Ethereum (ETH) made significant gains in mid-January 2024, following the SEC’s (Securities and Exchange Commission) historic approval of 11 spot Bitcoin (BTC) ETFs (Exchange Traded Funds). However, the asset’s price dipped soon after. Nonetheless, ETH is still in the greens, up by 2.1% in the daily charts, almost 6% in the 14-day charts, and 6.6% over the previous month. Moreover, the asset’s price is up by 44.4% since January 2023.

Also Read: Ethereum: SEC May Approve ETH ETF in May, Says Bloomberg

You could have had $7.8 million with $100 weekly investments in Ethereum.

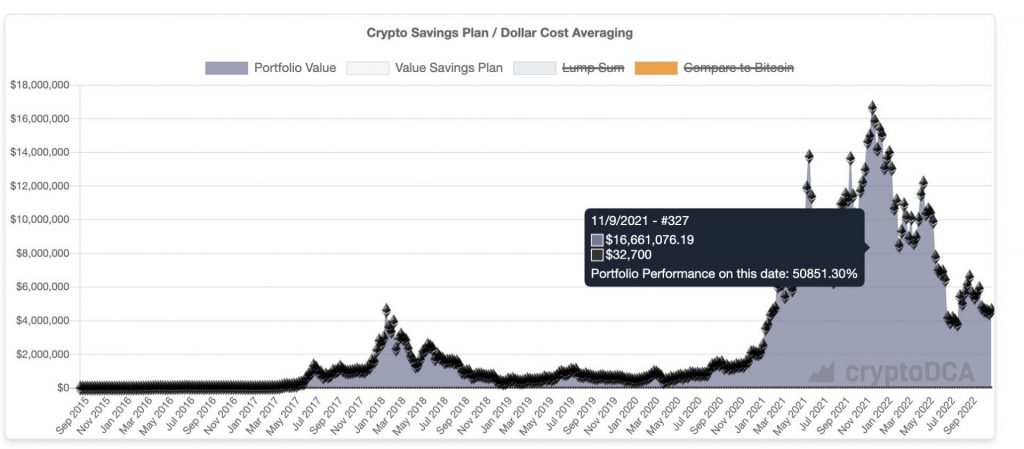

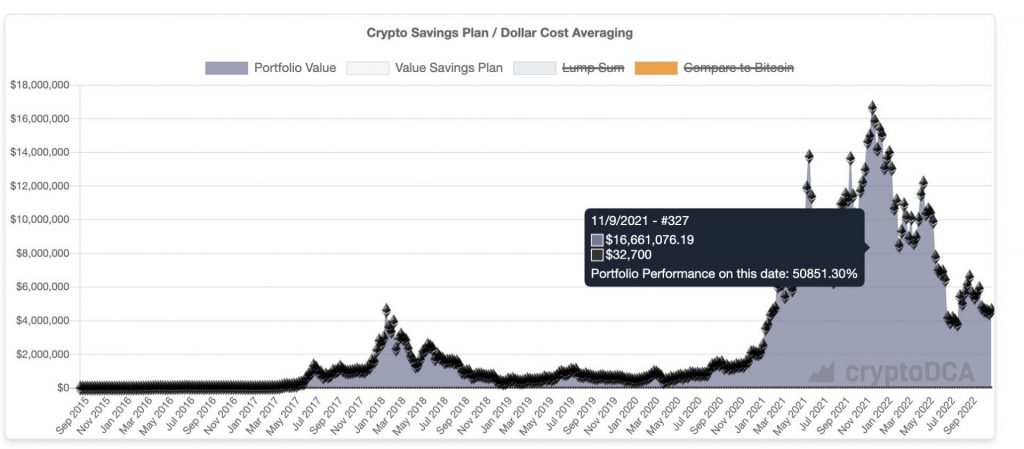

If you had invested $100 weekly into Ethereum (ETH) since its launch in August 2014, you would have put in $44,400 till now. However, the portfolio’s value would have skyrocketed to around $7.8 million, a rise of about 17,550%.

Also Read: Ethereum ETF To Push ETH by 70% to $4000: Standard Chartered

However, if you had invested $100 weekly till Ethereum (ETH) reached its all-time high of $4,878.26 on Nov. 10, 2021, you would have put in $32,700. However, the portfolio’s value would have risen to a whopping $16.66 million in this case, a growth of over 50,000%.

Can you still become a millionaire with ETH?

Ethereum (ETH) is currently down by over 51% from its 2021 peak. However, many analysts are bullish on the project’s future performance. ETH is one of the most developmentally active crypto projects with some of the highest number of applications.

Also Read: Ethereum: Standard Chartered Predicts ETH May Hit $35,000

According to a report by global financial institution Standard Chartered, ETH could reach a price of $8,000 by 2026. The price increase would represent a growth of about 238%. Moreover, the financial giant anticipates ETH to reach $35,000 in the long run. Hitting $35,000 from current levels would translate to a growth of over 1380%.