The first quarter of 2022 has come to an end and prices of smart contract operators Ethereum, Solana, and Cardano have looked to bounce back from lows hit during February and early March. Here’s a round-up of how the top smart contractor operators have performed during Q1 2022 amid recent developments.

Ethereum [ETH]

Most developments surrounding the altcoin leader in 2022 focused on how the network was faring prior to a Proof-Of-Stake transition later this year. A constant increase in the amount of Ether staked since January showed that confidence in ETH’s long-term success was high despite broader market fluctuations.

In January, Ethereum declined below the $3,500 mark for the first time in four months due to broader market sell-offs. The price continued to slip lower in February and formed a bottom around the $2,400 level. However, the latter half of March was a different story. A sustained recovery seemed to be in effect, with ETH pacing steadily above $3K and then $3,200. Recent gains did slightly improve ETH’s year-to-date ROI, although investors still lost nearly 12% on their ETH investments thus far. Currently, the $3,400 price mark, backed by the 200-SMA (green), was the next significant area on the chart.

Cardano [ADA]

Similar to Ethereum, Cardano’s ecosystem with advancing well with the Vasil Hard Fork event set for June. Blockchain upgrades, an entry of peer-to-peer lending, and a Coinbase staking introduction allowed Cardano to remain a significant-top 10 project. The said updates upped the demand for the Cardano network, with its Total Value Locked hitting new records each passing day.

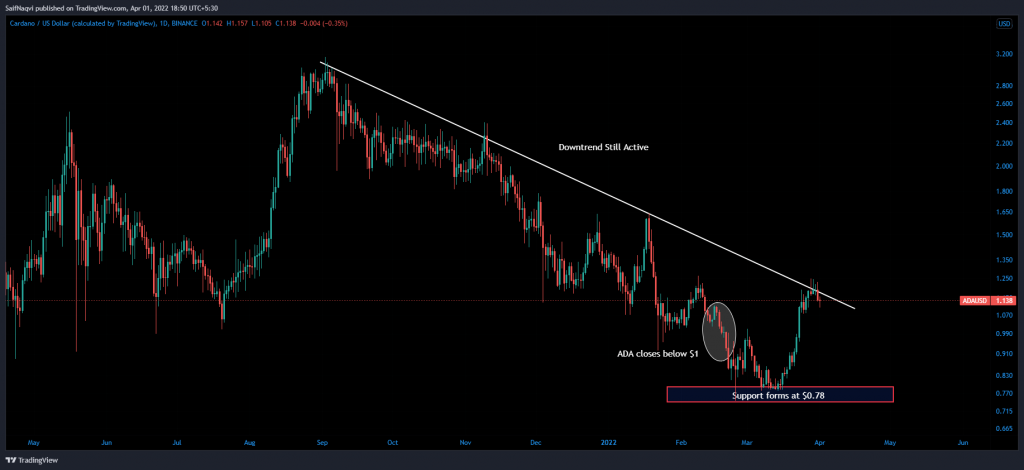

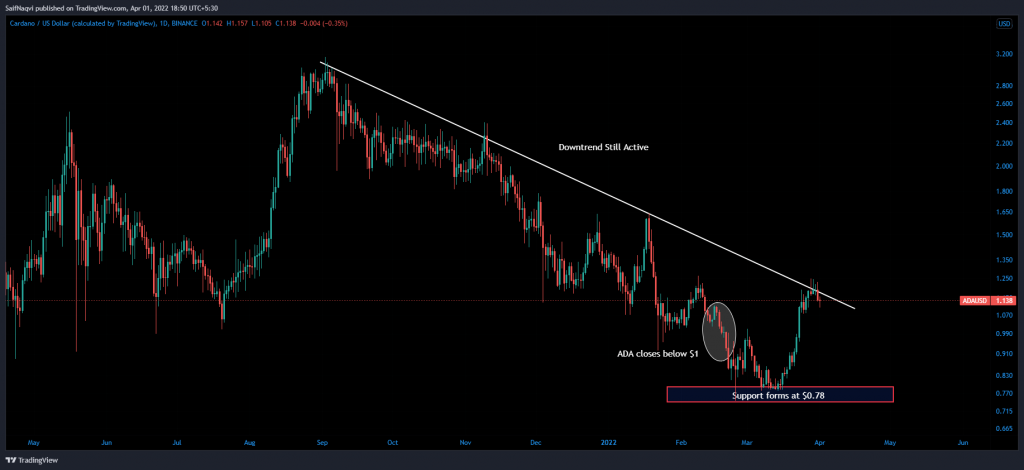

Late January was a scary period for ADA investors, with its price falling by 40% amidst broader market weaknesses. Sellers continued to dominate throughout February as well and many hit the panic button once ADA closed below $1 for the first time in over a year. A support area was finally established at $0.78 In March and although the price has enjoyed a recent bullish period since then, a downtrend was yet to be broken. As a result, ADA, year-to-date ROI was a negative 17%.

Solana [SOL]

Partnerships and listings have been the name of the game for Solana thus far in 2022. The project made headlines after Coachella and crypto exchange FTX combined in February to launch Solana-based NFTs. March was particularly busy for the project. Earlier in the month, SOL bagged a listing on Gemini, and later, FTX and digital asset investment firm CoinShares combined to launch the world’s first physically-backed Solana ETP.

Unfortunately, however, the Solana network was embroiled in a few controversies following a $322 Million hack and two damaging rug pulls.

SOL’s price was reflective of temporary FUD moments, with its YTD ROI at a negative 33% 0 the highest among the 3 coins in question. Its candles declined throughout Feb-March and eventually discovered strong support between $80-and $90. However, SOL has looked strong over the last two weeks. The price was recovered by nearly 70%, higher than Ethereum and Cardano in terms of percentage gains.