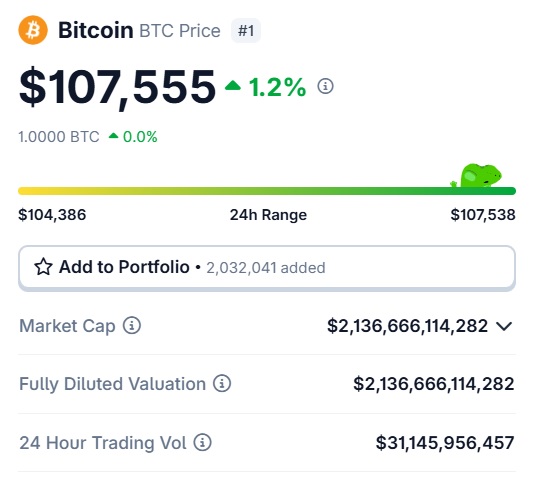

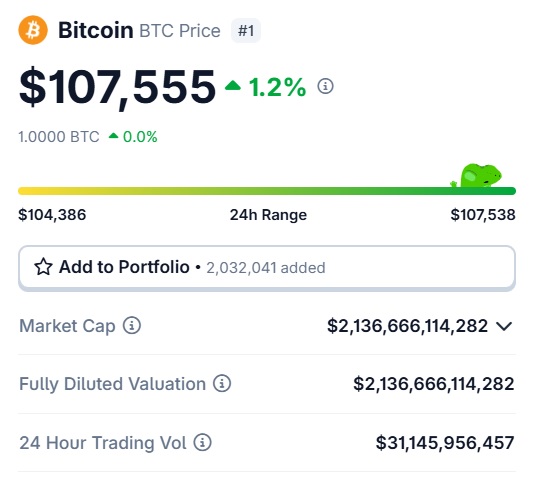

Bitcoin is trading at the $107,555 level on Wednesday and has piqued the interest of the global institutional funds. Its growth from being an obscure cryptocurrency in 2009 to becoming the most talked-about asset, BTC has come a long way in 16 years. Financial experts, who do not believe in Bitcoin, still talk about the asset as interest in cryptocurrencies is growing. The leading digital asset is now only 1.2% away from breaking its all-time high of $108,786. It had reached the ATH on the day Trump took the oath as the 47th President of the United States.

Also Read: Ethereum Ether (ETH) Price To Surge: Traders Bet on ETH to $6k

Bitcoin Towers Around the Financial System: BTC Reshaping Portfolios

Tracy Jin, the COO of MEXC, spoke exclusively to Watcher Guru, highlighting how Bitcoin is catching up with gold. She opined that gold is a hedge against market volatility, while BTC is now a hedge against fiat-based risks. Jin explained that BTC is ironing out financial imbalances and maintaining a bridge between the old and the new economic sectors. It could be the gateway to the financial future where BTC will be equally compared to gold.

Also Read: Apple (AAPL) to Make Siri the Next ChatGPT as Stock Could Surge

“Despite Bitcoin’s market cap still sitting well below gold’s ($2 trillion vs. $21 trillion), its structural appeal is growing. With fixed issuance, full transparency, and programmable infrastructure, BTC is increasingly viewed as a long-term hedge against fiat risk and sovereign debt fragility, especially in a world of growing macroeconomic imbalances,” said Jin to Watcher Guru.

She continued stressing that Bitcoin’s ecosystem is growing, and taking an entry position now could be beneficial. “As institutional and sovereign interest deepens, Bitcoin is no longer just powering the crypto ecosystem. It is now actively shaping modern portfolio strategy. Whether this rally continues or finds equilibrium around $100,000, the asset’s role as a strategic macro instrument is no longer in question,” she summed it up.

Also Read: Chainlink Finds Path to $30: Here’s What LINK Needs to Do