While most other countries will now, at the time of writing, receive some sort of relief and breathing room from the global tariffs pause, China is currently facing, well, a dramatically steep 125% tariff rate in this trade war impact, which is actually up considerably from the previous 104% Trump tariffs that were just recently implemented. This major policy shift came just about 24 hours after implementing sweeping duties that had triggered, well, historic market volatility across the globe.

Also Read: 2 Stocks to Consider Buying as US Markets Rebound

Trump’s Global Tariff Pause and Its Impact on Trade War Dynamics

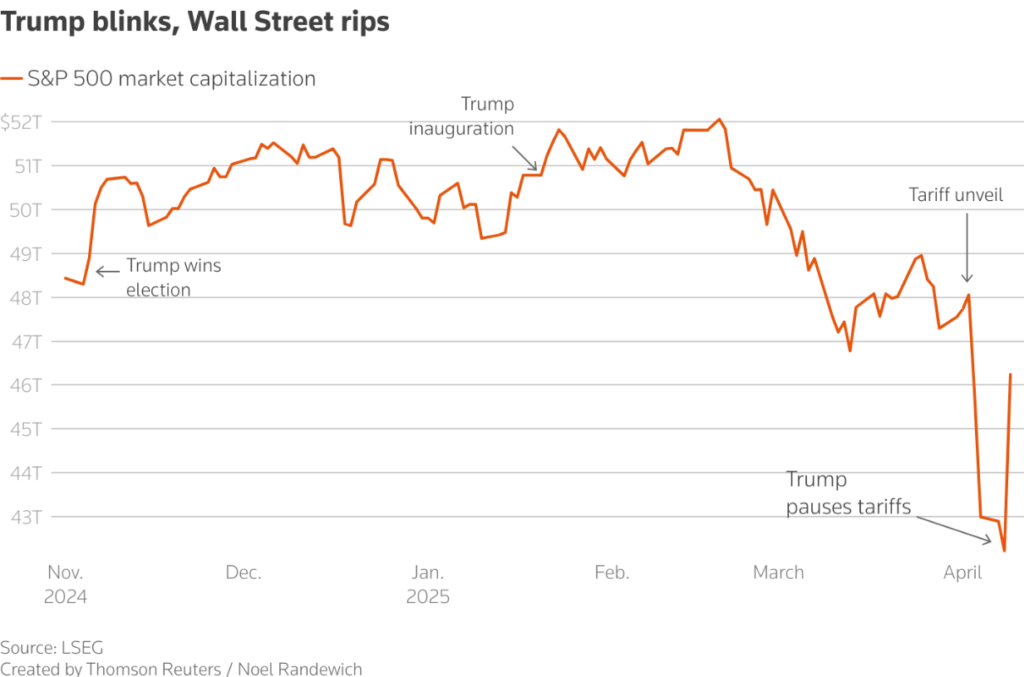

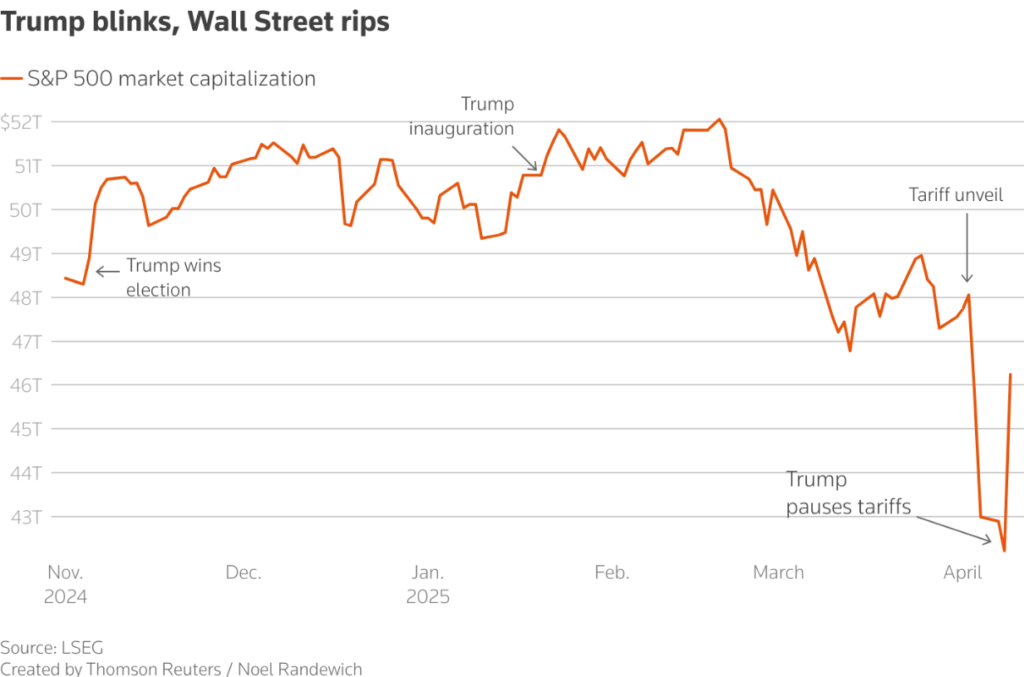

The 90-day global tariffs pause was announced on Wednesday after markets had experienced really intense volatility for several days. While most countries will now receive some relief, China currently faces a steep 125% tariff rate, which is up from the previous 104%.

Trump told reporters:

“I thought that people were jumping a little bit out of line, they were getting yippy.”

China Singled Out in Trade Battle

The global tariffs pause specifically excludes China, which actually accounts for about 14% of all U.S. imports right now. Beijing has already responded with their own 84% tariffs on American goods.

China’s foreign ministry spokesperson Mao Ning posted:

“We don’t back down.”

Trump claimed during his announcement:

“China wants to make a deal. They just don’t know how quite to go about it.”

Also Read: Pi Network Surges 100% After Breakout: Is $1.87 the Next Target?

Economic Implications

A 10% blanket duty still remains in place on most imports despite the global tariffs pause announcement. The markets, however, responded rather positively, with the S&P 500 closing 9.5% higher yesterday.

Treasury Secretary Scott Bessent stated:

“This was his strategy all along. And you might even say that he goaded China into a bad position.”

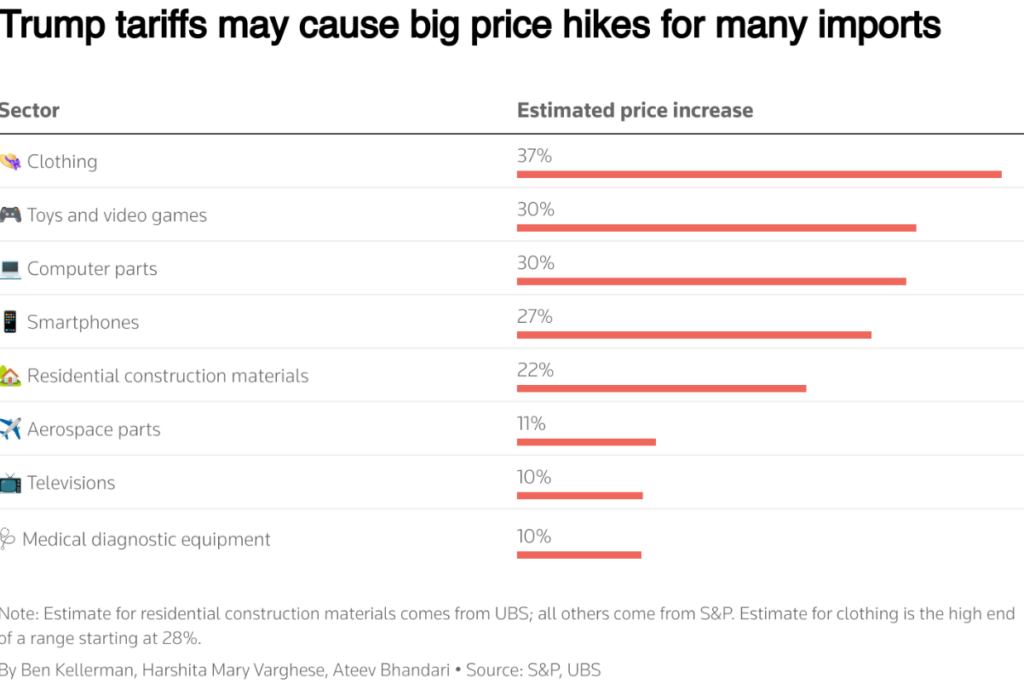

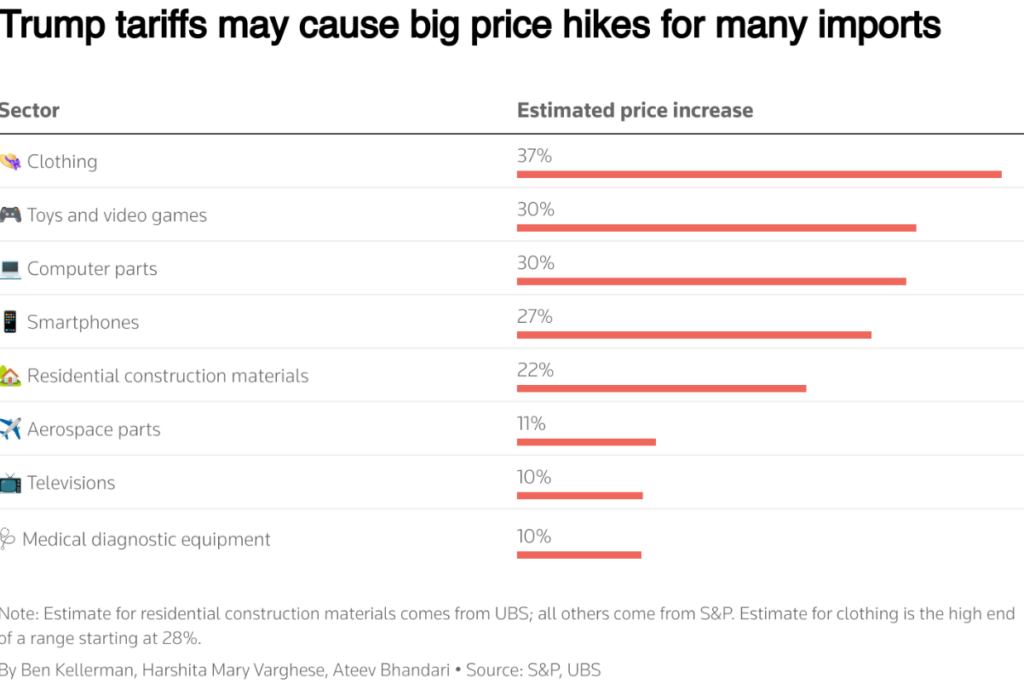

Goldman Sachs has just revised their recession probability down to 45%, though they noted that existing tariffs would still increase the overall rate by approximately 15%.

Also Read: Throwback Thursday: Trucker Made $1.7 Million With Shiba Inu

Daniel Russel, vice president at the Asia Society Policy Institute, said:

“China is unlikely to change its strategy: stand firm, absorb pressure, and let Trump overplay his hand. Beijing believes Trump sees concessions as a weakness.”

Spanish Prime Minister Pedro Sanchez made a recent statement and said:

“The measure announced by the U.S. administration seems to open the door to negotiation.”

This global tariffs pause currently signals, you know, a potentially significant shift in Trump’s approach to international trade and such, while also still maintaining a strong focus on China tariffs in the ongoing and, well, rather complicated trade war impact on the global economy right now, at least as things stand.

Also Read: Ripple’s XRP Forecasted To Reach $5.5, Here’s When