Numerous Ethereum futures exchange-traded funds [ETFs] initiated their trading in the United States. On the morning of Oct. 2, 2023, a consortium of investment companies, including ProShares, VanEck, Bitwise, Valkyrie, Kelly and Volshares, jointly launched a total of nine ETFs on the Chicago Board Options Exchange [CBOE]. Out of these funds, only five are exclusively composed of Ether futures. The remaining are a blend of Bitcoin and Ethereum futures contracts.

Despite their initial hype as groundbreaking products, these ETFs did not have a significant impact. Collectively, on the first day of trading, all nine ETFs experienced trading volumes of less than $2 million. The most favored among these futures ETFs was Valkyrie’s BTF. This investment vehicle monitors a combination of Bitcoin and Ether. It garnered a total trading volume of $882,000.

Furthermore, these Ethereum futures ETFs contributed to only 0.2% of the total trading volume, which was significantly lower than that of Bitcoin futures. For instance, ProShares Bitcoin Strategy ETF [BITO], which was launched in Q4 2021, during a booming crypto market amassed over $1 billion in trading volume on its debut day.

This led many market analysts to highlight Ethereum’s lackluster performance. Eric Balchunas, a senior ETF analyst at Bloomberg, expressed his view on X, stating that it was a rather unimpressive day in terms of trading volume.

Also Read: Grayscale Files With SEC to Convert Ethereum Trust to Spot ETF

Is Ethereum losing hold over the institutional investors arena?

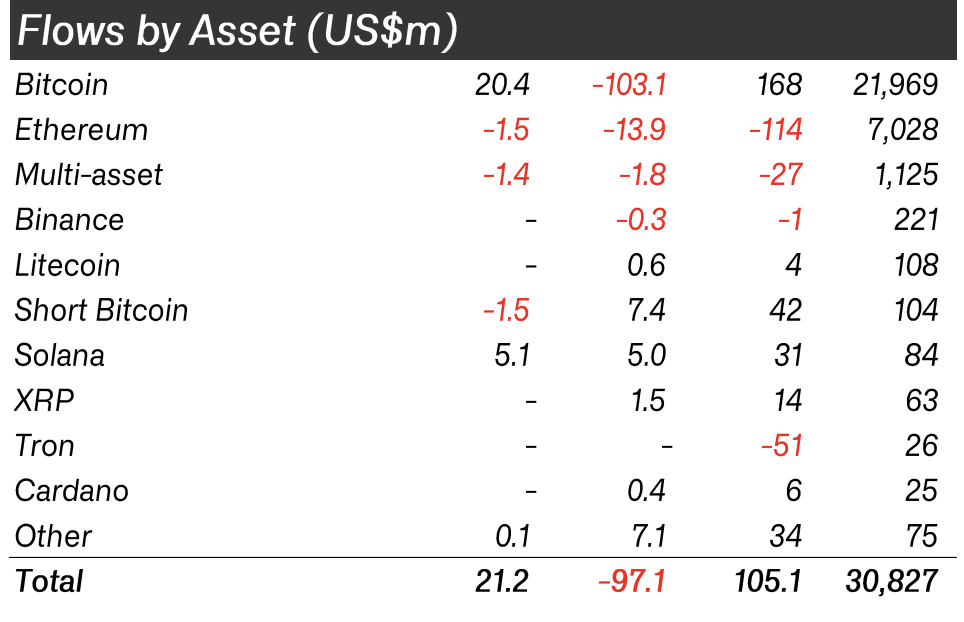

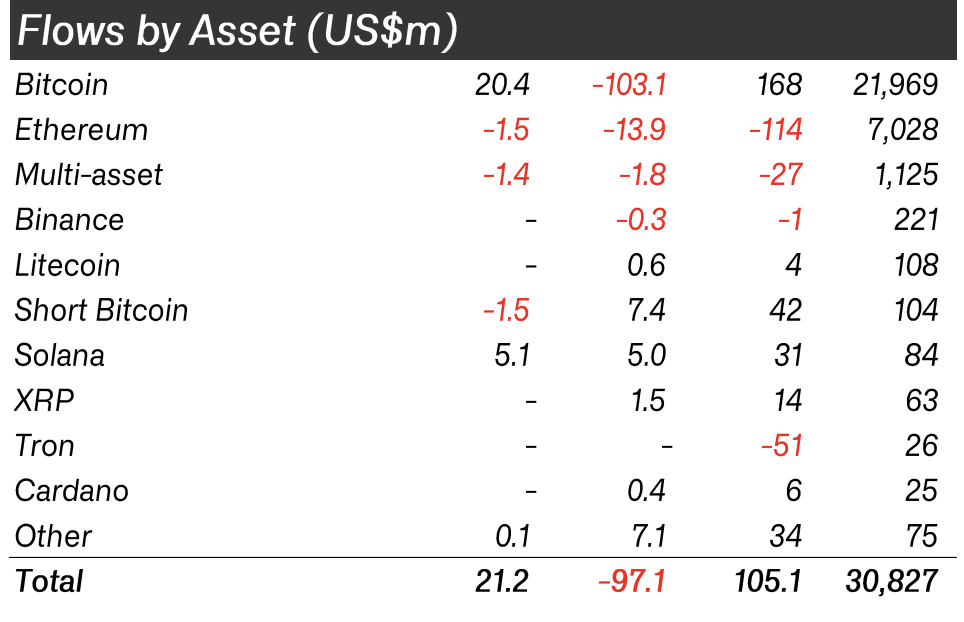

Many observers even suggested that Ethereum might be falling out of favor with institutional investors. However, it’s important to note that this trend has been ongoing for some time. In September, Ethereum experienced significant outflows, and it currently ranks as the most disposed of digital asset by large entities, with yearly sales reaching $114 million. As a result, analysts have labeled it as the least favored digital asset among exchange-traded product [ETP] investors.

Balchunas seems to partially agree with this as he said,

“Unprecedented day today with multiple ETFs all launching at the same time. No clear winner has emerged, all of them were pretty average, lower than I would have predicted, but its the long run, and remember, these hold futures (ETF investors much prefer physical to derivatives).”

Furthermore, ETH was among the cryptocurrencies that suffered losses today, experiencing a daily decline of 4%, which was notably higher compared to other digital assets. Currently, at press time, the cryptocurrency was trading at a price of $1,662.64. This further caused a major surge in long liquidations. The ETH market experienced a whopping $26.24 long liquidations out of the total $28.83 million.

Also Read: Ethereum: Institutional Investors Fade With $108 Million in Outflows