Crypto asset prices have mostly remained unchanged over the past day. Data from CoinMarketCap revealed that the aggregate value of all cryptos rose by merely 0.1% in 24 hours. Likewise, Bitcoin’s uptick amounted to merely 0.04%, while for Ethereum, the number stood at 0.3%.

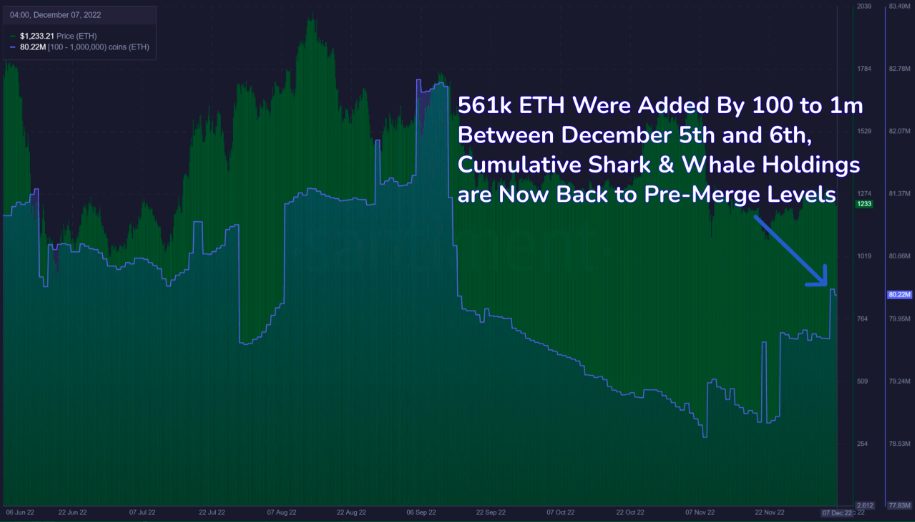

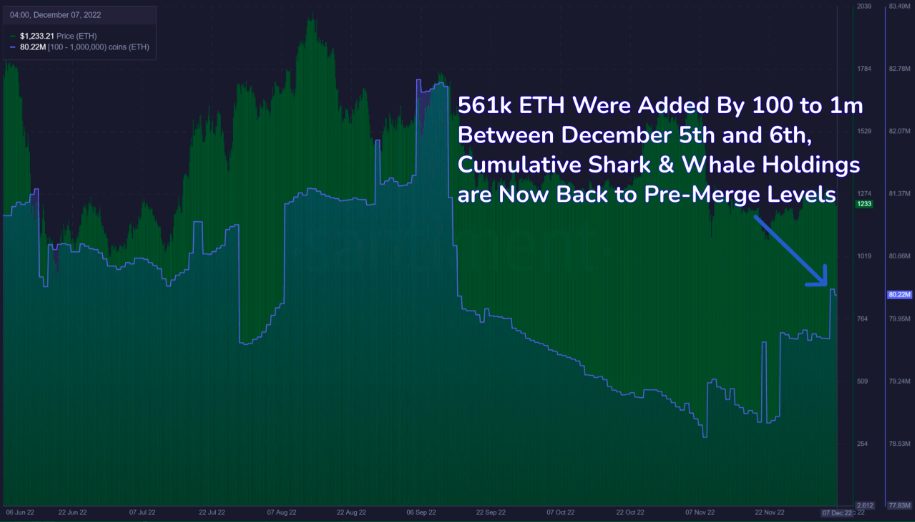

Irrespective of the price monotony, market participants have been adding Ethereum to their bags. The cumulative shark and whale HODLings are now up to pre-Merge levels, thanks to the 561k tokens added between December 5 and 6.

Chalking out the monthly number, Santiment’s latest tweet noted,

“Whales and sharks are adding more Ethereum while prices fluctuate around $1,230. The key shark and whale addresses (holding 100 to 1m ETH) own two-thirds of the coin’s overall supply, adding 2.1% more collective coins to their bags in the past month.”

Also Read: Ethereum, Ripple Are Committing Securities Fraud: Michael Saylor

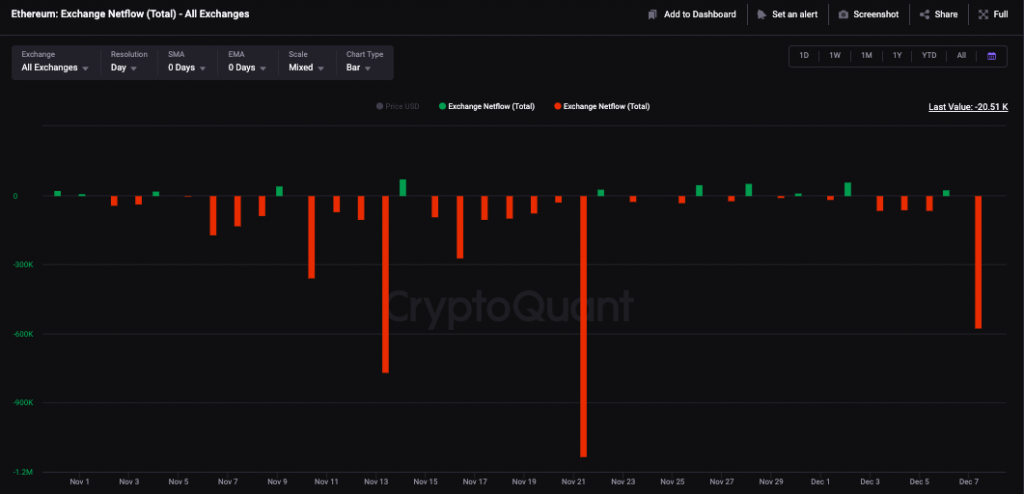

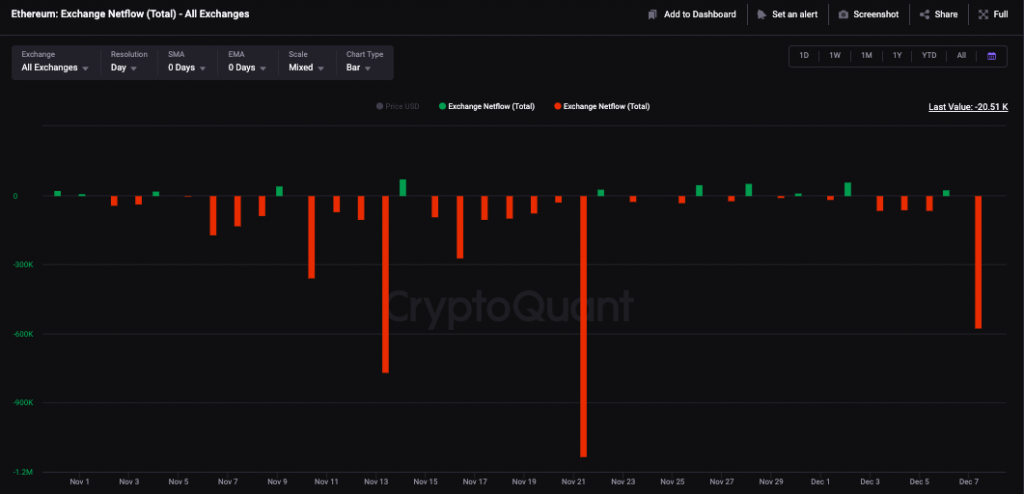

Parallelly, the exchange net flows are currently in red and are at a 2-week high level. The same is essentially a positive sign amid the current conditions, for it suggested that the macro accumulation trend is on.

Per data from CryptoQuant, 575.05k ETH tokens left exchanges on 7 December alone. Prior to that, as depicted below, the size of the flows wasn’t that note-worthy.

Also Read: Is a 30% rise Incoming for Ethereum?

Is $1300 in sight for Ethereum?

If Ethereum continues receiving support from buyers, it’d just be a matter of time until it breaks past its immediate resistance and heads toward $1296—a level that coincides with its 50 EMA.

As depicted below, ETH has faced stiff resistance at the said price a handful of times in the recent past. In fact, data from ITB brought to light that in the price band extending from $1296 to $1483, around 3.91 million addresses have bought a total of 9.61 million ETH. So, the path to the brink of $1300 seems to be fairly clear for Ethereum, but post that, it’ll be put to test by the bears.

If the momentum flips the other way around over the next few trading sessions, then a pullback to $1.199k can be expected. If the bearish conditions persist, then $1.104k would likely be ETH’s next stop.

Also Read: Ethereum’s Shanghai upgrade confirms 1st testnet “Shandong”