A bullish rebound on Tuesday morning allowed Ethereum to regain 10% of its lost value after multiple corrections last week. While the rebound was a sigh of relief, it was still early for investors to rejoice. Sell pressure was yet to extinguish and with major indicators still holding a bearish position, Ethereum could likely return to $2,100 over the coming days.

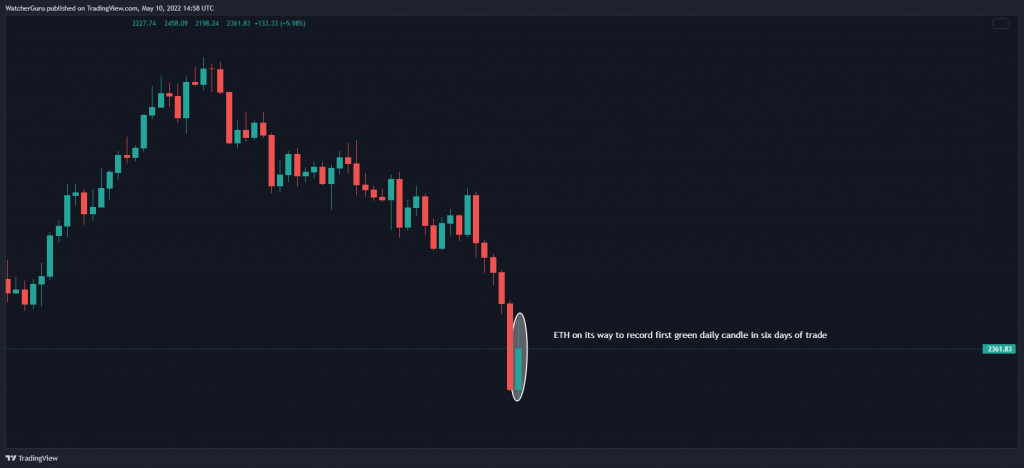

On the outset, Ethereum’s daily chart presented the start of bullish price action. The altcoin managed to regain 10% of its lost value and prepared to mark its first green candle in six days of trade.

However, major indicators were largely unimpressed with Ethereum’s rebound. The daily MACD maintained its downtrend, suggesting that downwards pressure was still outpacing selling pressure. The RSI also held in the bearish territory around 35- suggesting that bears were still more dominant on the macro frame.

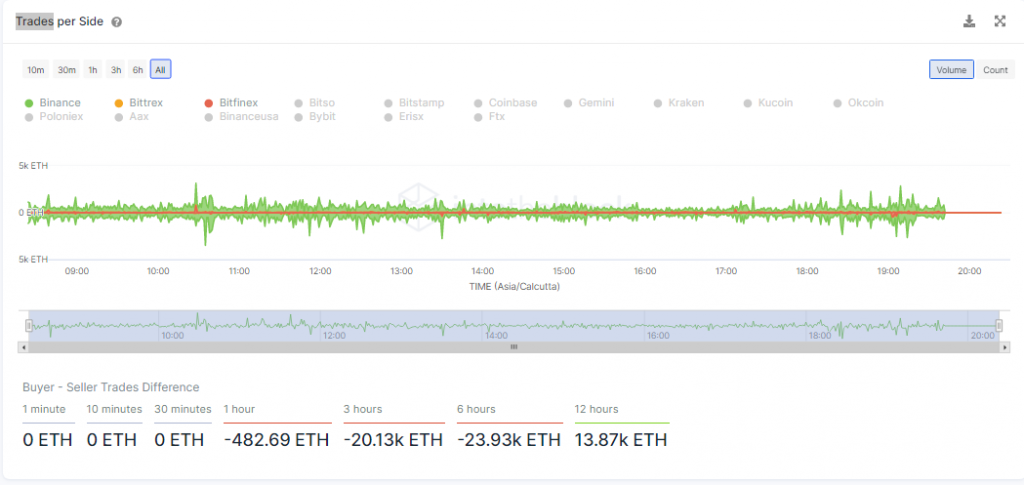

ETH’s bullish rebound also stopped attracting more buying pressure at press time. After buy-side trades outweighed sell-side trades in the last 6 hours, the narrative quickly changed in favor of the sellers once again.

The reading left Ethereum in a delicate position on the hourly chart. A red candle developed after the price zoned in on $2,500 and the 4-hour 20-SMA (red), suggesting that ETH’s minor relief period was already extinguishing.

Ethereum – Key levels to look at

Should the market tumble once Ethereum fails to close above $2,500, support areas of $2,100 and $2,000 were the following logical choices of defense. A breakdown below these areas would bring back Ethereum to its demand zone at around $1,700, marking the potential for another 23% decline from ETH’s press-time level.