Ethereum’s Shapella upgrade was highly anticipated by the entire community. Investors have been able to withdraw their staked ETH through this development. However, fear was instilled in many as it was speculated that selling pressure would surge. But the situation is taking a different direction.

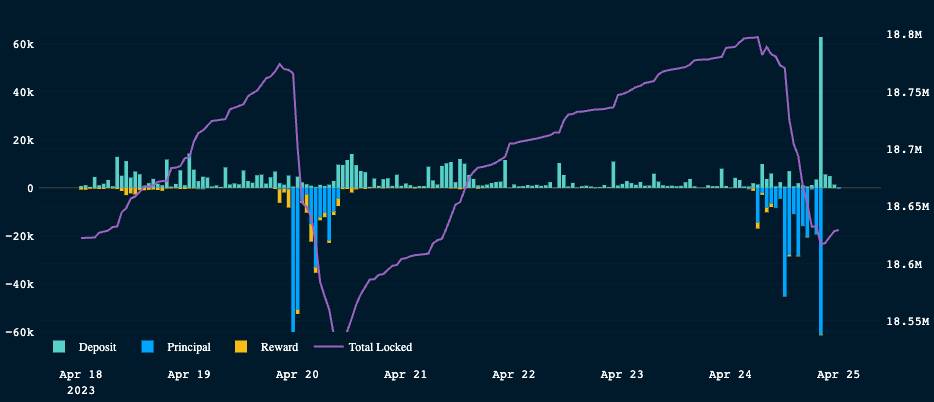

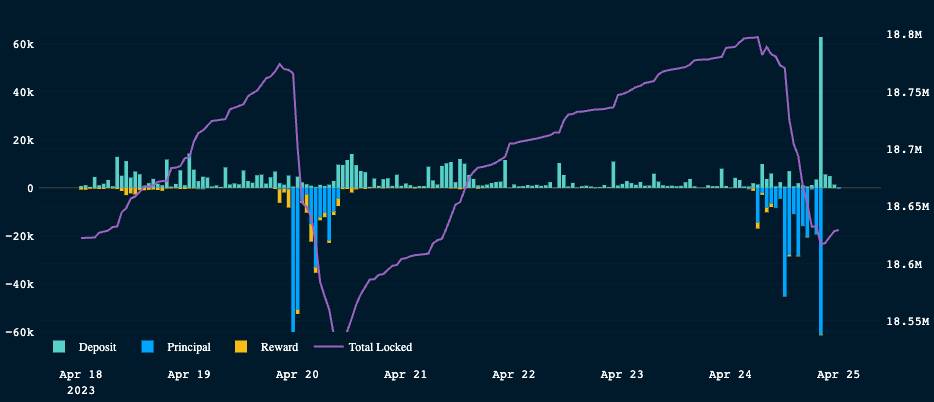

Recent reports reveal that Ethereum staking withdrawals have reached the third “round.” Yet, ETH staking deposits have come close to matching the withdrawals. Analytics firm Nansen noted that on April 24, 61608 ETH in principal and reward withdrawals made up the latest significant round of withdrawals. Alongside this, 63,009 ETH deposits were made at the same moment, according to Nansen.

It should, however, be noted that Kraken accounted for most of these withdrawals. This is in light of the Securities and Exchange Commission’s charges against the exchange in February 2023. Therefore, Kraken will be closing down its staking services. Consequently, a large portion of the early ETH withdrawals came from Kraken accounts as stakers received their holdings back. 2.3% of the entire amount of withdrawable ETH is still held by Kraken, according to Nansen.

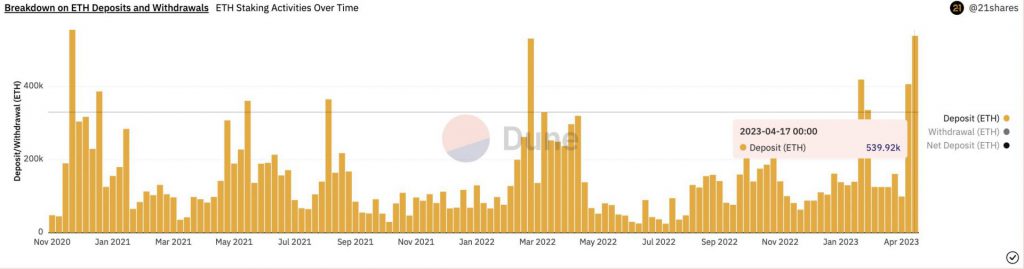

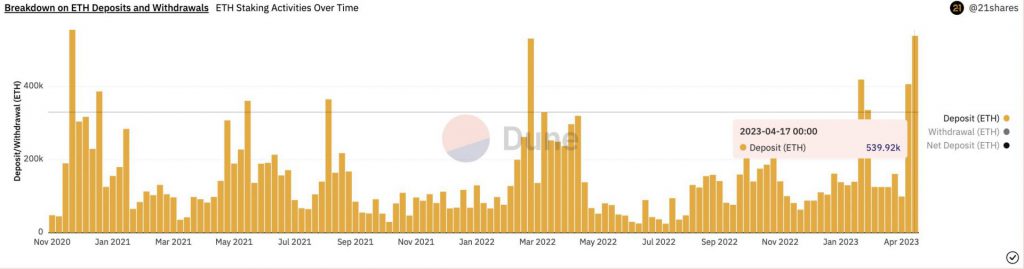

Additionally, about 900,000 ETH in staking rewards were withdrawn by investors in the first eight days following the update. During this period, staking deposits reached over 667,000 tokens, which was more than six times what was deposited in the last eight days before withdrawals were permitted. In turn, the selling pressure was under control as stakers decided to re-stake as opposed to selling their ETH holdings. Adding to this, the network saw the second-largest weekly deposits of 539.9K ETH, again, squashing the sell pressure fear.

Institutional investors veer into the Ethereum ecosystem

It looks like institutional investors wanted in on the staking development. Data revealed that the spike in ETH staking deposits was also driven by institutional staking services. According to 21Shares’ Dune dashboard, the top five institutional-grade staking service providers have staked a total of 235,330 ETH, or over $450 million, since Shanghai. These providers include Bitcoin Suisse, Figment, Kiln, Staked.us, as well as Stakefish.

Shapella has raised Ethereum’s utility, and demand. This time, the network was successful in obtaining institutional-grade exposure. At press time, the price of ETH was $1,813, down 1.64% for the day. This downward trend is undoubtedly caused by the general market sentiment rather than just the update.