Markets around the globe, both traditional and crypto, are in a state of uncertainty. Although the crypto markets saw a little relief as of today, the general feeling of fear is still looming in the air.

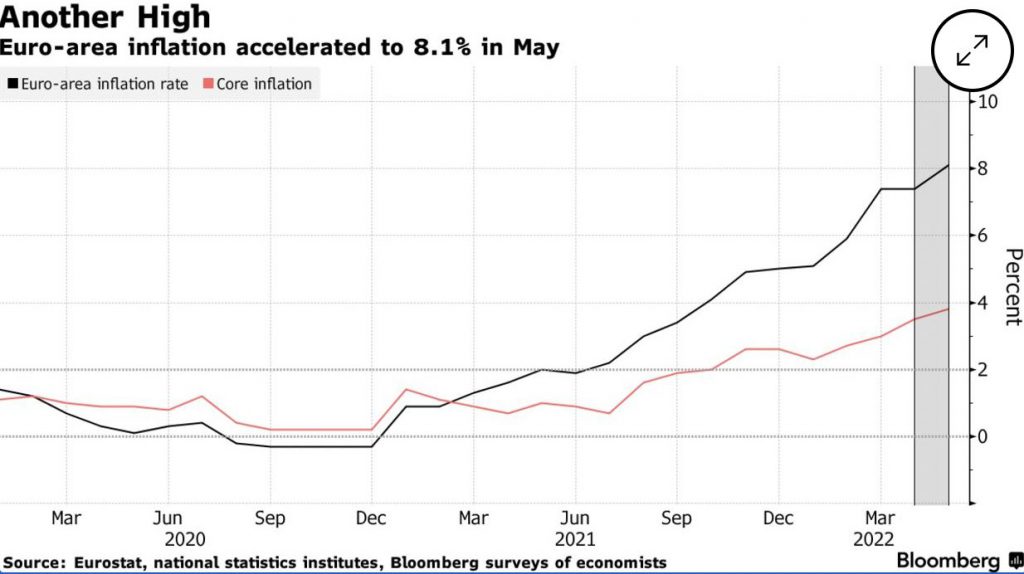

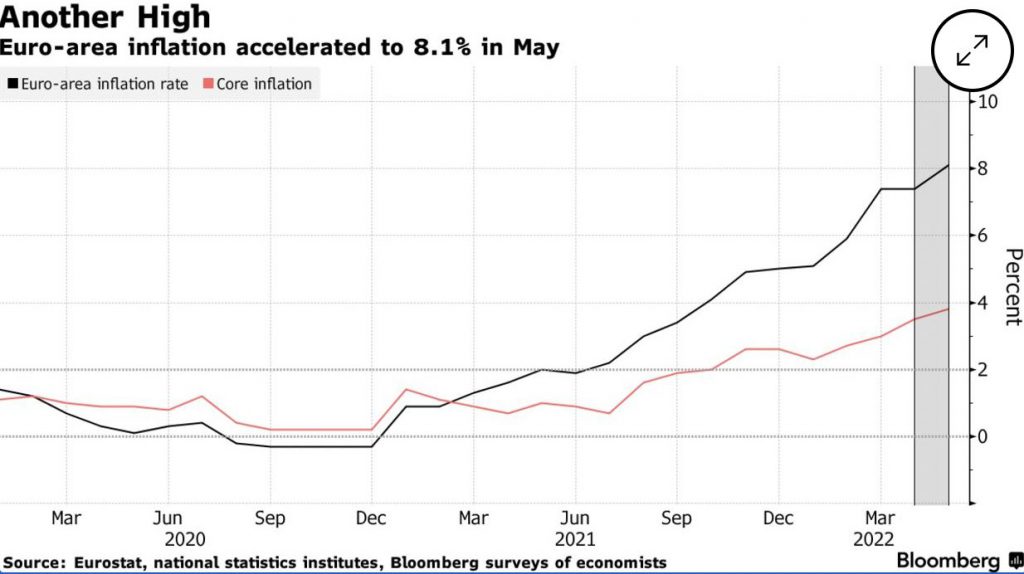

Inflation in the eurozone has surged to an all-time high, fueling discussion at the European Central Bank (ECB) over how quickly interest rates should be raised from record lows. In May, consumer prices increased by 8.1% over the previous year, beating the consensus expectation of 7.8% in a Bloomberg survey. Food and energy costs have soared as a result of Russia’s invasion of Ukraine, which has pushed commodity prices to surge. A measure that does not include volatile goods such as these increased by 3.8%.

With rate rises in the United States and the United Kingdom in full swing, the European Central Bank is ready to raise borrowing costs for the first time in more than a decade to battle the currency bloc’s extraordinary price rise. Last week, European Central Bank President Christine Lagarde stated that quarter-point rises are probable at July and September meetings.

Can Crypto offer some solace to fiat holders?

Crypto markets, while recovering now, have proven to be a good hedge against inflation. Even if the purchasing power of fiat currency falls, a hedge against inflation should, in principle, increase in value. Gold and real estate have always been the go-to investments for inflation protection. During inflationary eras, the value of these assets typically remained constant or even grew. Crypto has proven itself to be capable of taking the baton.

Bitcoin is the world’s first and largest crypto. The primary reason that Bitcoin is a shelter against inflation is its restricted number of coins.

Furthermore, financial giants such as JPMorgan, Goldman, and Sachs have begun to provide crypto to their customers. This just adds to the rising trustworthiness of digital assets.

Although ECB President, Lagarde, has said that crypto assets are highly speculative and remain a very risky investment tool, a recent survey by the European Central Bank has found that the number of crypto investors was on the rise. According to the survey one out of every 10 consumers in the six Eurozone polled owned cryptocurrency. And as per the findings, the wealthiest families are the most likely to own crypto assets, but lower-income households are not far behind.