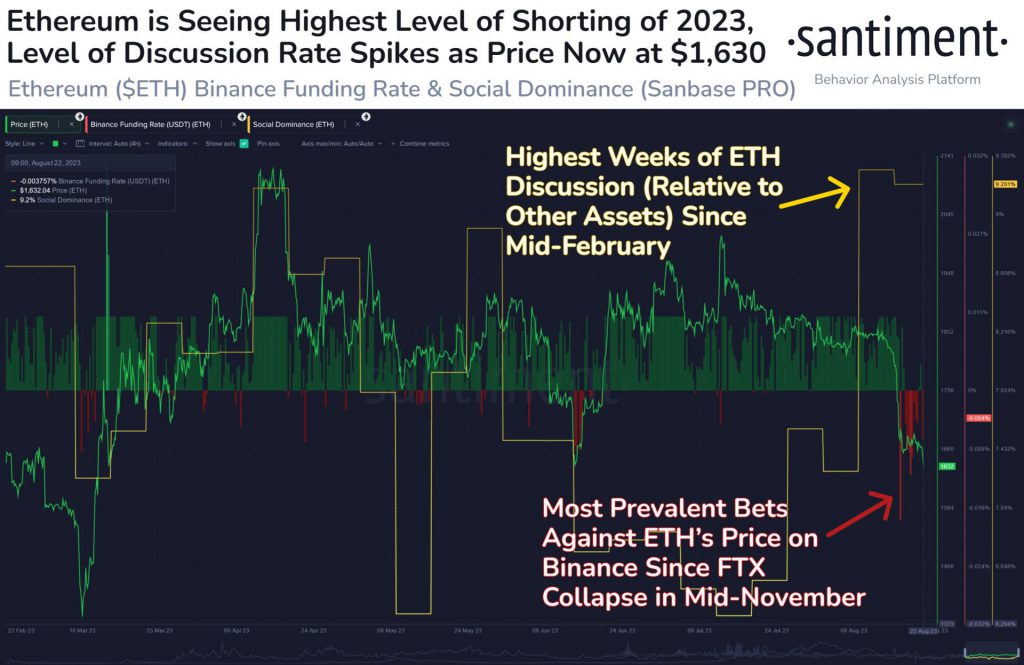

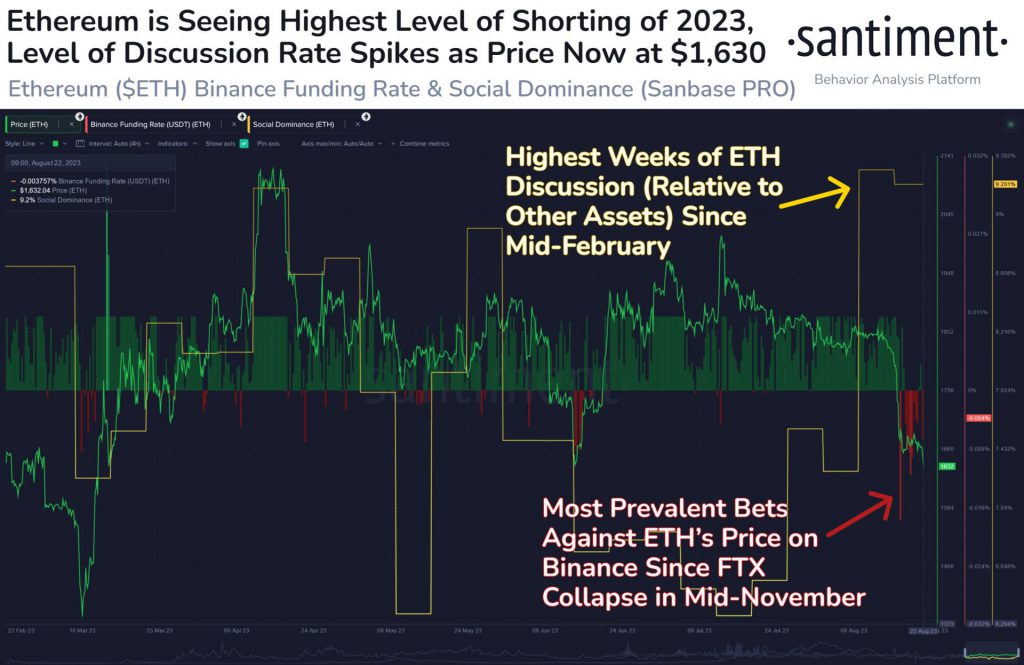

The entire crypto market was in a slump. During this bearish phase, a significant number of participants began initiating short positions. Now, these positions against Ethereum [ETH] on various cryptocurrency exchanges have surged to a yearly high.

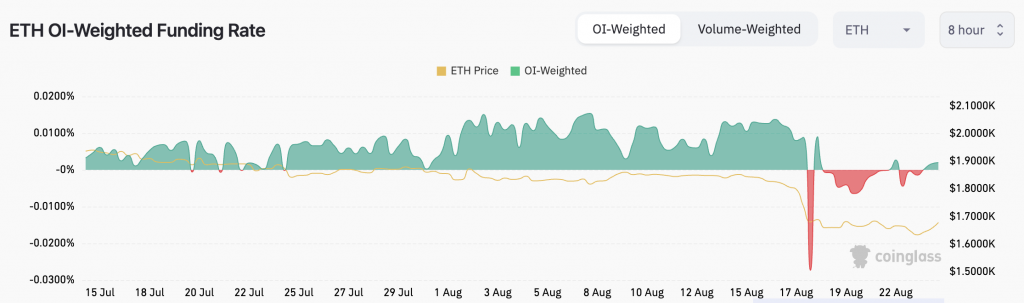

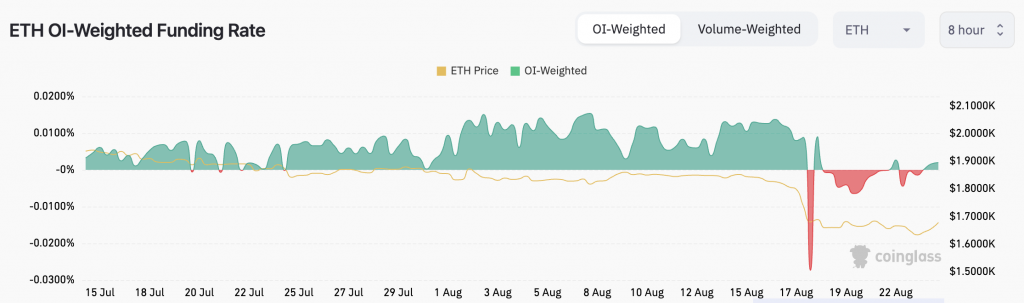

Santiment noted that this represented the most widespread anticipation of a decline in ETH’s price on Binance since the collapse of FTX in mid-November. The ETH OI-Weighted Funding Rate data from Coinglass illustrated the sums transferred between short and long traders who possess perpetual contract positions in the asset. A positive rate indicates bullish sentiment. Nevertheless, Ethereum’s rate has reached -0.0273% and has maintained a negative stance since Aug. 18.

However, at press time, the funding rate had surged to a positive 0.0020%. This further indicated a bullish notion.

Ethereum is a hot topic of interest

Apart from the traders’ sentiment, the overall community was engaged in discussions about the altcoin. Despite the decline in the coin’s value, Ethereum’s social influence, assessed through a seven-day moving average, surged to its peak since February. This surge indicated an increase in conversations revolving around the altcoin, a trend that typically precedes a rise in the asset’s value.

The majority of these discussions might primarily stem from FUD. Nevertheless, Santiment perceives an optimistic perspective in this situation. Commenting on the potential for a price increase, Santiment, pointed out,

“The spiked discussion rate and high level of shorts to be liquidated could cause a healthy rebound.”

Also Read: Ethereum’s Vitalik Buterin Moves 600 ETH to Coinbase, What’s the Motive?

Whales veer into the ETH market

Over the past two weeks, Ethereum saw a dip of 9.5% in its value. Now, investors have exhibited sudden activity. Data suggests that four whales amassed a total of 56.1K ETH, which is worth about $94 million, within the last seven days.

The actions of these investors purchasing during a market downturn suggest that they are getting ready for a potential increase. Currently, ETH is being traded at $1,674, showing a daily gain of 1.83%. This movement can be linked to the factors mentioned earlier, along with the overall sentiment in the market. However, the heightened short positions, conversations, and engagement from influential investors could contribute to the altcoin’s ability to sustain its present momentum.

Also Read: SEC Approval of Ethereum Futures ETF Expected in October