The crypto market has been in dire straits over the past few hours. Most coins—right from large-cap and mid-cap to small-cap—faced the brunt. As a result, the global crypto market cap shed approximately 7.59% of its value over the past day and stood at merely $1.67 trillion at press time.

The market dump was led by Bitcoin. The largest crypto asset noted a freefall from $39.5k to $36.3k in just the past 16 hours. In fact, during the early hours of Friday, BTC also went on to visit the $35.5k mark. Ethereum, on the other hand, dipped from $2.92k to $2.73k in the same 16-hour time frame, after briefly having visited $2.68k.

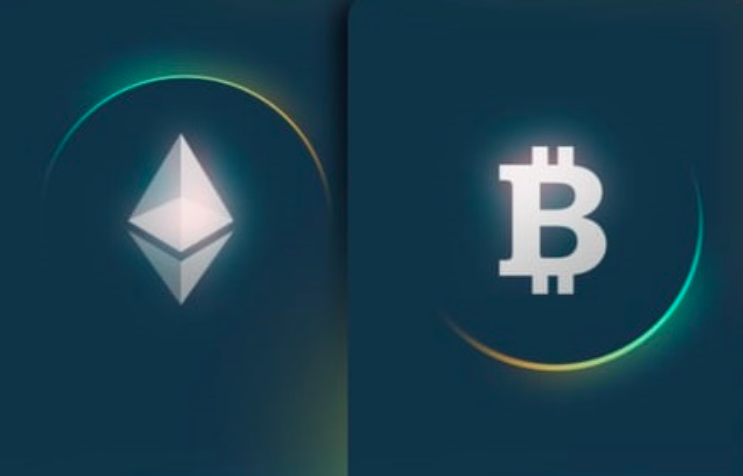

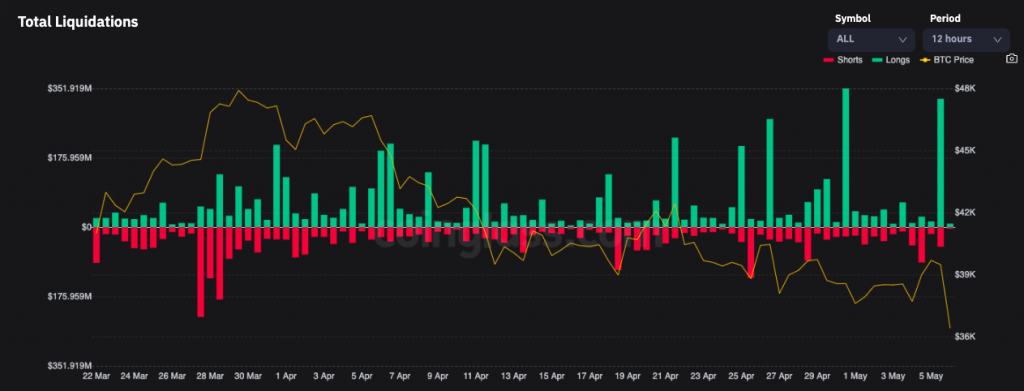

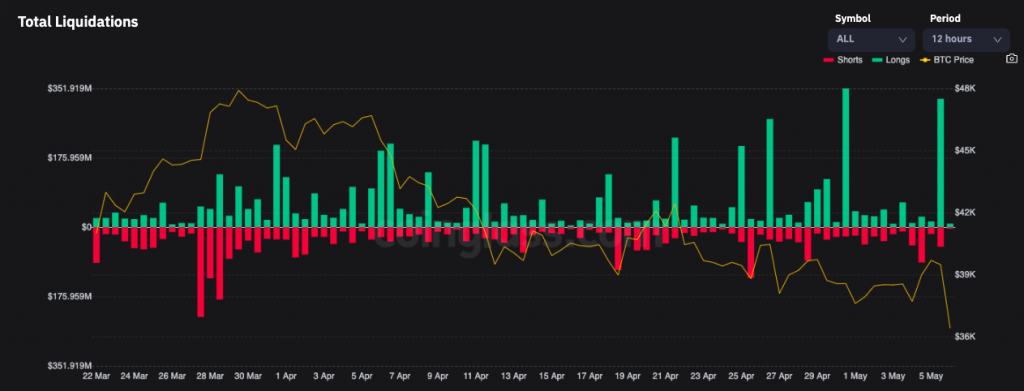

Here, it should be noted that the sentiment had flipped to positive on Wednesday, post the FOMC outcome announcement. The same momentum even continued on Thursday, and as a result, long trades kept piling up.

With the flip in market sentiment to bearish, bullish traders felt the pinch the hardest. As can be seen from below, the long ‘rekts’ overshadowed the short ‘rekts’ by a substantially high margin [approximately 6.5 times].

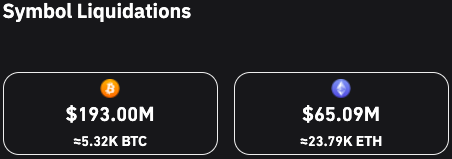

Over the past 24-hours, a total of $407.52 million had been liquidated from the crypto market. Almost half of the same, were Bitcoin liquidations, while Ethereum followed next.

As highlighted below, BTC positions worth $193 million were rekt over the past 24-hours, while ETH positions worth $65.09 million were wiped out.

Time to take a breather?

Well, the crypto market has seen quite a few bloodbaths until now this year. Back on 21 January, for instance, top alts were testing their 2021 September lows. One month later, on 22 February tokens like XRP and Cardano noted substantial dips again. Post that, in mid-April, Solana, VeChain, and Near tumbled off their charts.

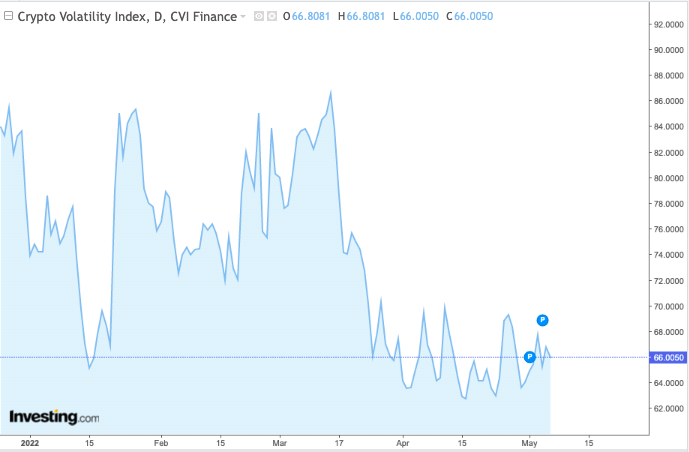

During all of the said days, the volatility in the crypto market was quite high. Now, despite the dip noted over the past 16-odd-hours, the Crypto Volatility Index’s reading continues to hover around its lows, indicating that the market is probably prepping to cool down for a brief while before making its next ascending/descending move.