Riding on the back of the FOMC meeting rate hike announcement, and the Fed Chair’s assertions that the US is “not” in a recession and the economy is on track to grow this year, markets across the board rallied. Well, a 75 BPS hike is technically not a healthy sign. However, analysts and market participants were expecting the same. So, the Fed merely delivering didn’t cause chaos in the markets. Besides, given that similar back-to-back hikes have been green-flagged over the past few months, this time’s rise did not necessarily feel new/significant.

More importantly, Powell also asserted that at some point it’ll be appropriate to slow down rate hikes. As per renewed analyses, analysts are eyeing a 50 BPS and 25 BPS hike in September and November, respectively. Evidently, the slight ray of optimism torched has been well-welcomed, and investors have gradually started becoming forward-looking. While The Nasdaq 100 posted its best one-day gain since November 2020 and S&P 500 also traded in the green, the crypto market—as speculated last week—followed suit. And this time too, instead of Bitcoin, the show was led by Ethereum.

Rallies galore post Interest Rate rise but how long?

While Bitcoin has rallied by 9% over the past 24 hours, Ethereum has notched up in value by 13%. Leaving aside the macro factors highlighted above, the token’s price rise had full-network backing this time.

Ethereum’s active addresses, for instance, noted a massive spike yesterday and ended up creating a new ATH. Santiment revealed that 1.06 million ETH addresses made transactions yesterday, eclipsing January 2018’s held record of 718k.

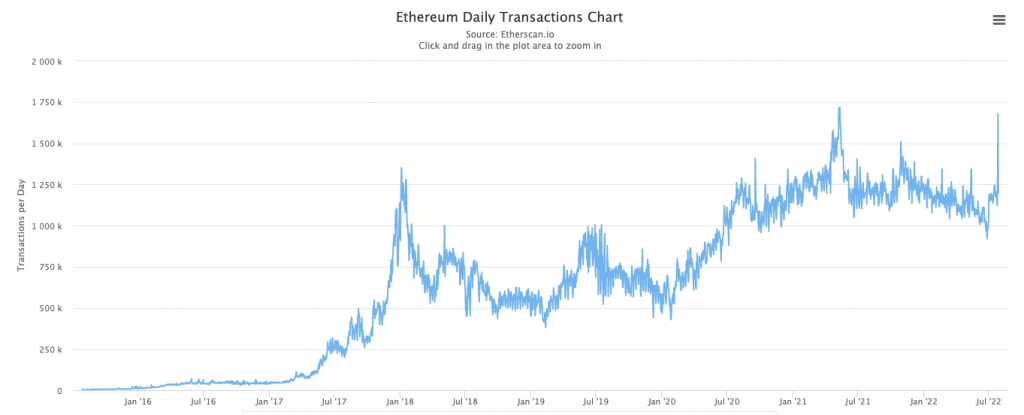

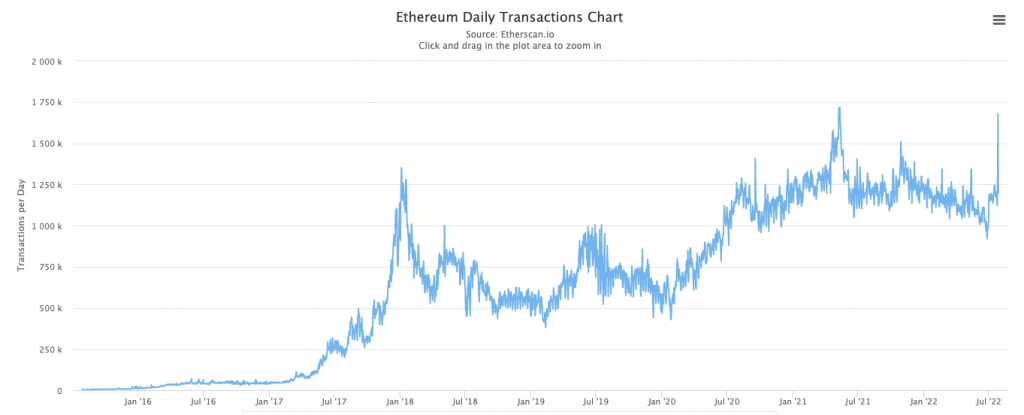

The spike in the number of active addresses did translate into a spike in the number of daily transactions. The same essentially put it at almost par with the levels noted back in May 2021, before the flash crash.

Parallelly, it is interesting to note that Ethereum’s NVT ratio has also claimed a new 1-month high. The same indicates that the network value is able to overshadow the value being transferred on the network and is indicative of actual network growth.

Rising network activity, in most instances in the recent past, has aided the network’s token rally. So, will the same aid in extending ETH’s short-term bull spree this time as well?

Ethereum’s pump is likely a bull trap

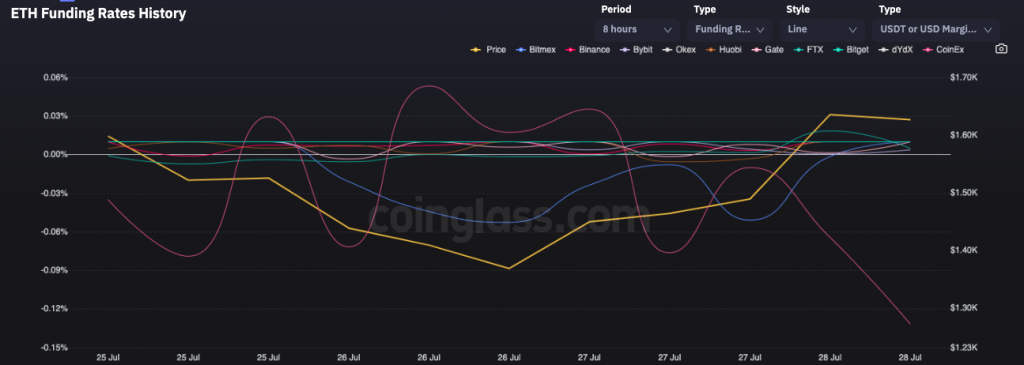

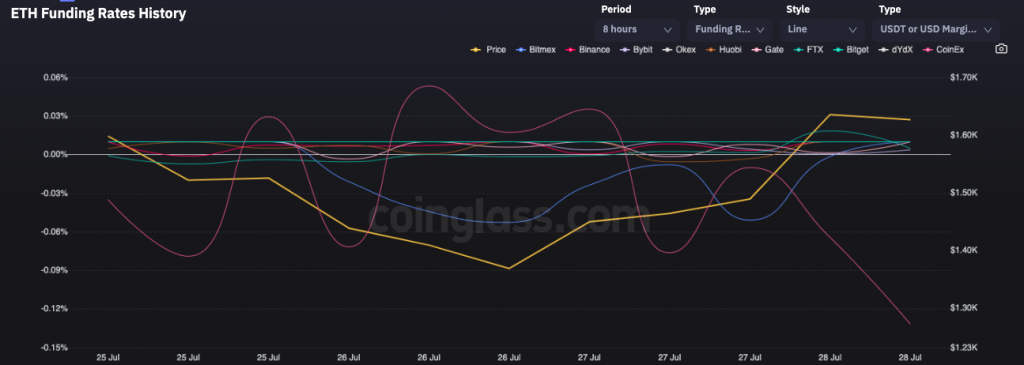

The collective trader sentiment, at this stage, is not very optimistic. The funding rate curves of most prominent exchanges have already started pointing down south, indicating a weak-bullish momentum. In fact, on CoinEx, the rate had noted an unusual dip to -0.13%. Collectively, they suggest that the market is slowly starting to ditch bulls.

Alongside, the Long:Short ratio has also been hovering below one, around 0.8 of late, indicating that short Ethereum orders have been piling-up relative to the longs. The same further suggests that traders are expecting ETH’s overheated price landscape to cool down.

So, keeping the said datasets in mind, it is likely that the recent pump is a bull trap and the Ethereum market is primed for a correction. The improving network-related fundamentals, however, wouldn’t go in vain. They’ll end up playing a role in refining the long-term price of ETH.