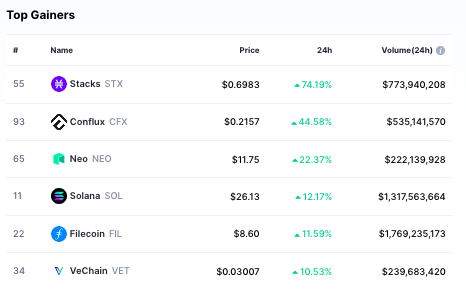

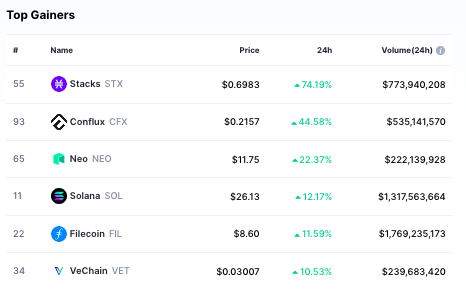

During the eastern trading hours on Monday, Solana was yet again the talk of the town. With over 121k and 85.5k tweets, ‘Solana’ and ‘$SOL’ were trending on Twitter at press time. Alongside, the altcoin was one of the top daily gainers. In just the past 24 hours, SOL rallied by more than $12%.

Also Read: Elon Musk Announces Dogecoin’s Shiba Inu Dog as the New CEO of Twitter

Will Solana’s bullish momentum continue?

On the daily timeframe, Solana has printed four successive green candles. As shown below, the 20, 50, and 100 EMAs have acted as reliable supports so far. Now, for the uptrend to continue, SOL next has to claim its 200 EMA at around $28.53. From there on, if the bullish momentum persists, a rise up to $37-$38 is possible. The same would translate to a 40%+ hike.

Also Read: Bitcoin’s Current Valuation Is Higher Than Meta, JPMorgan

However, it is important to note that Bitcoin just got rejected around the $25,000 threshold. As a result, most top coins have been consolidating. Given that SOL shares a 30-day correlation of almost 0.8 with Bitcoin, it would likely not be able to remain decoupled anytime soon. In such a scenario, it could drop down to its EMA supports. If the macro correction intensifies, then a drop to $18.6 and $16.4 could also materialize, depending on the bearish intensity.

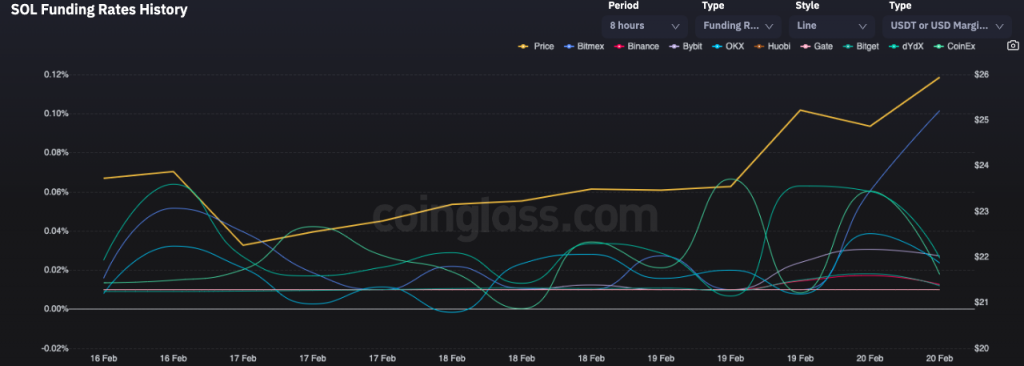

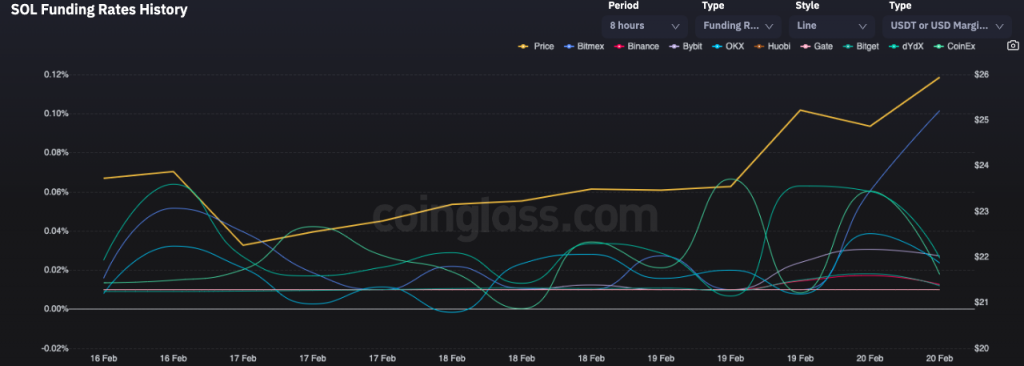

However, traders seem to be bullish on Solana. As shown below, the funding rate on all major exchanges is currently positive. In fact, barring one instance, the rate has not dropped into the negative territory since Feb. 16. The same brings to light long traders’ convictions.

Also Read: UK’s FCA to ‘Disrupt’ Illegal Cryptocurrency ATMs

Alongside, people from the ecosystem also seem to be bullish. Prominent analyst “Inmortal” recently tweeted,

“Fireworks above $25.”

It is worth noting that SOL has already crossed the threshold and has strong support ranges around the aforementioned level. Thus, the odds of its price pendulum slowly and steadily swinging in the bullish direction seem to be slightly better than the converse scenario at the moment.