Crypto for mortgages is becoming reality, and right now, the Federal Housing Finance Agency (FHFA) has ordered Fannie Mae and also Freddie Mac to consider cryptocurrency holdings in mortgage risk assessments. This directive allows borrowers to use crypto assets mortgage risk evaluation without converting digital assets to dollars first. The new Fannie Mae crypto guidelines and Freddie Mac digital assets policies could transform how Americans secure home loans using their cryptocurrency wealth.

Also Read: Amazon & Walmart Explore Launching Their Own Stablecoins

What Fannie Mae, Freddie Mac & FHFA Crypto Policy Mean for Mortgages

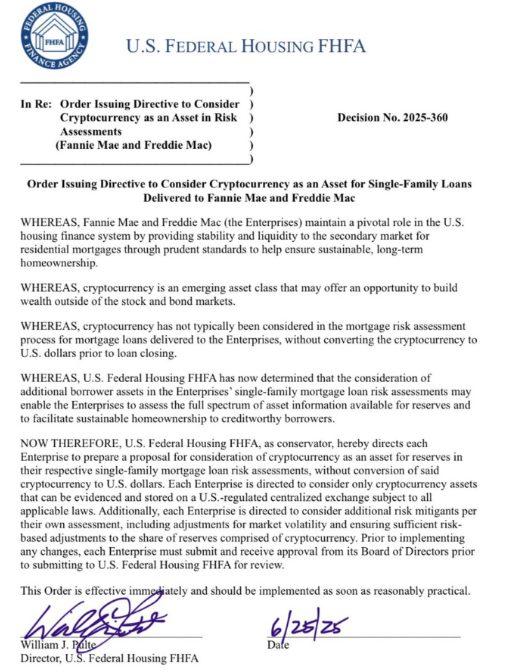

Official Directive Details for Crypto for Mortgages

FHFA Director William J. Pulte issued the directive Wednesday, and he’s requiring both GSEs to develop crypto for mortgages policies. The order specifies consideration of crypto assets mortgage risk without dollar conversion requirements.

At the time of writing, Pulte made his announcement on X, where he explained the reasoning behind this move. The directive requires cryptocurrencies to be stored on US-regulated centralized exchanges subject to applicable laws. Both Fannie Mae crypto guidelines and also Freddie Mac digital assets frameworks must address single-family mortgage loan assessments specifically.

After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.

— Pulte (@pulte) June 25, 2025

SO ORDERED pic.twitter.com/Tg9ReJQXC3

Market Impact of New Crypto Assets Mortgage Risk Policies

The crypto for mortgages directive represents the first federal recognition of digital assets in conventional lending, and this is happening right now. Since 2008, both GSEs have operated under government conservatorship, purchasing mortgages from lenders to maintain market liquidity.

This crypto assets mortgage risk integration could affect millions of mortgage applications. The Fannie Mae crypto guidelines will establish precedents for how lenders evaluate digital asset holdings, while Freddie Mac digital assets policies will complement these standards. This is a major shift in how the mortgage industry operates.

Existing Crypto for Mortgages Market

Several institutions already offer crypto-backed lending, and they’ve been doing this for a while now. JPMorgan plans to allow wealth management clients to use Bitcoin ETFs as collateral. Circle’s USDC stablecoin will become eligible collateral for futures trading next year through Coinbase Derivatives and also Nodal Clear.

Mauricio Di Bartolomeo, co-founder of Bitcoin lending platform Ledn, said that many Bitcoin holders have used their digital assets as collateral to purchase real estate, without selling any of their holdings.

The new policy could mainstream these practices through conventional channels, expanding access beyond specialized lenders. This opens up opportunities for crypto holders who previously faced barriers in traditional lending markets.

Implementation Challenges

The crypto for mortgages integration faces volatility challenges, and this is where things get complicated. Traditional mortgage underwriting relies on stable assets, while cryptocurrencies experience significant price fluctuations. Both Fannie Mae’s crypto guidelines and Freddie Mac’s digital assets policies must address these risks.

Risk management protocols will need buffer mechanisms for price movements. The GSEs must develop valuation methodologies that protect borrowers and also mortgage purchasers from crypto assets mortgage risk exposure.

Timeline and Future Outlook

The implementation timeline remains unspecified, and at the time of writing, both GSEs must prepare formal proposals before launching crypto assets mortgage risk assessments. Fannie Mae’s crypto guidelines and Freddie Mac’s digital assets policies development could take several months.

Also Read: Vietnam Passes Law Officially Recognizing Crypto Assets

This regulatory shift marks significant progress toward mainstream cryptocurrency acceptance in traditional finance, opening homeownership opportunities for digital asset holders nationwide. Right now, this represents one of the most concrete steps federal housing authorities have taken to integrate digital assets into conventional mortgage lending.