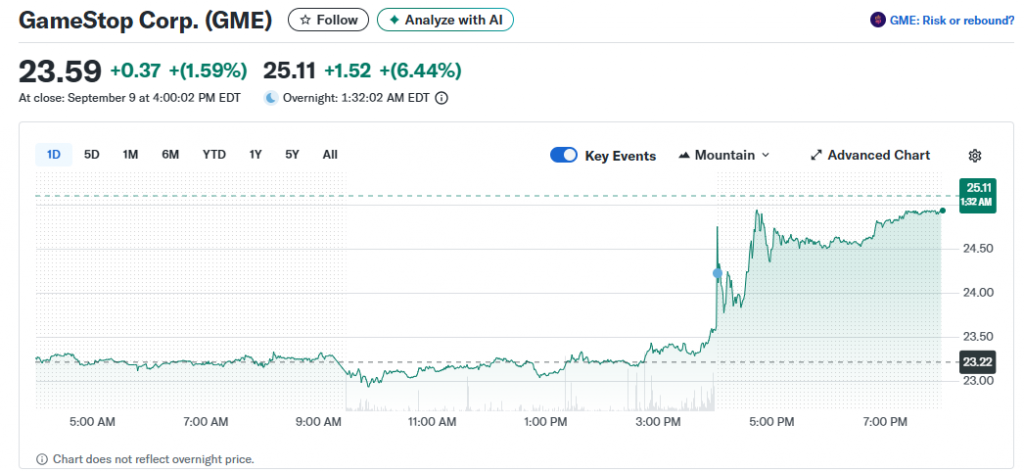

GameStop stock actually jumped over 5% in extended trading Tuesday after the company reported some pretty strong Q2 earnings that beat analyst expectations by $0.09, along with announcing a special dividend warrant. The surge in GME stock follows the video game retailer’s first revenue growth in seven quarters, and the GameStop earnings showed a 22% increase to $972.2 million. Right now, the GME earnings report also revealed that profit jumped to $168.6 million and cash reserves have swelled to $8.7 billion.

Also Read: OCTO Stock Skyrockets Over 3000% After $250M Worldcoin Deal

GameStop Stock News On GME Earnings, Dividend Warrant And Price Today

GME Stock Beats Q2 Earnings Expectations

GameStop stock delivered some impressive Q2 results with earnings per share of $0.25, which actually beat analyst estimates of $0.16. Revenue of $972.2 million also topped the consensus estimate of $823.25 million, and hardware and accessories sales rose 31% while collectibles grew 63%.

The performance of GME stock reflects strong operational improvements, with quarterly profit reaching $168.6 million compared to just $14.8 million last year. Cash and cash equivalents increased to $8.7 billion from $4.2 billion year-over-year, along with Bitcoin holdings that total $528.6 million.

Special Dividend Warrant Boosts GameStop Stock Price Today

The most significant GameStop stock news was actually the special dividend warrant announcement. Shareholders will receive one warrant for every 10 GameStop shares, which allows them to purchase additional shares of GME stock at $32 between October 7, 2025, and October 30, 2026.

One Stocktwits user said:

“$GME this is gonna get wild. Those warrants are key.”

The warrant program has driven retail sentiment to ‘extremely bullish’ levels at 94/100 on Stocktwits, and message volume has surged nearly 200% in 24 hours.

GameStop Stock Transformation Strategy Continues

Even though there was a GME earnings beat, GameStop stock remains down 25% year-to-date as of the last close. The stock has missed some of the recent “meme stock” momentum that lifted other retail favorites. However, Tuesday’s after-hours performance actually suggests renewed confidence in GME stock.

GameStop continues shutting physical stores to focus on e-commerce and compete with Amazon. The collectibles business, including trading cards and gaming merchandise, represents a key growth area as part of this transformation.

At the time of writing, the GameStop stock price today reflects cautious optimism following the earnings surprise. According to InvestingPro, GameStop’s Financial Health score shows “good performance,” which marks significant improvement from previous struggling quarters.

Also Read: Nvidia (NVDA) Forecast: Why Analysts Are Mixed on the Stock

The combination of resumed revenue growth, improved profitability, substantial cash reserves, and the innovative warrant dividend suggests that GME stock may have actually turned a corner in its ongoing transformation from traditional retail to a more diversified gaming company.