As far as the crypto market is concerned, the past few days have been quite brutal. Asset valuations have been free-falling and creating local lows, and traders, as a result, have been getting rekt en-masse.

The #2897 ranked FLOKI Inu was no exception to the broader bearishness. The token had depreciated by 14% over the past 24-hours, while over the past 7-days, it shed over 36% of its value.

Viewing Floki Inu from the macro lens

When zoomed out, Floki Inu’s condition looked far more critical. The token’s price broke above the upper trendline of its multi-month descending channel in February. Per technicals, such a move is usually considered to be bullish. However, post the breakout, FLOKI got into consolidation and hovered in the bracket between $0.00004856 and $0.00002501.

During the last week of April, it lost the floor of the said range as support and has been trending lower ever since. The result—FLOKI was trading at a massive 97% discount when compared to its November peak at press time.

Positives to look out for

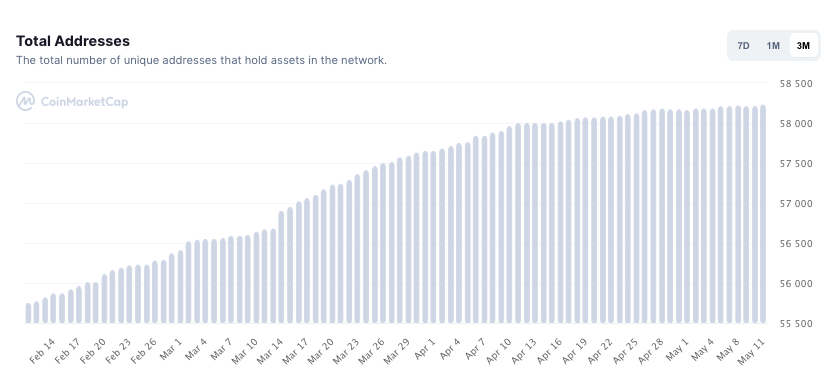

Despite the bearishness, HODLers have not been exiting the ecosystem. In mid-February, the number of unique HODLers stood at 55.7k. At press time, it nonetheless stood at an inclined 58.2k. The same is an indication of investor conviction and is fundamentally a positive sign.

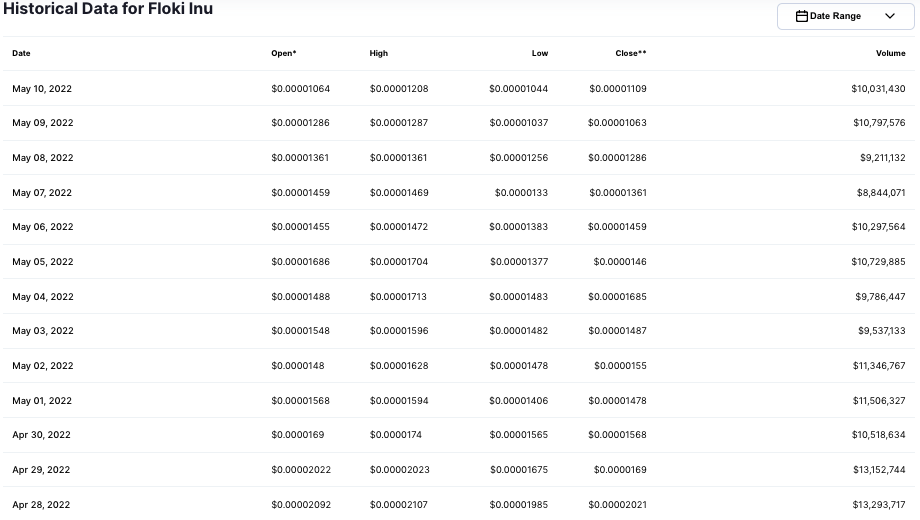

Alongside, it is interesting to note that FLOKI’s trade volume has been consistently oscillating in the $8.8k to $13.2k range roughly over the past 2 weeks. A spike in the volume, coinciding with price dips, usually indicates the presence of sell pressure and vice versa.

However, with no abnormal deviation registered of late, it can be inferred that FLOKI’s price is currently dwindling only because of the dip being noted in the broader market. So, when Bitcoin and co. pose a recovery, even Floki Inu can be expected to follow suit.