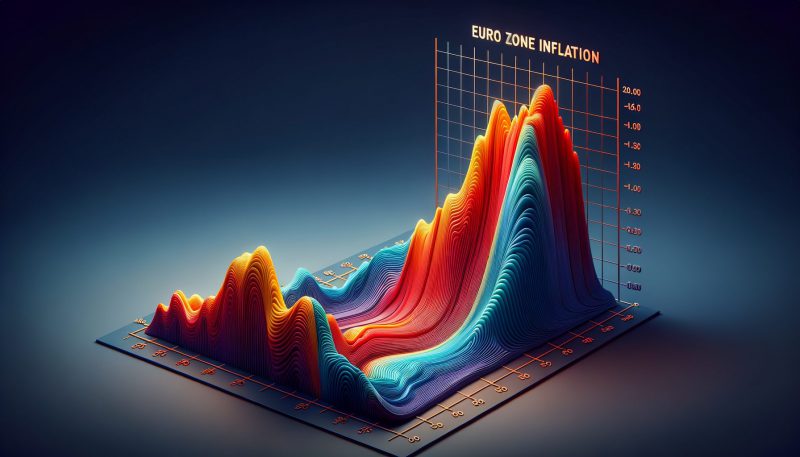

The CPI (Consumer Price Index) in the euro zone fell to 2.4% in November, falling 0.5% from October’s 2.9%. According to a poll by Reuters, economists anticipated a reading of 2.7%. Core inflation, which excludes the volatile food and energy sectors, fell to 3.6%, also below expectations.

Despite CPI cooling in the Euro Zone, European Central Bank officials have said it may be too early to reduce interest rates. Officials will first monitor the possibility of pressure from increasing wages and energy markets.

Also Read: What is Core Inflation

Headline inflation in the euro zone has significantly reduced from its October 2022 peak of 10.6%. According to Bert Colijn, a senior euro zone economist at ING, ‘sluggish demand’ might keep inflation at bay.

When will inflation reach its 2% target?

Although inflation has cooled to new lows, Europeans still feel the pinch of rising costs. According to Yacin Malkoc, a Belgian grocery store manager, ‘Whether it’s in fruits and vegetables, especially in strong products like bananas, mushrooms, or tomatoes, there has been an increase of more or less 30%.‘

Food prices in Europe have continued to surge throughout 2023. Nonetheless, the price spikes have been less frequent in recent months.

Also Read: Social Security Benefits to Rise 3.2% in 2024 Amid High Inflation

European Commissioner Paolo Gentiloni stated, ‘According to our estimates, the increase in wages will catch up with inflation. And of course, this will contribute to the purchasing power, this will increase consumption and the increase of consumption is the premise to restart growth. So there is a little bit of moderate optimism looking to 2024.’

Inflation in most major economies has decreased in the last few months. UK’s CPI fell to a two-year low of 4.6%, while in the US, it fell to 3.2%. However, neither country has met its CPI target yet.