Cryptocurrency markets have inspired the creation of new trends, including the use of traditional finance methods. Floki Inu mining uses the traditional deflationary model in its mining process to reduce token supply and increase the coin value.

Floki is a BEP-20 token, which is a Binance Smart Chain extension of ERC-20 tokens. BEP-20 tokens allow creators to create a native asset like Floki as a BEP-20 token. Heavy emphasis is on cross-chain compatibility, and therefore the tokens are unminable but can be created on BSC Network. Miners receive BNB as fees for token creation. Thus, the term “mining” or “mine” in this article symbolically represents Floki token creation and not the actual cryptocurrency mining.

$Floki uses a buyback and token burn in its mining model. Therefore, this reduces the supply of the coins in the market as traders mine, create, sell and buy. This protects the coins from swamping the market with a limitless number of coins and increases the price value of Floki Inu. It offers passive income rewards: a 2% reflection reward, a 3% marketing for influencers, and a 6% buyback on automation. The coin also has a 1% burn of each transaction, which costs 5%. The transaction distribution to holders is at a rate of 5%. It also allows for auto farming simply by ‘holding the coin.

Hyper-deflationary BSC and ETH Network Mining

The token sits on both Binance-Smart-Chain and Ethereum Networks. The coin even has a bridge that allows miners to transfer coins from one network to the other.

Hyper-deflationary tokens are similar to deflationary tokens; they have a fast token burn and buyback rate, making Floki a hyper-deflationary token because it burns a certain percentage of tokens in each transaction; contract burning.

Both networks contain a burn wallet with the address: 0x000000000000000000000000000000000000dEaD. The wallet shares in the reflection just like its holders. Therefore, the larger the burn wallet, the larger the reflection.

Unique $Floki Mining Features

- Value Increase

Once you purchase liquidity tokens as a trader, Floki adds the transaction to its blockchain. As a result, a new Floki token is added to the ledger, which causes the price value of Floki to increase.

- Free Tokens

Burning tokens adds free FLOKI to the pool. Holders, therefore, get Free Floki tokens because of the burn.

- Holder Rewards

This process is called auto farming, where you can grow your Floki balance by holding the token as a trader.

Mining Statistics

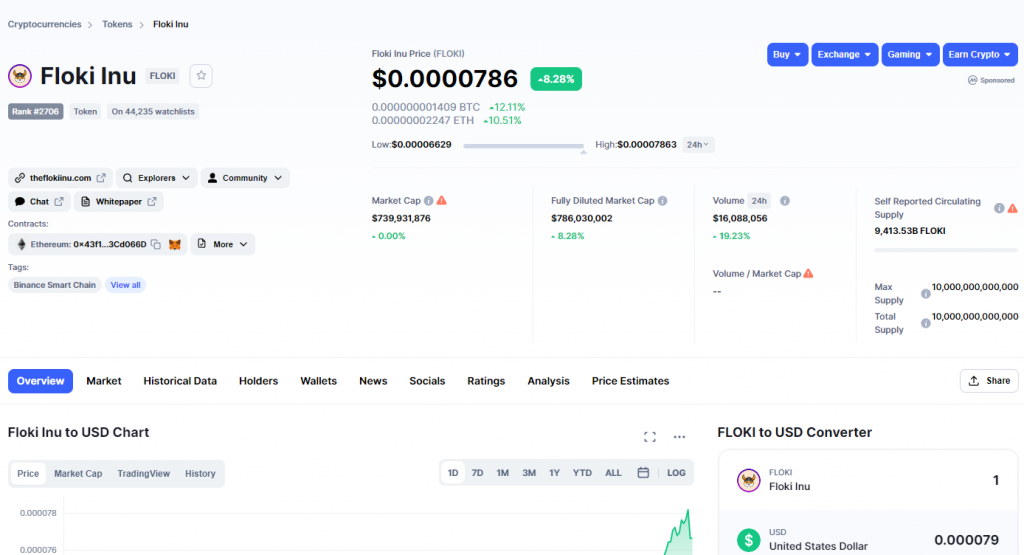

Tokenomics and market cap determine the mining statistics of a coin. Floki has a $9.2 Trillion coins circulation and a market cap of $626 million across both networks. The Floki Mining statistical breakdown is as follows:

- 10,000,000,000,000

ETH Total Supply

- 744,605,003,515.385

ETH Bridge

- 1,436,946,302,756.505

ETH Burned

- 69,727,239,637.778

ETH LP

- 7,748,721,454,090.333

ETH Circulating

- 10,000,000,000,000

BSC Total Supply

- 4,982,349,385,394.597

BSC Bridge

- 3,500,199,224,715.143

BSC Burned

- 64,039,422,073.148

BSC LP

- 1,453,411,967,817.113

BSC Circulating

- 9,202,133,421,907.445

Total Circulating

- $623,869,007.47

Combined Market Cap

Summary of Floki Inu Mining

Floki Inu’s white paper summarizes the mining procedure into three, store of value, proof of meme, and auto farming because of holding and earning rewards.