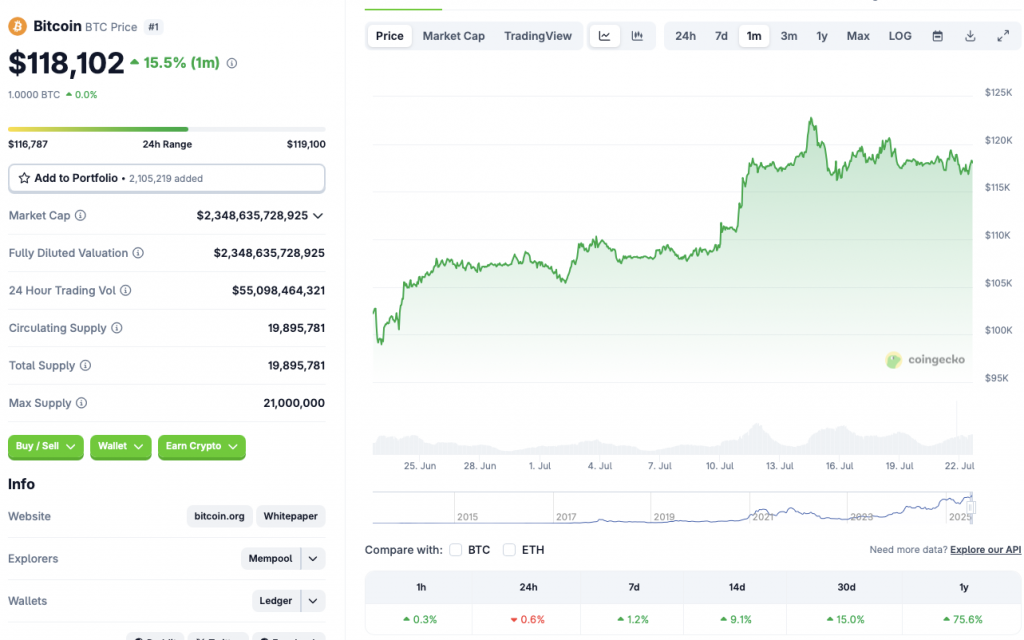

Bitcoin (BTC) climbed to a new all-time high of $122,834 on July 14. The original cryptocurrency has since dipped to the $188,000 price level. BTC has faced a 0.6% correction in the last 24 hours. Despite the dip, the asset continues to trade in the green zone across other time frames. BTC is up 1.2% in the weekly charts, 9.1% in the 14-day charts, 15% over the previous month, and 75.6% since July 2024.

Bitcoin’s (BTC) price has seen a slight decline over the last few days. The dip could be due to investors booking profits after the asset climbed to a new peak. The Bitcoin (BTC) transfer from Elon Musk’s SpaceX may have spooked investors. However, the company has not shown any signs of selling its BTC holdings yet. Musk has been very vocal about his support for cryptocurrencies. Many of his business ventures have enabled crypto payments, especially Dogecoin (DOGE) and BTC.

Also Read: Bitcoin to Rally Towards $130,000 Next

BTC may continue its downtrend if investors keep booking profits. BTC’s rally over the last few months was likely due to increased institutional inflows into ETF-related products. The market could move in any direction over the next few days.

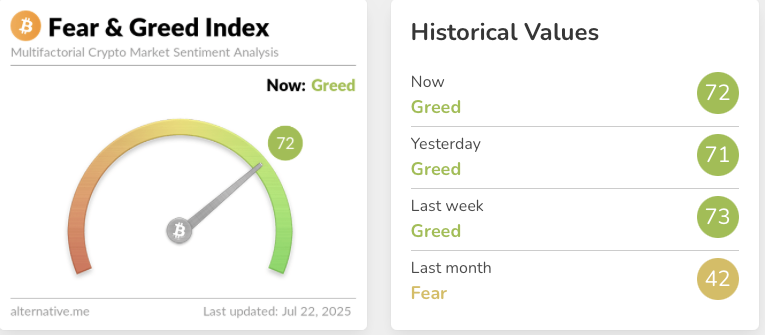

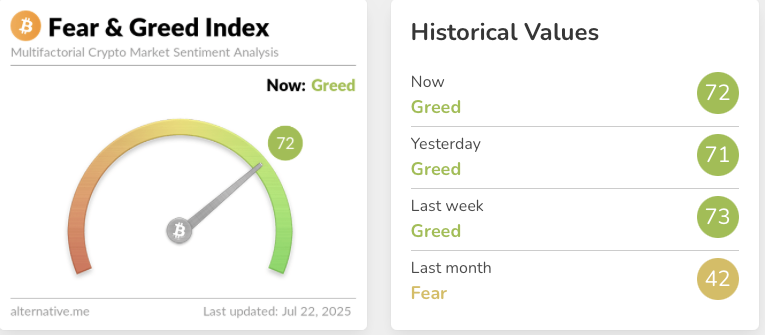

BTC’s fear and greed index continues to hover in the “Greed” zone. This aspect could lead to another bullish leg for the asset.