Inflation in the Eurozone has been on the rise. As reported earlier this month, the number reached a 25-year high after it peaked at 8.9%. However, the same has hit a new high in August and is expected to rise further going forward. Per the preliminary data from Eurostat—the European Union’s statistics agency—Eurozone inflation currently stands at an ATH of 9.1%, with high energy prices fueling the same.

The flash rate was above expectations. A Reuters poll of economists was anticipating a rate of 9%, while economists polled by The Wall Street Journal had put forth a consensus forecast of 8.9%.

August marks the ninth consecutive month for the consumer price index rise. The climb had, notably, started back in November last year.

Macro instability

August’s rise in the inflation rate was further driven by an acceleration of food, alcohol, and tobacco prices. Notably, they rose 10.6% on year compared with a 9.8% rise in July. Furthermore, inflation for industrial goods and services also notched up, and so did the core consumer price index. The latter reflected an elevated value of 4.3% in August, up from 4% in July.

Alongside rising prices, the European Central Bank is considering another large interest rate hike for next month. The ECB increased interest rates by 50 bps on July 21—its first rate hike in 11 years. And now, a similar or larger hike is expected on 8 September.

Peter Schaffrik, Global macro strategist at RBC Capital Markets, told CNBC’s “Squawk Box Europe” on Wednesday,

“Some members are inclined to advocate a 75 basis points interest rate increase. Despite the slowdown in the economy that we will almost certainly be getting, the central banks won’t let up on their hiking path.”

Also Read: UK to enter recession in Q4 amid energy crisis: Goldman

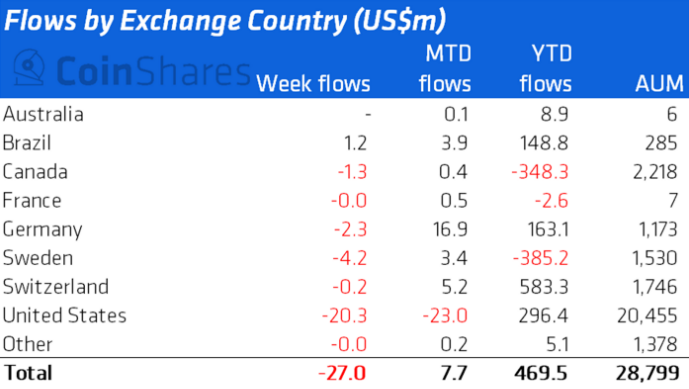

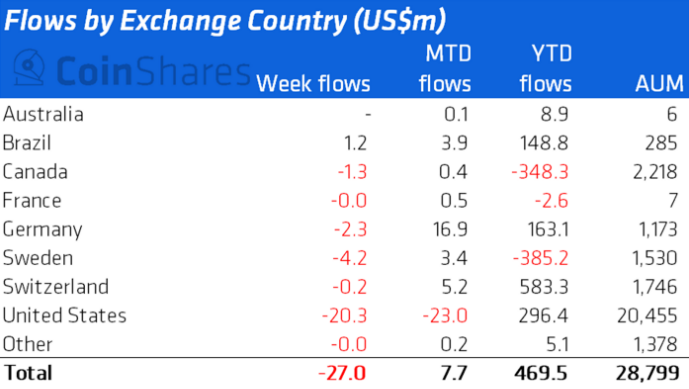

With weakness persisting across the board, interest with respect to crypto has also been fizzling out. In Eurozone member states, digital asset investment products have been noting outflows of late. Last week, the number stood at a negative $2.3 million for Germany, while for France, however, the number remained unchanged.