One of the open secrets in the business is the “miner extractable value” or MEV. In order to understand the phenomena and the dangers it entails, the Bank for International Settlements (BIS) has published a report titled “Miners as intermediaries: extractable value and market manipulation in crypto and DeFi”. The Ethereum (ETH) blockchain is the main topic of the paper.

What is MEV?

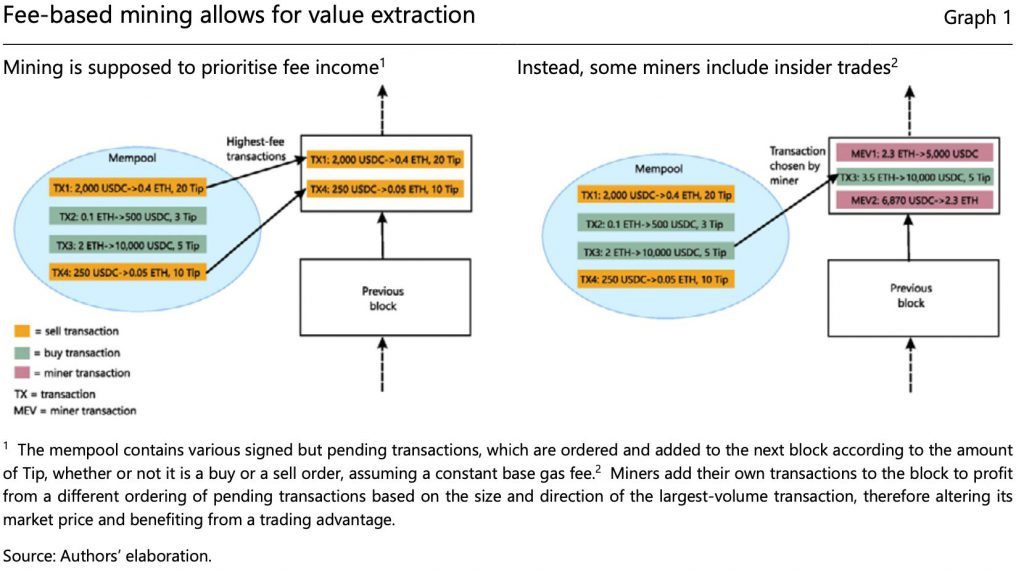

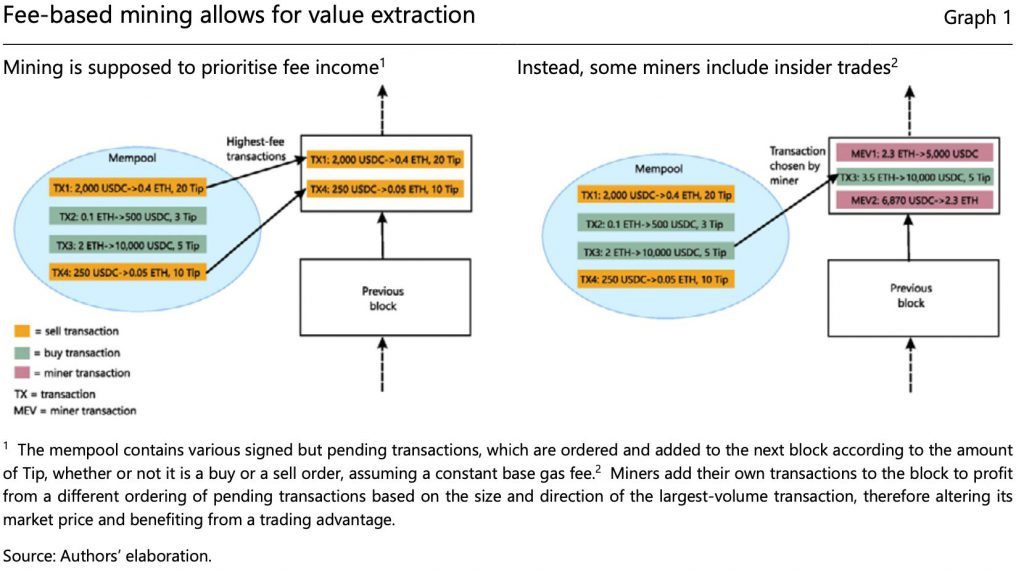

A miner has complete freedom over how to put together a new block once they have the ability to add one. They are able to gain value from other users in this way. They can build their block from all pending transactions – the memory pool or “mempool” – in such a way as to maximize profits in addition to collecting legal transaction fees (for example, “gas” fees in Ethereum).

In the paper, BIS has defined MEV as

“The profit that miners can take from other investors by manipulating the choice and sequencing of transactions added to the blockchain.”

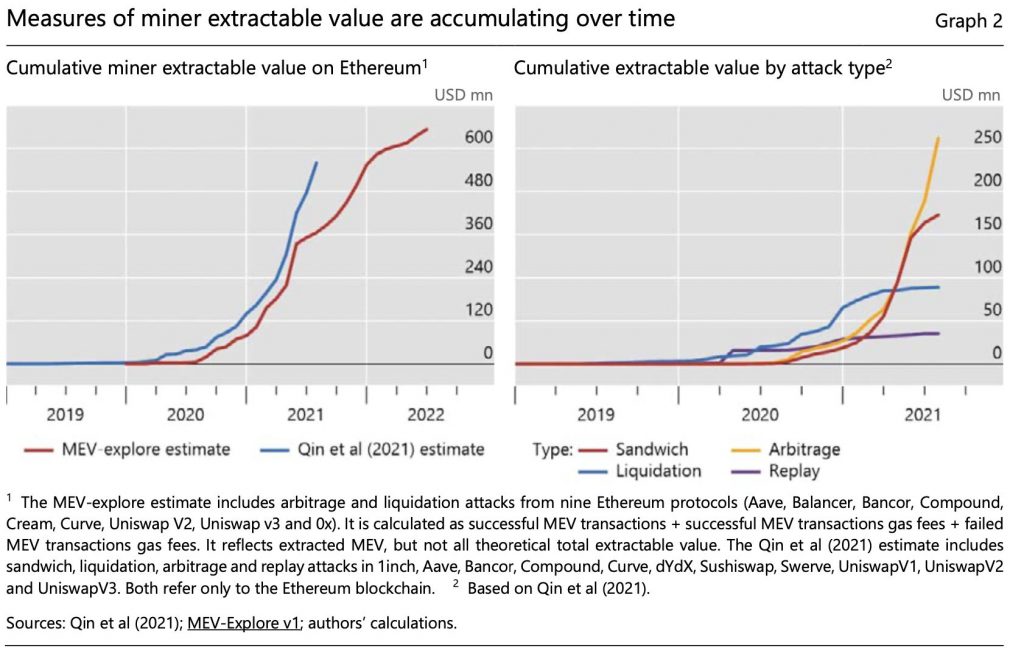

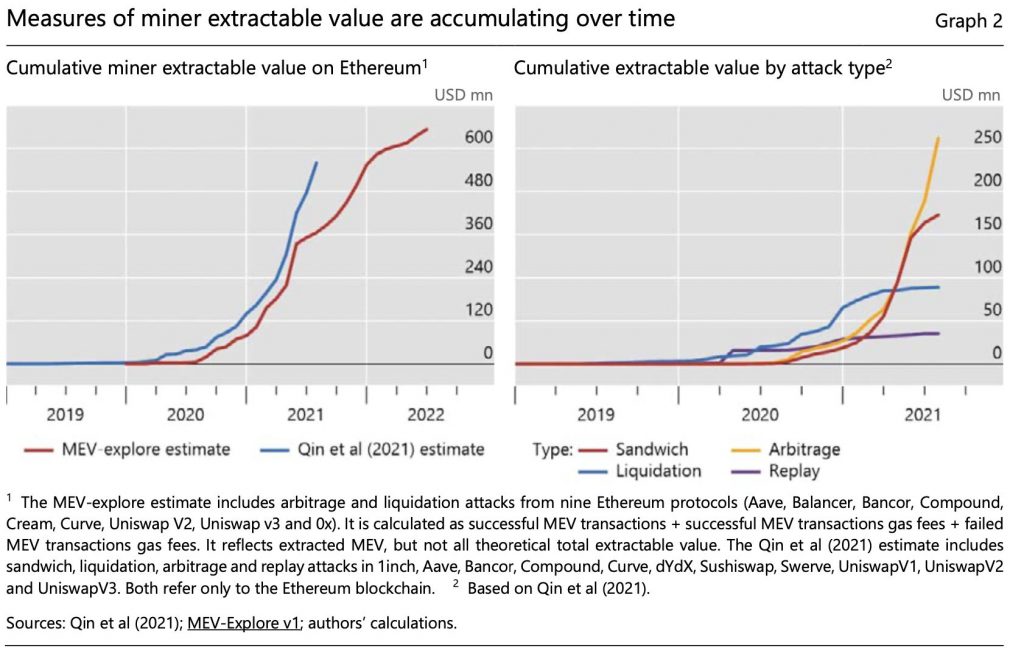

As per BIS’s research, because MEV is so widespread on the Ethereum network, miners occasionally add one out of every 30 transactions just for this reason. According to two recent estimations, the total MEV since 2020 has reached around USD 550–650 million on the Ethereum (ETH) network alone. Furthermore, since only the major procedures were used to generate these estimations, they are probably understated.

Is this practice legal?

Although it is morally questionable, the practice is not yet illegal. The report claims that in addition to the miner’s activities delaying other legal transactions, this benefit is also obtained at the expense of other market players. Transactions are ranked not by fees but by the potential for the miner to benefit from them instead.

The paper states,

“By manipulating market prices via a specific ordering – or even censoring – of pending transactions. Because the ledger is publicly observable, these forms of market manipulation can be seen, even if the underlying identity of the miners or other parties in question is unknown.”

Will the Ethereum merge put an end to MEV?

Ethereum’s move to a proof-of-stake system will altogether remove mining. Validators will then have to stake their coins in order to secure the network and validate transactions. Although MEV should be a thing of the past when this occurs, BIS’s paper seems to say otherwise.

The paper states,

“Similar arguments hold for a proof-of-stake-based network, into which the Ethereum network aims to transition.”

BIS says that we need a network of dependable intermediates whose identities are made public, and a permissioned distributed ledger technology may be used to address MEV and related concerns. However, that would entail a centralized structure, similar to conventional finance.

Well, it would appear that for now we are most likely stuck with MEV, and maybe with time, we will have a more sustainable solution.