Ethereum’s price trades within a bearish pennant and remains open to a further 42% drop. However, signs of accumulation were beginning to show and the same offered a lifeline to ETH. Should the broader market remain risk-on, ETH might negate the pattern and force a move to the upside.

On the daily chart, Ethereum’s candles have traded within two sloping trendlines since the latter half of May, forming a bearish pennant when connected to the flagpole. Based on the flagpole’s length, ETH was vulnerable to a further 42% drop, which would drag its value to yearly lows of $1,100.

Accumulation on the up?

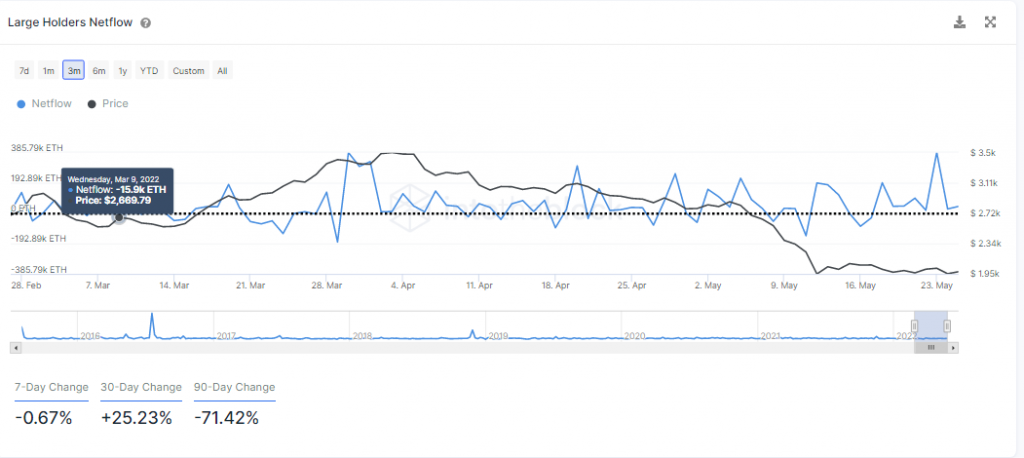

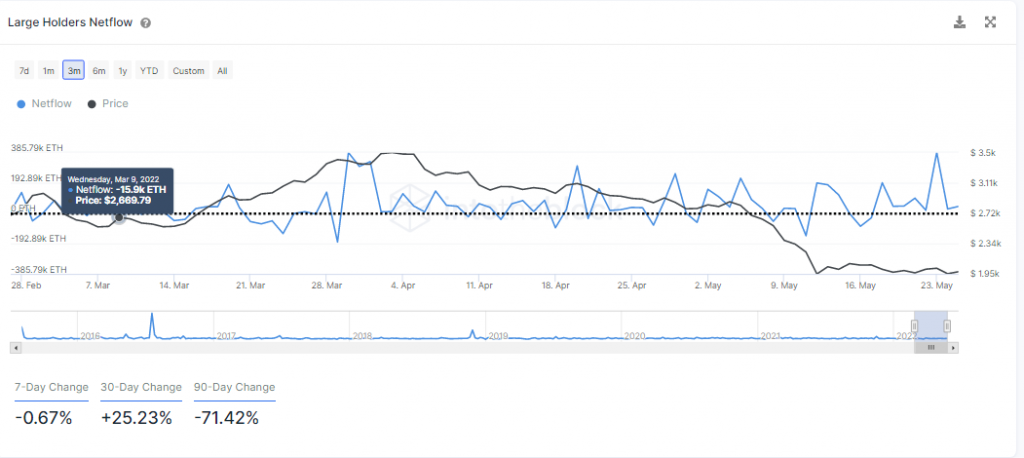

Now, it’s common knowledge that investor accumulation can trigger price increases. On that front, Ethereum was starting to show positive signs. According to IntoTheBlock, large holders NetFlow have risen by 25% in the last 30 days. An increase suggested that addresses holding over 0.1% of ETH’s circulating supply were adding ETH to their balance.

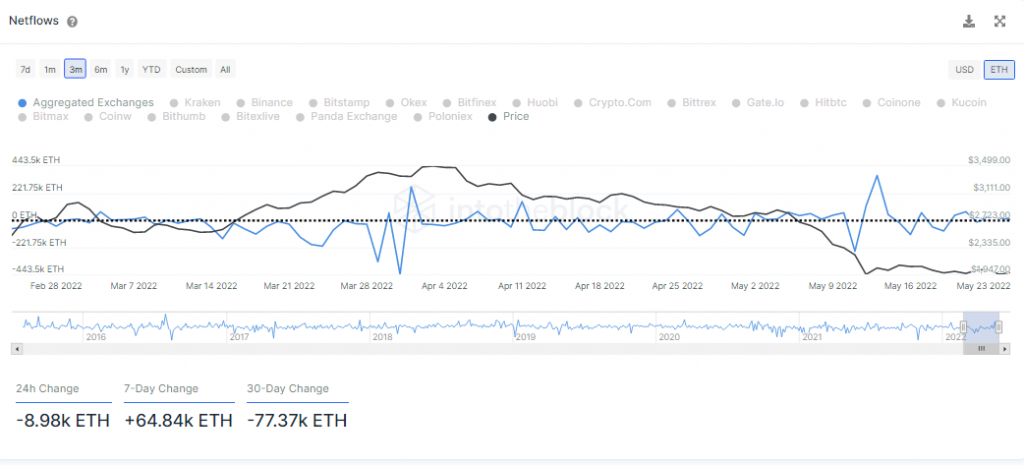

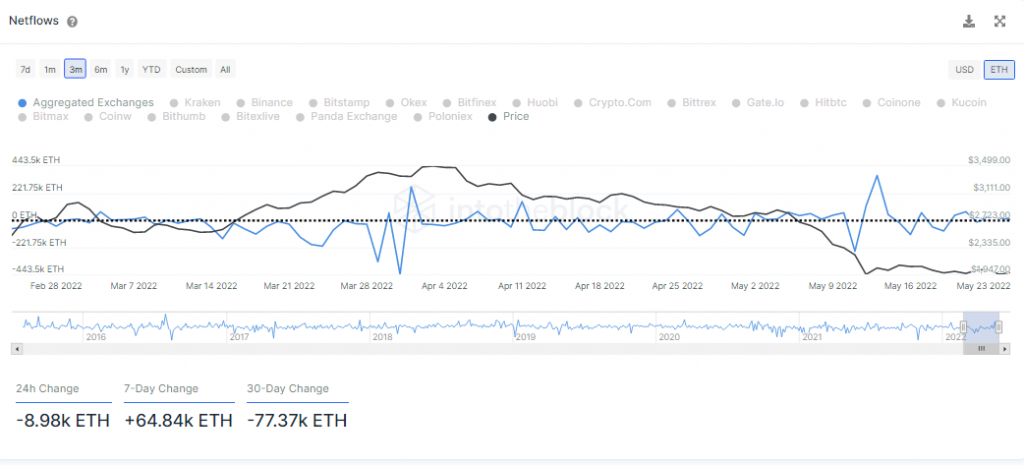

A positive trend was also observed through monthly NetFlows, which stood at a negative 77.15K. This figure indicated that around $154 Million worth of ETH had left exchanges during May, showing accumulation from retail investors.

With fewer users transacting on the Ethereum network amid market uncertainties, the average fees also declined to $2.54 on 24 May – the lowest level since July 2021. As per Santiment, a drop below $5 typically tend to correlate with an ETH rise.

Ethereum Daily Chart

In hindsight, the aforementioned developments could help ETH negate the bearish pennant setup. Bulls may even force an upwards breakout should Bitcoin rally over the weekend. A move above the $2,100 boundary could bring about a $2,300 Ether in the next couple of days. The next contact point was at $2,500.

However, keep in mind that the present accumulation pattern was not as strong as the one observed in July 2021, when retail investors and whales were collectively making large purchases. Hence, ETH was still susceptible to broader market weaknesses and investors should maintain caution nonetheless.

With investment outflows still a worry for Bitcoin, a weekend retracement should not be ruled out. In the same situation, ETH could be forced to close below $1,900, exposing the market to further losses.