Bitcoin investors face pressure as money leaves ETFs. Security risks and high fees add to their worries. The crypto market is changing, with Bitcoin at the center of concern.

Also Read: This Cryptocurrency Will Rise 84,380%, According to Michael Saylor

Understanding the Impact of ETF Exodus, Security Risks, and High Transaction Fees on Bitcoin

Massive ETF Exodus Shakes Bitcoin Market

Bitcoin ETFs saw record outflows this week. Investors pulled over $287 million from US-listed Bitcoin ETFs on Tuesday. The selling has also continued on Wednesday. As a result, this ETF exodus has rattled the crypto world.

Fidelity’s FBTC fund led the exodus. Investors withdrew more than $162 million. The Grayscale and Ark 21Shares funds also lost some money through this endeavour. This shows that investors are worried about this topic, and they have every reason to.

Security Risks Amplify Investor Concerns

Bitcoin struggles to stay above $57,000. Security risks remain a big problem. Hacks and fraud have plagued crypto. These ongoing security risks add to market unrest.

High Transaction Fees Hinder Adoption

Unfortunately, there are still high fees that continue to hold Bitcoin back. Added to that, fees can also spike when the network is busy, and that’n not ideal at all! These high transaction fees scare off new and current users. This hurts BTC’s market position.

Also Read: Fed Flags Texas Bank’s Crypto Deficiencies: Impact on Coinbase and ETF Issuers

Market Volatility Amid Regulatory Uncertainty

Bitcoin faces more challenges. Traders are watching for potential Fed rate cuts. These cuts could affect both traditional assets and crypto.

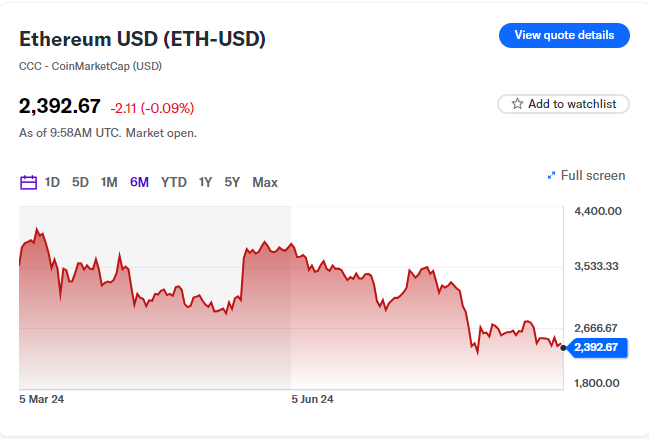

Other cryptos feel the effects too. Ethereum rose 0.7% to $2,412. Cardano went up 0.8% to $0.32.

Also Read: Cryptocurrency: Top 3 Must-Have Coins For The Next Bull Run

The Bitcoin market faces an ETF exodus, security risks, and high transaction fees. Investors are rethinking their choices. BTC’s future remains uncertain and volatile.