Paolo Ardoino, CTO of Bitfinex, has taken to Twitter and informed the public that the liquidation numbers reported by some data aggregators are misleading. On Monday, several data aggregators reported massive Ethereum (ETH) liquidations, a majority of which, reportedly, occured on Bitfinex.

Bitfinex is one of the largest cryptocurrency exchanges in the world and is popular among both amateur and expert traders. For that reason, liquidation volumes on the platform are frequently pronounced.

However, given that Ethereum (ETH) liquidations alone have surpassed $600 million, Monday’s liquidations would set a new high for the market. According to Coinglass, $682 million in short positions were liquidated in total, with $670 million occurring on Bitfinex. Also, according to statistics from CryptoQuant, Ethereum (ETH) has suffered the most one-day liquidations in three years as a result of the Bitfinex liquidations.

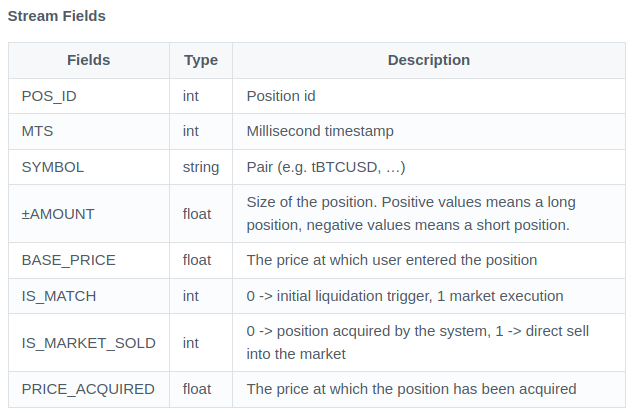

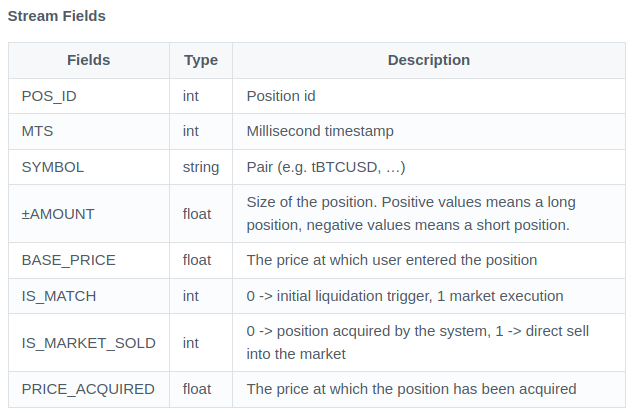

According to Ardoino’s Tweet, the liquidation APIs on Bitfinex are not like those of other platforms. Bitfinex discloses real positions (with their internal position id, size, and base price) and broadcasts updates while the position is liquidated through the market, whereas competitors only provide trade executions.

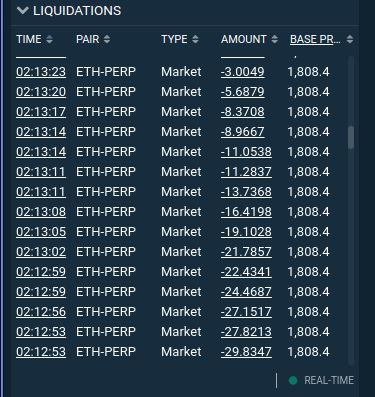

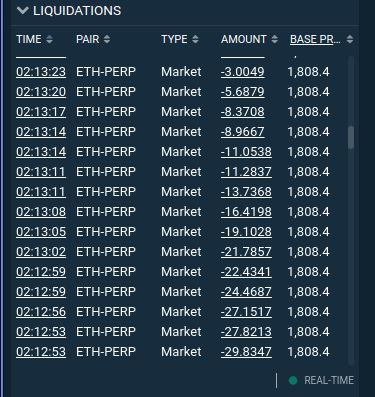

Ardoino says that data aggregators have been misreporting liquidation data and misinterpreting the “amount” field in the API.

The ‘amount’ parameter has been used by data aggregators as the execution size.

As a result, data aggregators continued to accumulate the quantities while Finex was continually updating the new position size through websockets.

According to Ardoino keeping track of the position id and treating the initial message (with a specified position id) as the entire amount being liquidated would be the proper method.

To simplify things for the future, Ardoino said,

“We will add for each row also the executed amount, as diff from the previous state to simplify the migration for the data aggregators.”

Ethereum was also trading around the $1700 level, its lowest level since July 2021. A break below this level would very certainly result in more token losses. The expectation of Ethereum’s forthcoming switch to proof-of-stake has driven the majority of its recent price movement. The enormous volume of short positions shows that the second-largest cryptocurrency was the target of a lot of market emotion.

At press time, Ethereum was trading at $1,757.62, down by 7.0% in the last 24 hours.