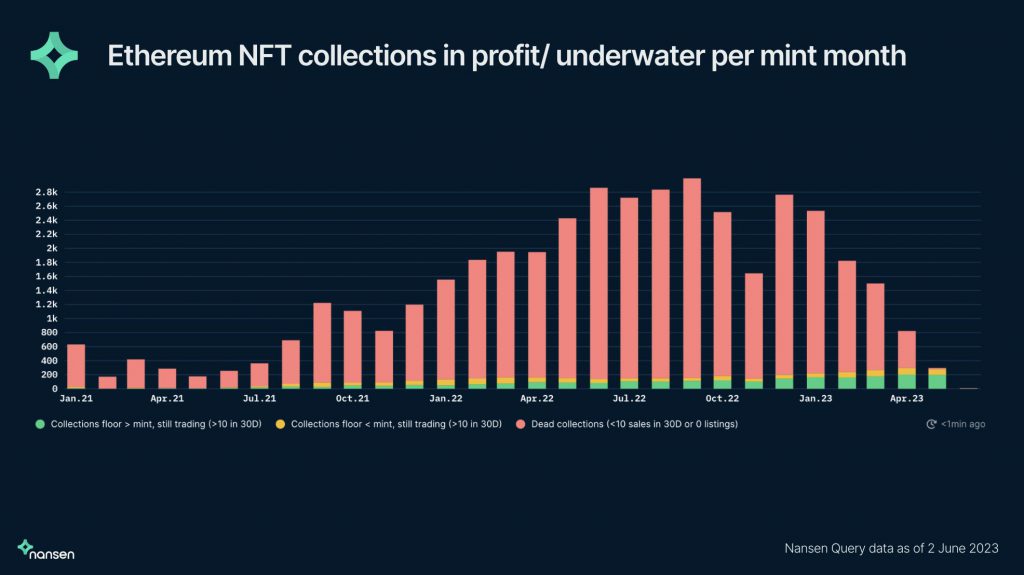

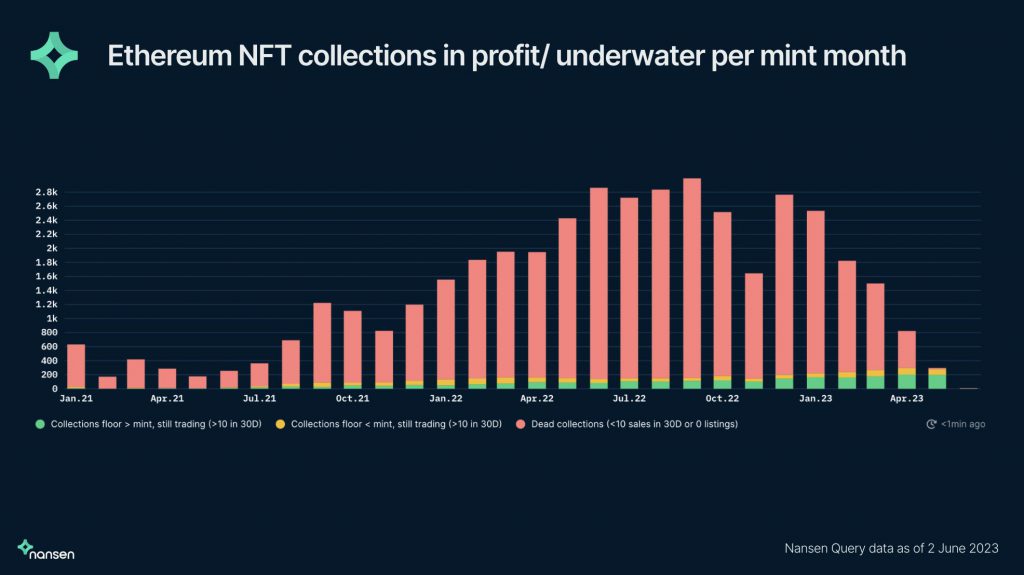

A recent report from Nansen revealed that 67% of new NFTs minted last month on Ethereum are currently in a profitable state. Well, this might seem to be an optimistic development, however, there’s a catch. Zooming out and shedding light on the whole picture, the blockchain data and research platform tweeted,

“New NFT mints have been on a decline since summer, with NFTs minted in May being 65% lower than that in April, AND the lowest it’s been since June ’21.”

Typically, whenever a new collection is minted, the percentage of new mints in profit is higher in the first month. However, that starts dropping after a few months, as illustrated below.

Also Read: Crypto, NFTs: UAE Central Bank Issues New AML, CTF Guidance for Institutions

Macro state of affairs in the NFT market

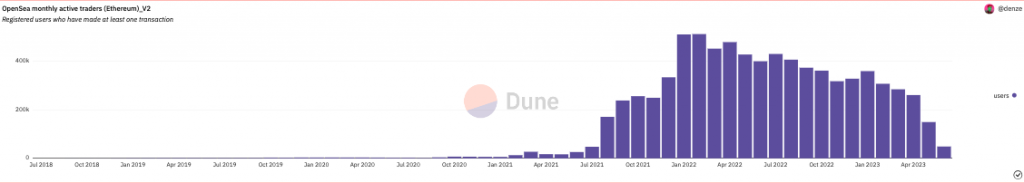

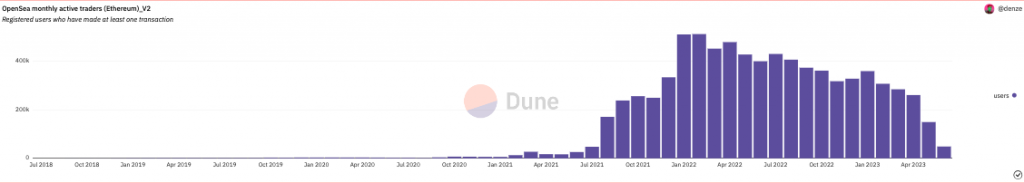

The mint downtrend typically signifies that people are steering away from the NFT market currently. In fact, even secondary sales are on the drop. According to data from Dune Analytics, the monthly active traders have been dropping on markets like OpenSea. From January’s 359.2k, the number dipped down by more than half, to 149.4k, in May.

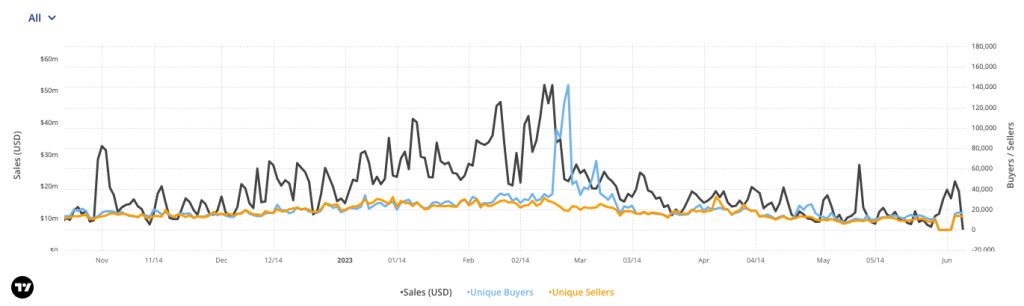

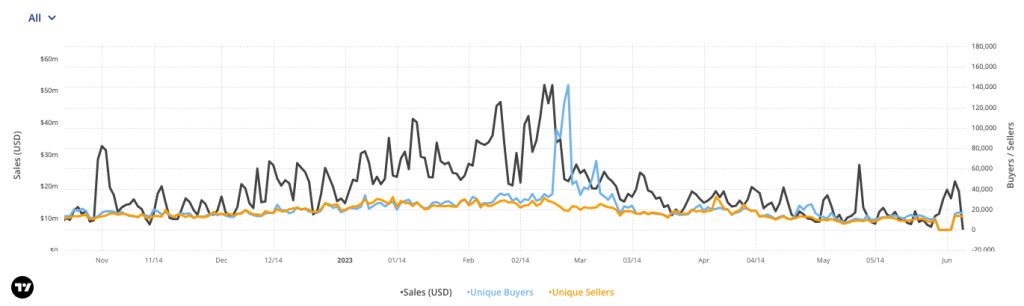

On the Ethereum blockchain, the NFT sales have dropped by more than 15% over the past month. Specifically, the 30-day sales volume stood at $416.8 million. The number of buyers and sellers has also been on a downtrend. Specifically, they’ve diminished by 30-50% each in the same period and reflected respective values of 65.5k and 55.4k at press time.

Despite the not-so-appealing trends, Ethereum is currently the top blockchain in terms of sales volume. Other counterparts like Bitcoin, Solana, and Polygon rank lower, for they’ve only managed to settle $40 million to $188 million in volume in the same monthly window.

Also Read: Bitcoin Flips Cardano, Solana to Claim 2nd Spot in NFT Sales