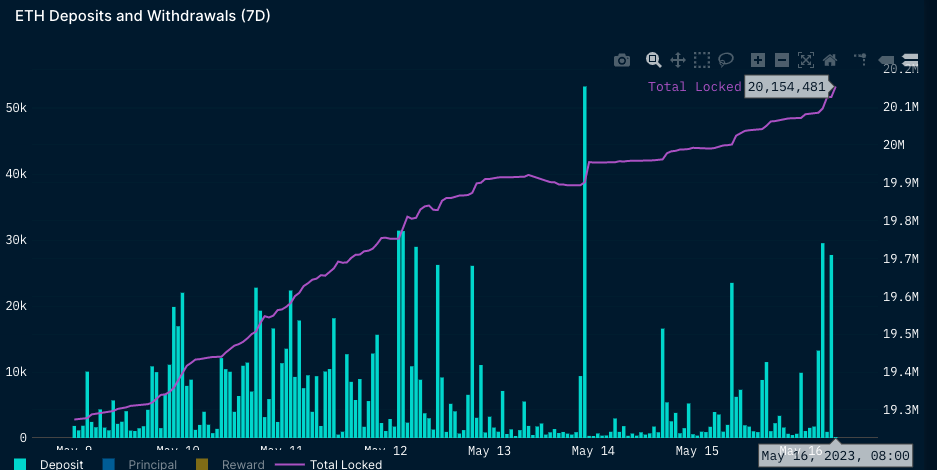

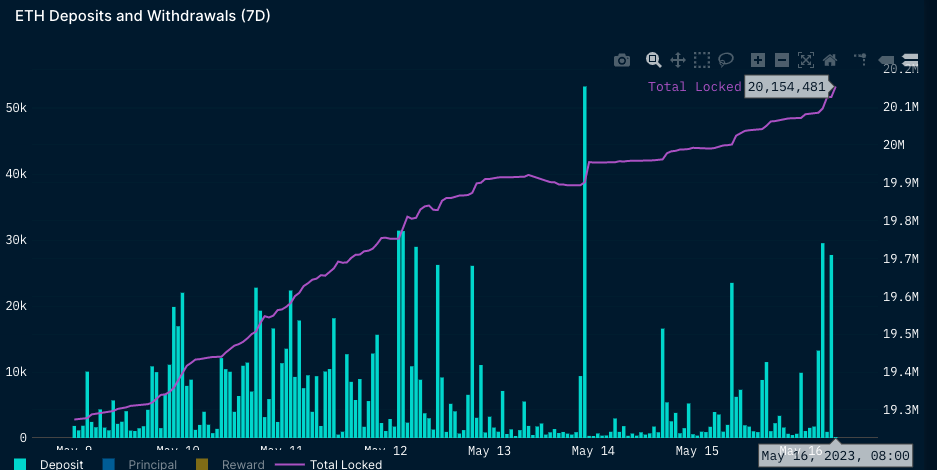

Ethereum holders have been staking their tokens in rapid succession over the past few weeks. Recently, the deposit activity was pushed to the highest level since the Shapella upgrade that went live last month. As a result, the number of ETH locked for staking has already surpassed 20.1 million tokens.

Also Read: Ethereum Active Deposits Claim 8 Month High: What’s Next?

To stake tokens, users lock their ETH to validate transactions. This is done in return for a reward paid out in Ether. Thus, staking yields can more or less be equated to passive income, making the whole deposit process lucrative.

A recent report from Bernstein highlighted that the Ether yield economy is becoming more mainstream. According to analysts Gautam Chhugani and Manas Agrawal, “It is hard not to see more demand for ETH deposits and ETH yields.”

Also Read: Crypto Whale Swaps ‘All’ Assets for Pepe Coin: Profits $1.23M Instantly

Ethereum yields to call shots this cycle

It is a known fact that the yields are directly associated with the Ethereum ecosystem’s activity. According to the analysts, that will continue to see increased adoption from both retail and institutional investors. Thus, Ether yields are in a position to call shots this cycle. Specifically, Bernstein’s report noted that the new crypto cycle “will be about yield this time.” The report stressed that banks make money by not sharing yields with savers. However, pinpointing how Ethereum stakers are in a better position, the Bernstein analysts wrote,

“Ethereum shares all that it makes with stakers and does not dilute its monetary policy.”

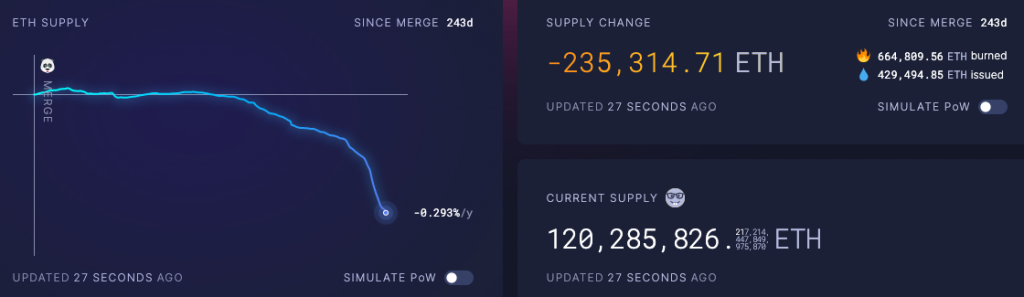

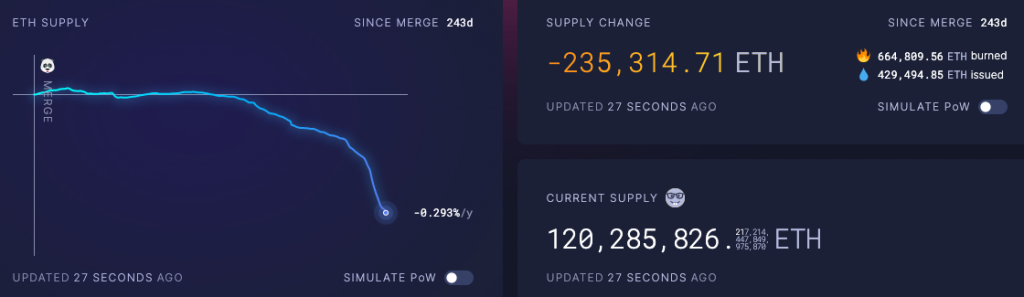

Here, it is also worth noting that Ether yields are in the ETH denomination. On its part, ETH has been deflationary since the end of January 2023. In fact, since the Merge, over 664.8k tokens have been burned, while only 429.4k tokens have been issued, putting things into perspective. Thus, ETH being deflationary is another boon for ETH yield earners.

Also Read: Bitcoin’s Energy Use is a ‘Skyscraper’, Ethereum a ‘Raspberry’: Research