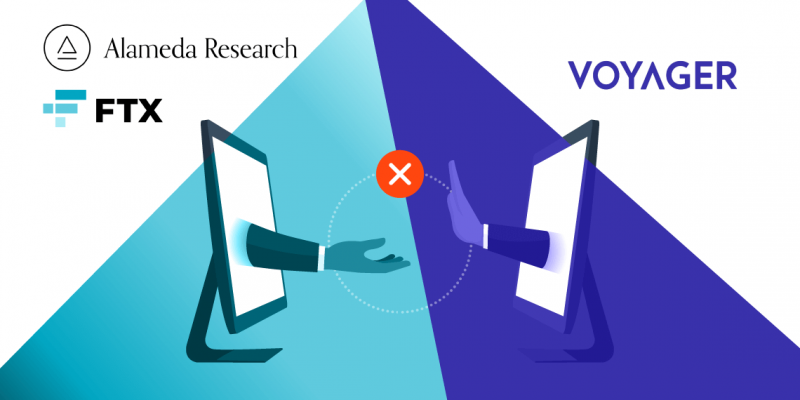

On Monday, the FTX tale took an interesting turn. The fallen cryptocurrency exchange’s sister company, Alameda Research, is suing Voyager Digital for the return of $446 million. According to FTX lawyers, Voyager Digital played a hand in its demise by “knowingly or recklessly” sending customer funds to Alameda. Ironically, FTX earlier planned to buy Voyager before its collapse in November.

Alameda Research had requested a return of the $445.8 million loan it gave to Voyager Digital. The payments were paid immediately before Alameda declared bankruptcy on its own. After Voyager Digital filed for bankruptcy protection, Alameda transferred the funds to the company. Alameda is now attributing the collapse of FTX to Voyager, asserting that the cryptocurrency lender was responsible.

According to court records, Alameda referred to Voyager as a feeder fund. Furthermore, the filings said that little to no due diligence was done before it invested the money of retail clients. Alameda stated in the complaint filing that Voyager offered loans to the business in the form of digital currencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), USD Coin (USDC), and others. Alameda plans to pursue the $445.8 million in damages along with any further compensation, which might include legal costs.

FTX’s FTT token falls with the larger cryptocurrency market

FTX’s native token, FTT, is following the larger cryptocurrency market as it plummets downward. The altcoin painted another red candle on Monday to maintain the cryptocurrency’s trajectory. While it could have rendered the upswing meaningless, FTT is currently not experiencing any significant selling, keeping its price below the $2 mark. The cryptocurrency markets are experiencing another downward movement as investors brace themselves for the Fed’s next interest rate hike.

At press time, FTX’s FTT was trading at $1.90, down by 4.9% in the last 24 hours. Moreover, the token has fallen by 24.2% in the previous two weeks. FTT is also down by a whopping 97.7% from its all-time high of $84.18, attained in Sept. 2021.